Multifamily Starts Rise One Quarter Year-Over-Year

The seasonally adjusted annual rate (SAAR) for multifamily starts increased for the third consecutive month (second consecutive month for the not seasonally adjusted annual rate), according to the latest report from the U.S. Census Bureau and the Department of Housing and Urban Development (HUD).

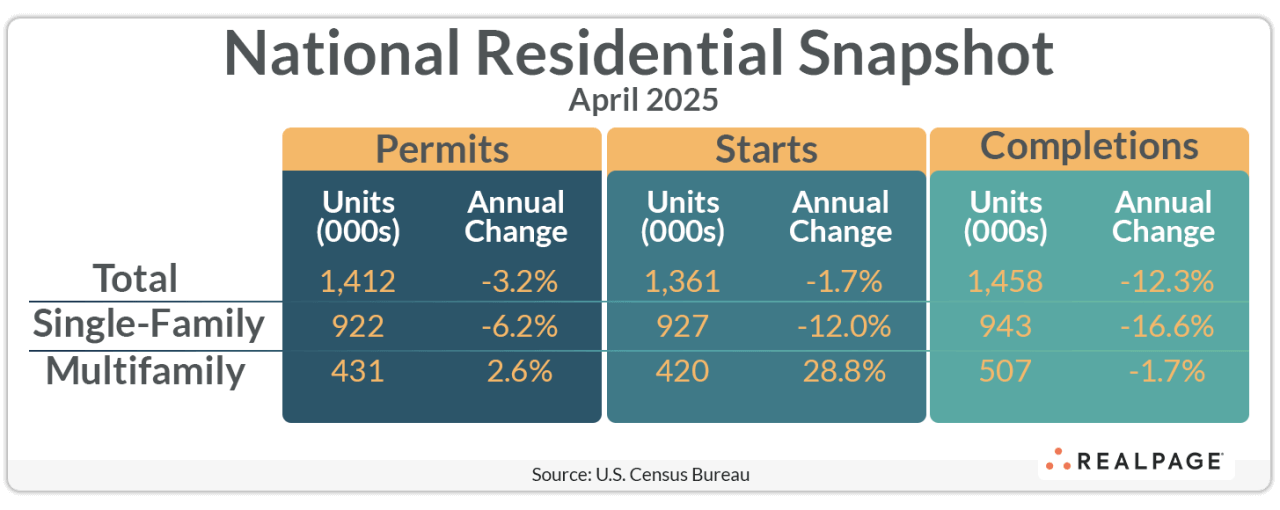

April’s SAAR of 420,000 multifamily units was 11.1% greater than the annualized rate in March and 28.8% higher than one year ago. Month-over-month, annualized starts increased an average of 8% from December and 2.6% since January for not seasonally adjusted starts.

Meanwhile, April’s SAAR for multifamily permitting decreased 4.4% from March to 431,000 units, but that was 2.6% greater than last year. The annualized rate for multifamily permitting appears to have leveled off, averaging 433,000 units for the past 12 months and almost matching the current rate.

Despite the increase in starts in the first few months of 2025, the SAAR for multifamily units under construction dipped 0.7% from last month and fell 20.2% from last year to 733,000 units. Multifamily completions were also flat with a 0.2% change from March and -1.7% decrease from last April to 507,000 units.

Turning to single-family construction, the SAAR for single-family permitting fell 5.1% from March and 6.2% from last year to 922,000 units. Meanwhile, annualized single-family starts fell 2.1% for the month to 927,000 homes and were down 12% for the year.

Single-family completions decreased 8% from February to 943,000 units, down 16.6% for the year, while single-family units under construction were down 0.8% from last month and 7.1% for the year to stand at 630,000 units.

Compared to one year ago, the annual rate for multifamily permitting decreased in the small Northeast region (down 22.5% to 61,000 units) and fell 12.6% in the South region (to 200,000 units). Permitting increased for the year in the Midwest region (up 55% to 54,000 units) and West region (up 49.7% to 115,000 units). Compared to the previous month, permitting was down in the South and Midwest Census regions and up in the West and Midwest.

Annualized multifamily starts more than doubled in the Northeast region again (up 114.7% to 81,000 units) and were up 69.3% in the Midwest region to 64,000 units. The South region had a more modest increase of 18.5% to 218,000 units, while the West region saw starts decrease by 13.3% to 59,000 units. Compared to March’s SAAR, starts were up in the South and Northeast and down in the Midwest and West regions.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing residential permits and starts data from the U.S. Census Bureau. For more on this data, read previous posts in the Permits series.