The Austin apartment market has experienced explosive development recently, but the pace of expansion is dropping as construction activity wanes. As supply volumes fade to more historic norms, however, it’s important to remember how the intense volumes of recent deliveries have impacted market fundamentals.

With nearly 345,300 existing units, the Austin apartment market is situated in Central Texas in the Texas Hill County and is bordered by the San Antonio market to the south. Austin features a picturesque landscape and distinctive culture, supported by a strong and diverse economy. In addition to being the state capital, Austin’s economy benefits from a diverse mix of industries and is home to three Fortune 500 companies – Tesla, Dell Technologies and Oracle.

Austin has lured residents from all over the country with its thriving job market and affordable cost of living (especially compared to other tech hubs like San Francisco and New York). Austin’s culture is attractive to young renters, with a robust music scene, world-renowned festivals like Austin City Limits and South by Southwest and an array of outdoor lifestyle options. Additionally, the Austin market is home to two major public universities, The University of Texas at Austin and Texas State University.

For all these reasons, Austin has attracted solid in-migration recently, triggering record apartment demand. And apartment developers responded by building more stock than the market has ever seen before.

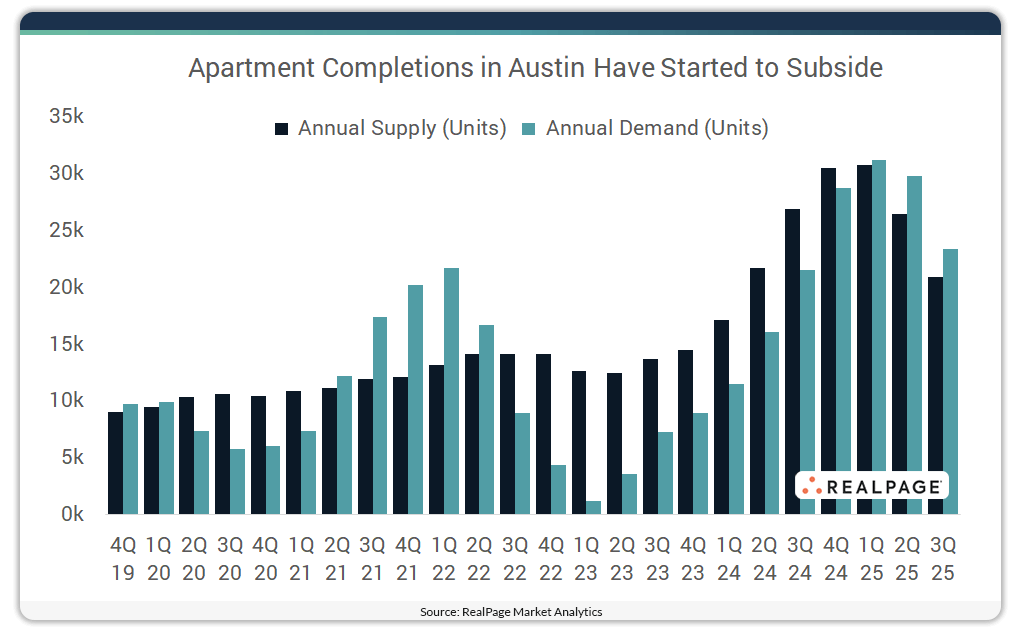

The Austin apartment market reached a peak in annual inventory growth in late 2024 and early 2025 when stock grew 10%, according to data from RealPage Market Analytics. That represented Austin’s largest delivery load since RealPage began tracking the market in 1995 and it was the fastest growth rate among the nation’s 50 largest apartment markets, far outpacing the next fastest-growing market (Charlotte at 7.4%).

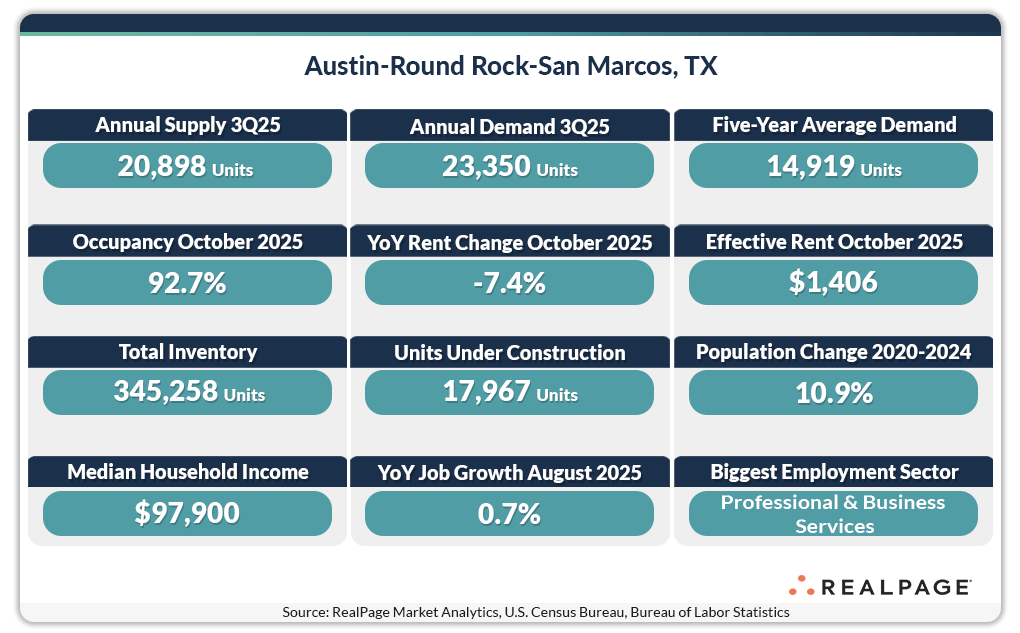

After leading the nation’s 50 largest apartment markets in annual inventory growth for five consecutive quarters, Austin dropped to second place in 3rd quarter 2025. Austin added 20,898 units in the year-ending 3rd quarter 2025, growing total inventory 6.4%, trailing only Charlotte’s expansion rate of 7.3%. For comparison, Austin averaged inventory growth of 3% annually during the 2010s decade.

Construction volumes in Austin have been steadily declining and now stand at the lowest point since 2018. Although inventory growth in Austin is expected to fall notably in 2026, the expansion rate will still rank in the top five among the nation’s largest markets. The Austin apartment market is scheduled to deliver 10,313 units in calendar 2026, growing total inventory 3%, in line with 2010s-decade average. That anticipated expansion rate ties with Nashville and trails only Charlotte (4.4%) and Pheonix (3.8%).

Seven out of Austin’s 16 submarkets received 1,000 units or more during the year-ending 3rd quarter 2025, led by urban-centric East Austin (3,989 units) as well as the more suburban Round Rock/Georgetown (3,249 units), Cedar Park (2,514 units) and North Central Austin (1,749 units) submarkets. San Marcos (1,571 units) rounded out the top five submarkets for new supply as the IH-35 corridor between Austin and San Antonio continues to grow. East Austin (home to Tesla’s 2,500-acre Gigafactory which began production in 2021 and employs 20,000 Central Texans) is expected to again lead for completions in the coming year, followed by San Marcos.

For much of the past five years, demand for apartments in Austin has fallen short of the volume of new units coming online. During the post-pandemic period in the latter half of 2021 and the first half of 2022, demand exceeded new supply due to pent up demand following the onset of the pandemic. And during the first three months of 2025, record demand surpassed record new supply. More recently, in 2025’s 3rd quarter, Ausitn absorbed 23,350 units, continuing to exceed concurrent supply. In the past year, demand was strongest in East Austin and Round Rock/Georgetown where new supply was greatest. Though both supply and demand should ease in the coming year, demand is forecasted to exceed supply in 2026.

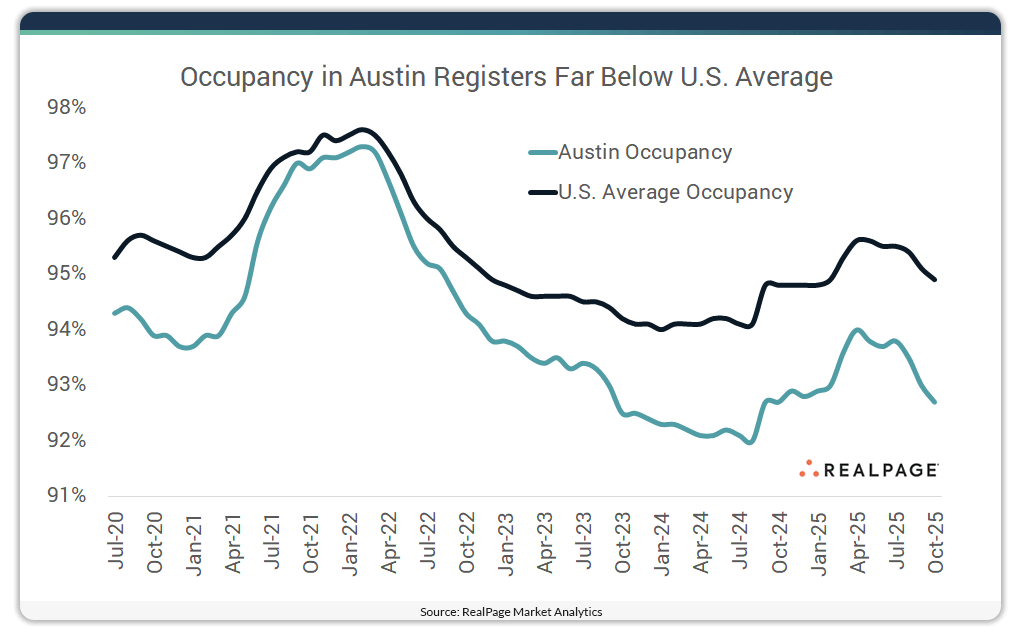

Despite strong demand, elevated completion volumes have taken a toll on Austin occupancy. As of October 2025, occupancy in the market registered at 92.7%, the second weakest reading among the nation’s 50 largest apartment markets, with only San Antonio lower at 92.3%. Though occupancy across the U.S. has weakened recently, Austin’s October rate was 220 pbs below the national average. In addition, Austin occupancy is now 200 basis points (bps) below the pre-pandemic average from 2015 to 2019.

Looking at product classes in Austin, Class A units led the market with occupancy of 93.9% in October. Class B product was weaker at 92.8%, while Class C assets were 91.8% occupied. Only two submarkets – Downtown/University and South Austin – surpassed 94% occupancy in October, while most others registered occupancy in the 92% to 93% range, with the weakest readings of 91.7% in San Marcos and Pflugerville/Wells Branch.

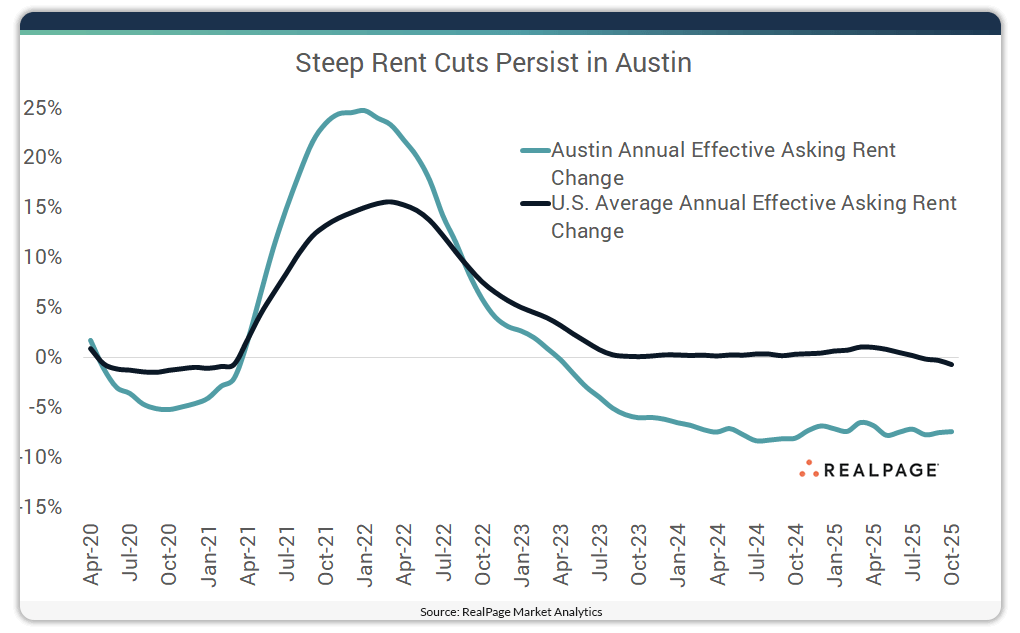

With occupancy taking a dive, Austin apartment operators have been instituting deep rent cuts to preserve occupancy. Effective asking rents declined 7.4% in the year-ending October 2025. That was the second-steepest annual rent decline among large markets, behind only Denver (-8.1%).

Rent cuts were common across product classes and submarkets in the past year. As with occupancy, Class A product performed better with a moderate 1.3% decline, compared to a 6.3% cut in Class B rents and a double-digit decline of 14.6% for the more affordable Class C product. All of Austin’s 16 submarkets saw year-over-year rent declines, with the deepest declines seen in Pflugerville/Wells Branch (-11.9%), Round Rock/Georgetown (-10.5%) and Southeast Austin (-10.4%).

Spurring the surge in apartment development and boosting demand, the population in the Austin market has been increasing at an elevated clip. From 2020 to 2024, the area grew 10.9%, well above the U.S. average population increase of 2.6%. As of 2024, the Austin area had nearly 2.6 million residents, making it the 28th-largest market in the nation, based on the latest estimates from the U.S. Census Bureau. Furthermore, the area has one of the most educated and affluent populations in the U.S. About half of the 25-year-old and older population have at least a bachelor’s degree, compared to the national average of around 35%. In addition, the median household income in Austin registers around $97,900, nearly 25% higher than the national norm ($78,538).

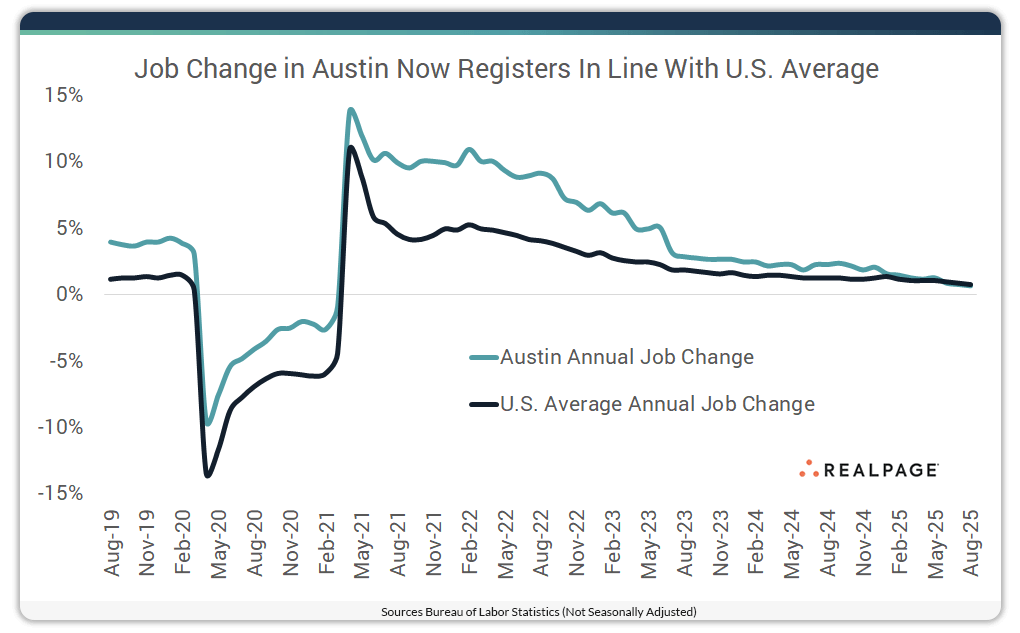

Job growth across Austin, which had been strong throughout the pandemic recovery period, has leveled off to stand in line with the national norm. In the year-ending August 2025 (the latest data from the Bureau of Labor Statistics due to the Federal Government shutdown), Austin added 9,700 jobs. Those additions expanded the employment base 0.7%, in line with the U.S. average of 0.8%. As of August 2025, Austin had 223,600 more jobs than the market had in February 2020, before the COVID-19 pandemic downturn. That growth translated to a rate of 19.5%, well above the U.S. average of 5.6%. Unemployment in Austin has been comparatively low, registering at 3.9% in August, which was the 11th-lowest rate among the 50 largest U.S. markets. Austin’s workforce is characterized by its strong government, education and technology sectors. Jobs in Professional/Business Services comprise 20% of the Austin workforce and only 14% nationally.

Austin’s strong demand drivers are expected to remain intact for the foreseeable future. And with supply pressure easing, market occupancy should begin to tighten and reach the effectively full mark (95%) by the beginning of 2026. Annual effective rent change should return to growth in the second half of 2026.