10 U.S. Apartment Markets Set to See Deliveries Increase Next Year

With apartment supply volumes dropping across the U.S., only a handful of major markets are expected to see an increase in delivery volumes in the coming year.

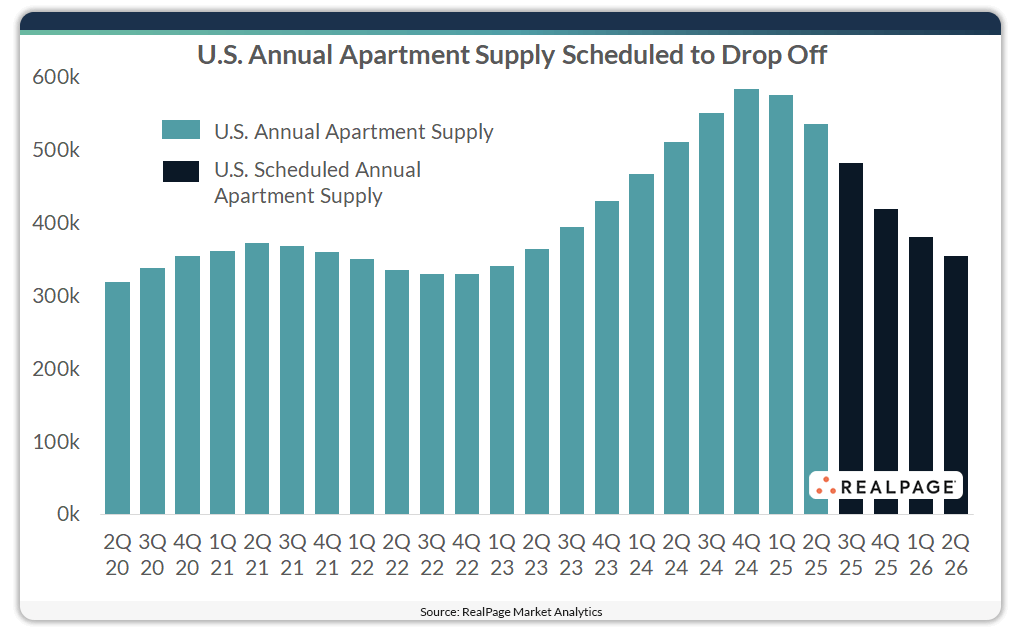

The U.S. overall is scheduled to see a 33.9% decline in apartment completions in the next 12 months, according to data from RealPage Market Analytics. This represents the return of a more normal supply environment, as developers cool off after completing notably elevated volumes in the past few years.

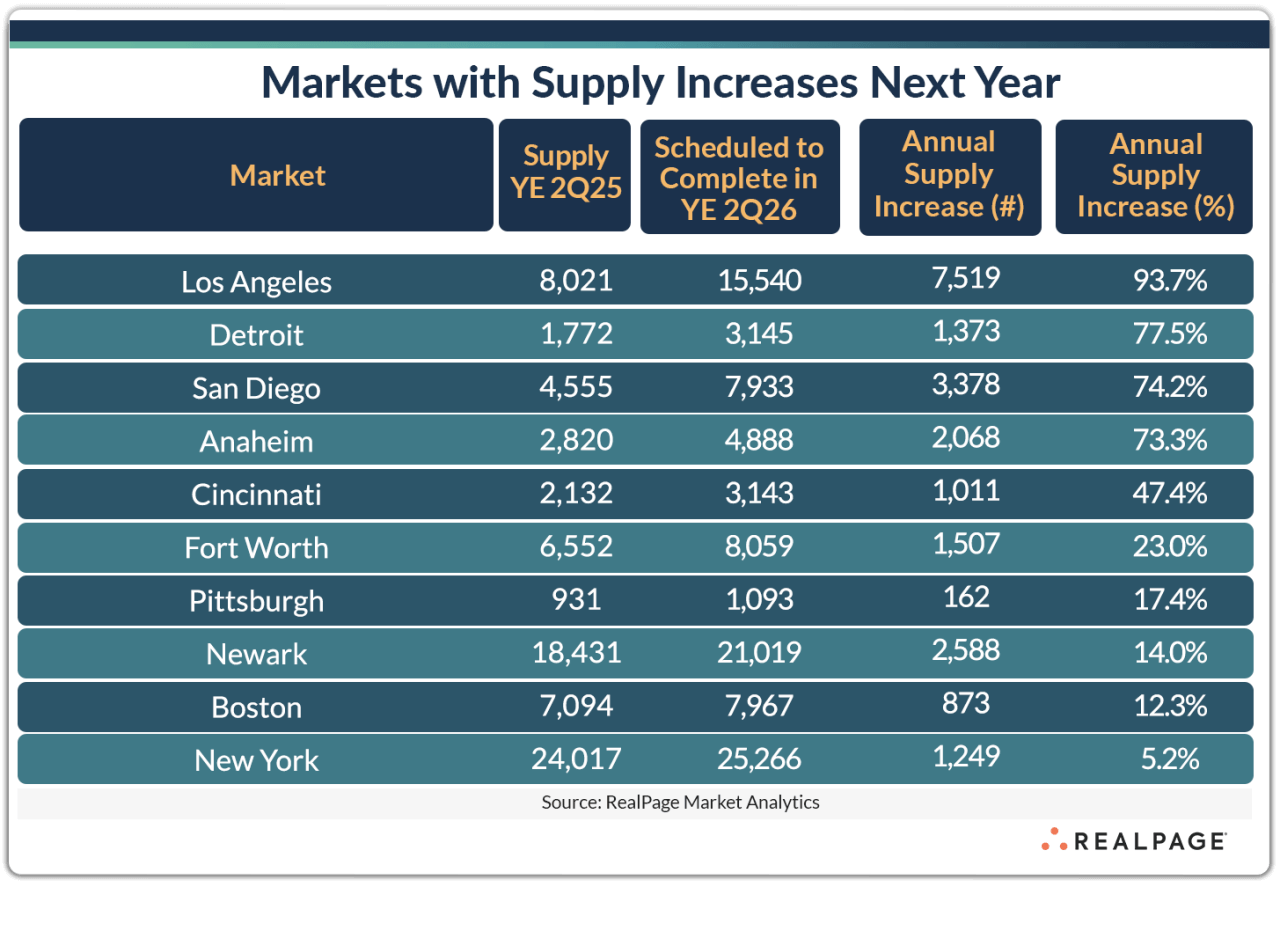

Most apartment markets nationwide are set to follow this trend, with declining supply volumes on the horizon. In fact, out of the nation’s 50 largest apartment markets, only 10 are scheduled to see deliveries increase in the next year.

The biggest increase in apartment supply in the coming year is set for Los Angeles. A little over 8,000 units competed here in the year-ending 2nd quarter 2025, and deliveries are scheduled to nearly double in the coming year to over 15,500 units. Construction delays are common in Los Angeles, meaning those numbers could change, but as they are now, this market is expected to see new deliveries hit peak volumes in mid-2026.

Two other California markets are among the few scheduled to see deliveries increase in the coming year: San Diego and Anaheim. Supply volumes in these markets have been limited recently, but are expected to increase by more than 70% in each over the next 12 months.

Two Midwest markets – Detroit and Cincinnati – are slated to see apartment completion volumes increase in the coming year. Detroit is scheduled to see the nation’s second-biggest increase in the next 12 months, after only Los Angeles. Nearly 1,800 units delivered in Motor City in the year-ending 2nd quarter 2025, but over 3,100 are expected to deliver in the year-ending 2nd quarter 2026. That’s a 77.5% increase over the current pace. The increase is Cincinnati is gentler, but not by much. The over 3,100 units slated to complete next year in Cincinnati represent a 47.4% increase over the current delivery volume. Cincinnati also ranked among the national leaders for rent growth recently.

Fort Worth is the only South region market set to see deliveries increase in the coming year. This is quite the counter trend from the other large Texas apartment markets, which are all scheduled to see deep declines in completion volumes in the next 12 months. Like the other Texas markets, Fort Worth has seen elevated construction volumes in recent years. Over 6,500 units delivered here in the year-ending 2nd quarter 2025. At the end of 2nd quarter 2025, there were 12,166 units under construction with 8,059 of those units scheduled to complete in the next four quarters. That volume is 23% more than the current pace.

A handful of Northeast markets are scheduled to see supply volumes increase between roughly 5% and 17% by mid-2026, including Pittsburgh, Newark, Boston and New York.