Investments in U.S. apartments continued to cool in the first three months of 2023 amid the rising cost of debt and economic uncertainty. Though the asset remains an attractive commercial real estate investment, sales have fallen below pre-pandemic levels.

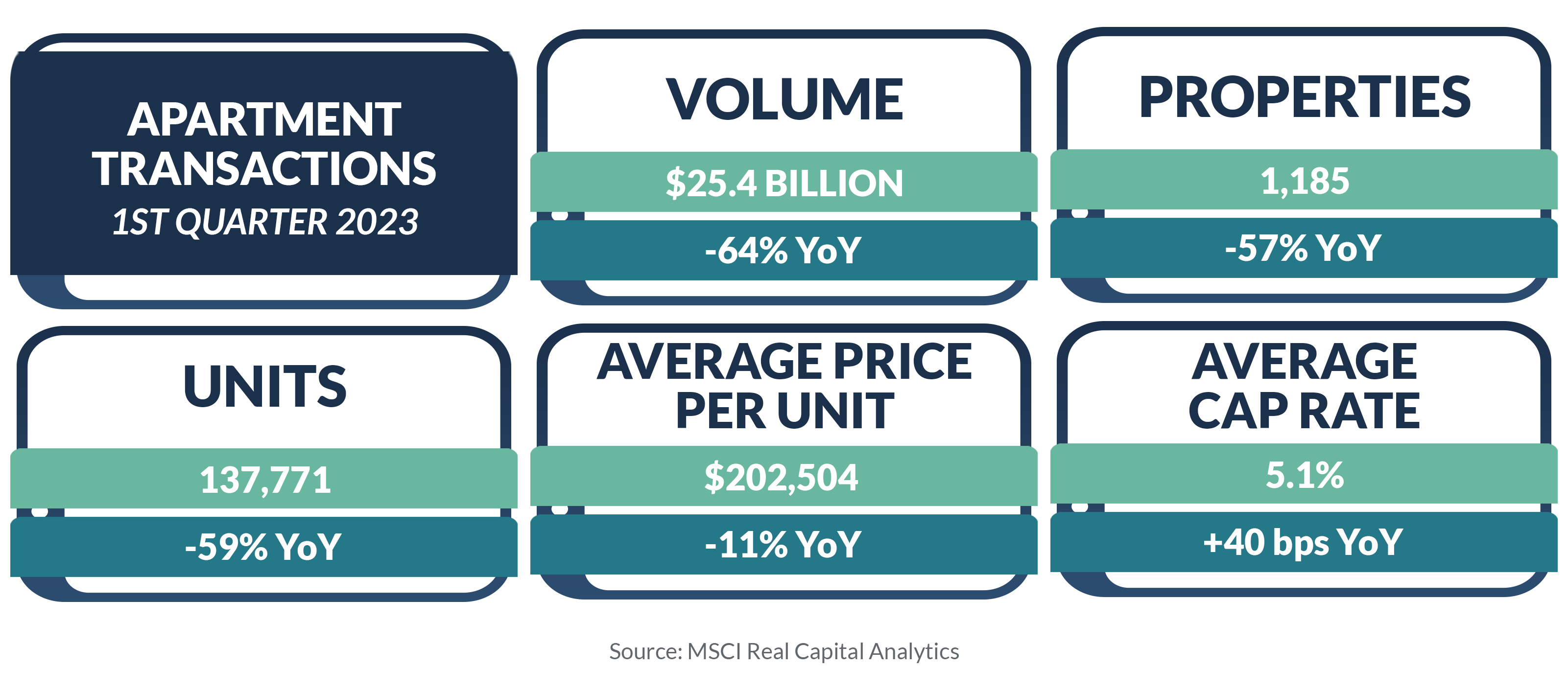

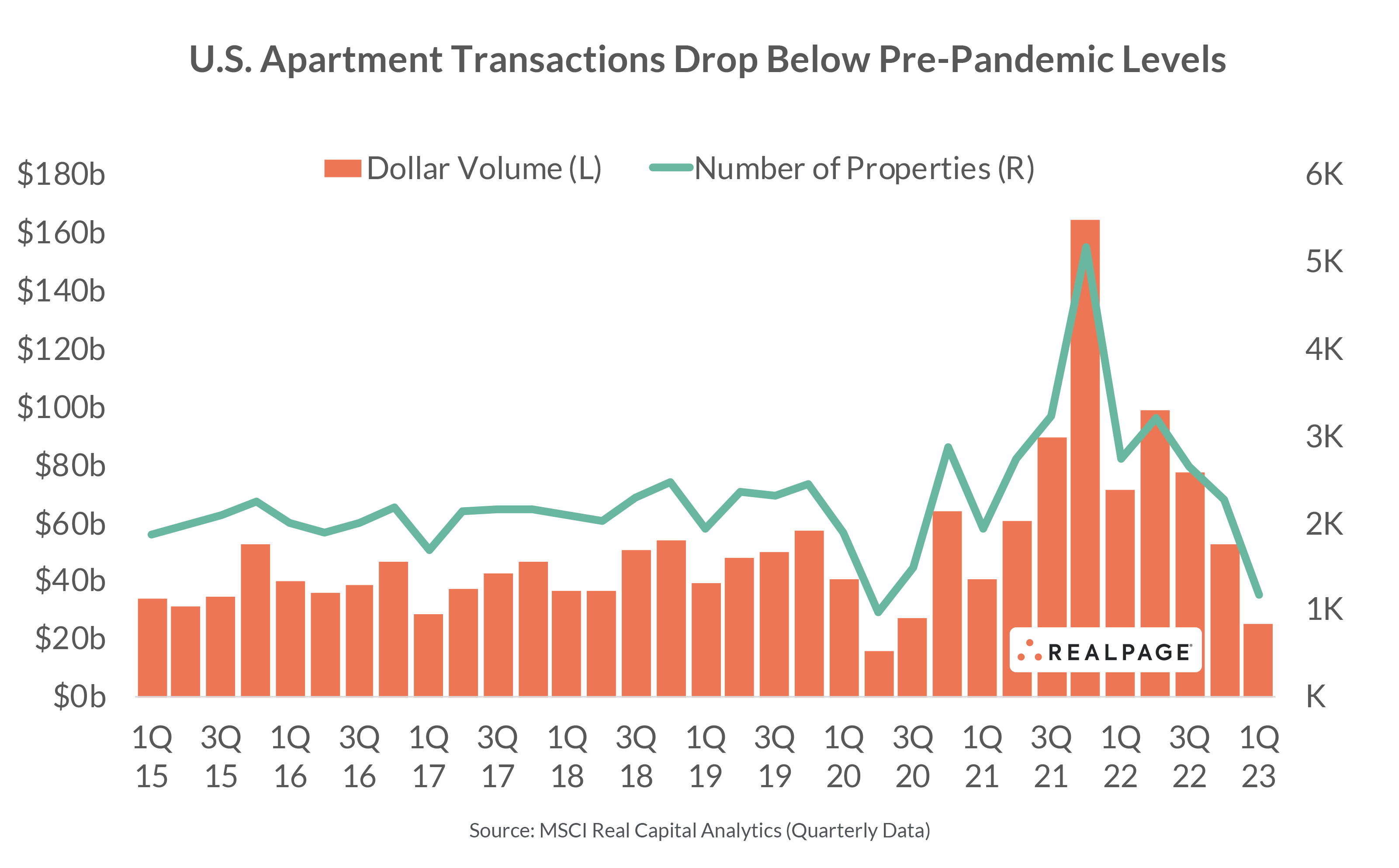

Nearly 1,200 apartment properties changed hands at a value of $25.4 billion during 1st quarter 2023, according to MSCI Real Capital Analytics. The overall sales volume during the quarter was down 64% year-over-year. This was also well below the 4th quarter 2021 peak, when around 5,200 properties changed hands for $164 billion as the result of pent-up demand following the onset of the pandemic. Recent activity was also well below the $42 billion quarterly average during the five years leading up to the pandemic. The average price per unit has also fallen, registering at $202,504 in 1st quarter. While down 11% year-over-year, that figure has remained above $200,000 for a seventh consecutive quarter. Prior to 2021, unit pricing never exceeded that threshold and averaged $151,000 from 2015 to 2019. Meanwhile, cap rates for transactions in 2023’s 1st quarter were up 40 basis points (bps) year-over-year but remained at historic lows, averaging 5.1%. In addition, multifamily cap rates during 1st quarter remained the lowest among major property types.

In the year-ending 1st quarter 2023, transactions totaled more than $255 billion with around 9,300 properties trading hands. Looking back over the past few years, sales dipped in calendar 2020 due to the pandemic, when about 7,200 apartment communities were sold for roughly $148 billion. That was well below the volume from 2019, when 9,000 properties traded hands for $195 billion. In 2021, transactions jumped back up again, with over 13,000 properties trading hands at a value of nearly $356 billion. Transactions began to ease in calendar 2022, with around 10,900 properties trading for roughly $301 billion.

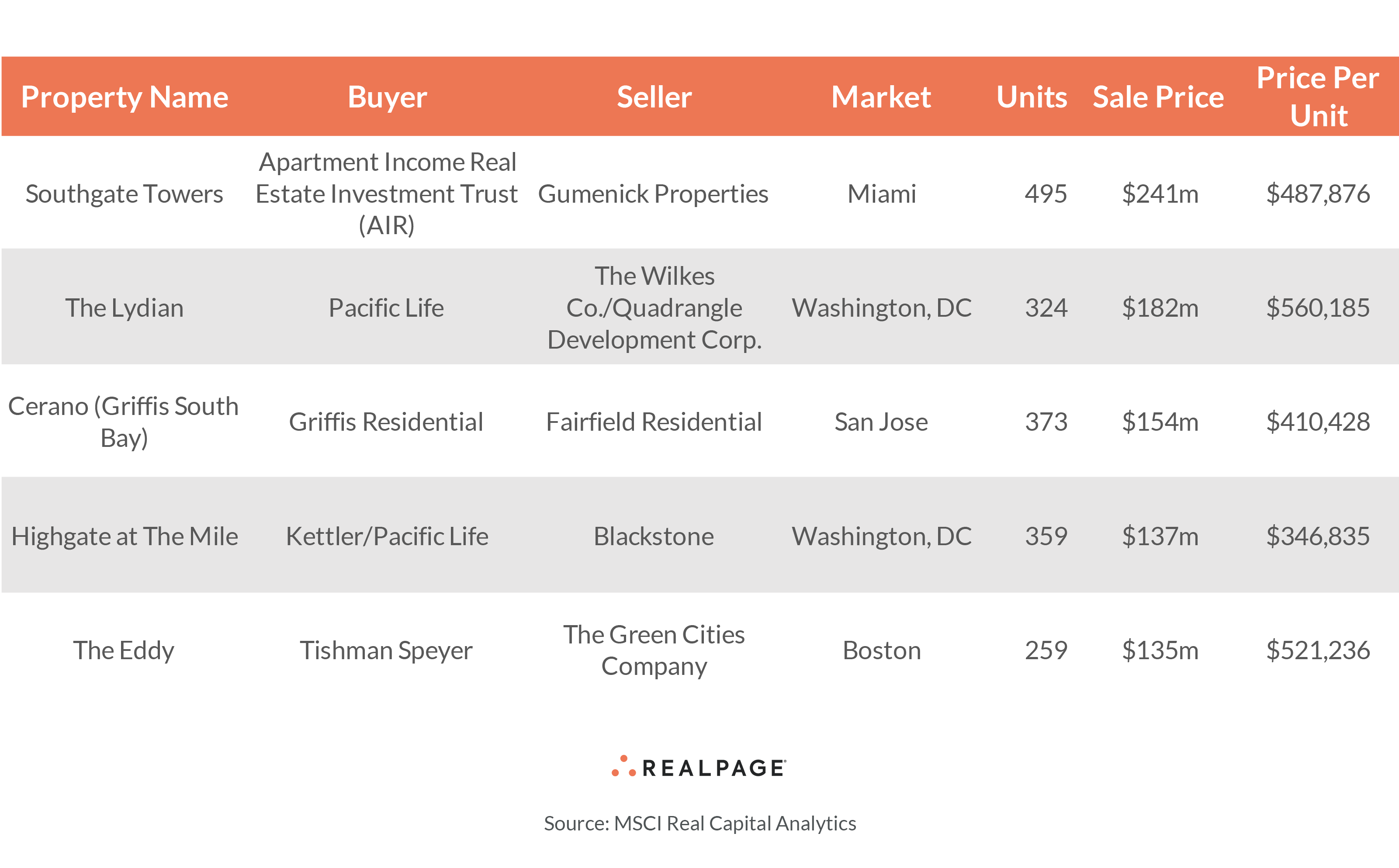

Following are the five largest single-asset apartment transactions from January through March, with all of these occurring along the East and West coasts.

Southgate Towers

In January, Denver-based Apartment Income Real Estate Investment Trust (AIR) purchased the 495-unit Southgate Towers apartment community in Miami from Virginia-based Gumenick Properties. The development traded for approximately $241 million, ranking as the largest single-asset apartment transaction during 1st quarter. The sale price came to around $487,900 per unit. The property sits on four acres on West Avenue overlooking Biscayne Bay in Miami Beach, within the Downtown Miami/South Beach submarket. The pair of 14-story buildings were built in 1958 and Gumenick completed a $40 million renovation in 2016. The community features a fitness center, yoga studio, lap pool, resort-style pool, EV charging stations, pool-side cabanas, grilling stations, community lounge and community pier.

The Lydian

The Wilkes Co. and Quadrangle Development Corp. sold The Lydian apartment community in Washington, D.C.’s Mount Vernon Triangle neighborhood in February. Newport Beach, CA-based Pacific Life bought the 324-unit project for nearly $182 million or roughly $560,200 per unit, ranking as the second-largest transaction during the first three months of the year. The Washington, DC developers wrapped up construction on the 14-story building in 2018. Located on K Street Northwest in the Central DC submarket, the building is adjacent to the Lyric, another apartment project by the two DC developers. The two communities are marketed together as Lydian + Lyric. The apartments are part of the 2 million-square-foot, mixed-use Mount Vernon Place community. Amenities at The Lydian include 24-hour concierge services, a fitness center, pet washing stations, a second-floor tranquility garden and cybercafé, a rooftop pool and spa, rooftop grilling stations with seating areas and an herb garden, and a rooftop club room. The building also includes 13,410 square feet of ground-floor retail space.

Cerano (Griffis South Bay)

The third-largest apartment transaction to take place in the nation during 1st quarter was the sale of an asset in the San Jose market. Colorado-based Griffis Residential bought the Cerano apartment community in the North San Jose/Milpitas submarket in late March. The four-story, 373-unit development is on Murphy Ranch Road in Milpitas. San Diego-based Fairfield Residential completed construction on the project in 2013 and sold the community to Griffis for nearly $154 million or roughly $410,400 per unit. The community features a 24-hour fitness center, yoga studio, spin room, business center, co-working room, resident lounge, resort-style pool with cabanas, outdoor grilling station, and an outdoor lounge and bocce ball court. Griffis Residential has rebranded the community Griffis South Bay.

Highgate at The Mile

New York-based Blackstone sold the Highgate at The Mile apartment complex in the Washington, DC market in March. The six-story community with 395 units is on Jones Branch Drive in McLean, within the Tysons Corner/Falls Church/Merrifield submarket. Ranking as the fourth-largest transaction in the nation during 1st quarter, the property was sold for $137 million, or roughly $346,800 per unit, to a joint venture between McLean, VA-based Kettler and Newport Beach, CA-based Pacific Life. Amenities include hotel-style concierge, screening room, 24-hour fitness studio, entertaining kitchen, indoor/outdoor lounge, pool, courtyard, outdoor dining space, grilling stations, bike storage, bikeshare stations, dog park and dog spa, and electric vehicle charging stations.

The Eddy

In January, New York-based Tishman Speyer purchased The Eddy apartment tower for $135 million, or over $521,000 per door, ranking as the fifth-largest transaction in the nation during the first three months of 2023. The 17-story tower located along New Street at the East Boston waterfront, within the Chelsea/Revere/Charlestown submarket, was built in 2016. East Boston’s tallest development is LEED Gold certified, with 259 apartments, a rooftop deck, an outdoor terrace with pool and sundeck, a modern fitness center, secure bike parking, and has direct water taxi access. The seller was Portland, OR-based The Green Cities Company.