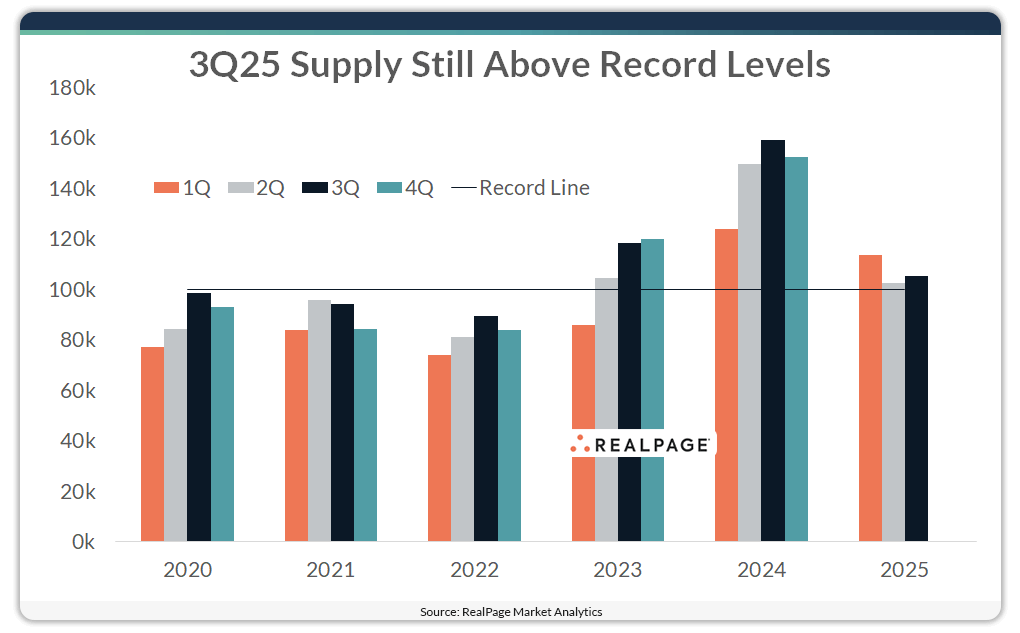

The U.S. apartment market hit a 10th consecutive quarter of record completion volumes in 3rd quarter 2025.

While new supply volumes have cooled considerably after peaking in 2024, quarterly delivery numbers keep hitting records. Roughly 105,525 units wrapped up construction in 3rd quarter, marking a 10th consecutive quarter of deliveries beyond the 100,000-unit mark.

Quarterly completion volumes broke past 100,000 units in 2nd quarter 2023 for the first time since RealPage Market Analytics began tracking the U.S. apartment market in the 1990s. Delivery totals then increased for five straight quarters, peaking in 3rd quarter 2024 before ebbing slightly in the last three months of 2024. The drop in quarterly deliveries in 2025 has been notably steep, though volumes have yet to fall below that 100,000-unit mark.

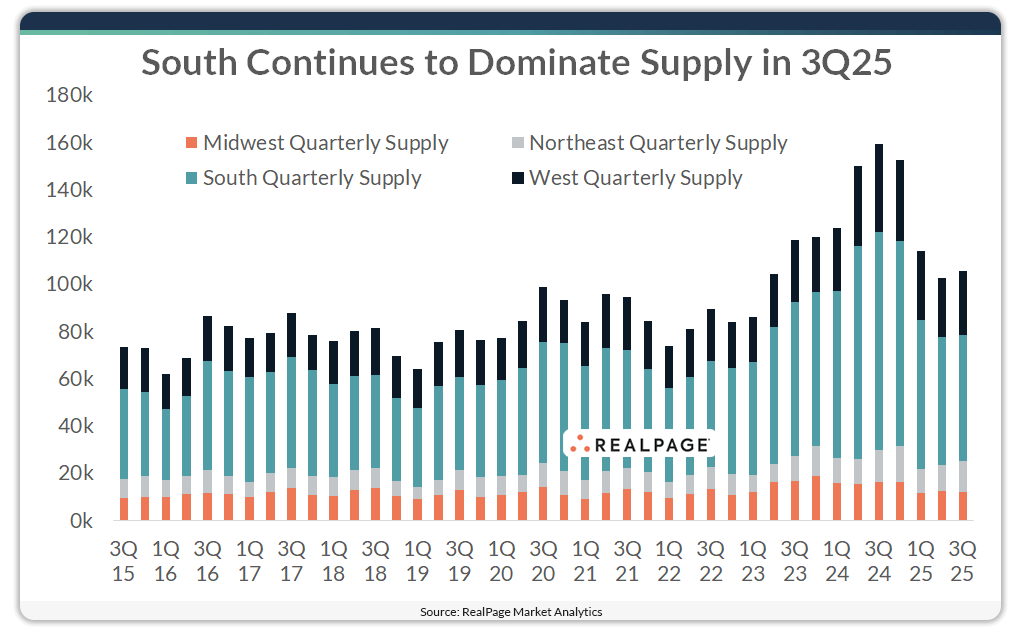

Apartment deliveries remain elevated across all U.S. regions, though all are down from recent peaks.

New apartment deliveries continued to be most prolific in the South region of the U.S., where about 53,410 units wrapped up in 3rd quarter 2025. However, the South has also seen the steepest pullback in delivery volumes recently. Completions in the South peaked at over 92,100 units in 3rd quarter 2024 and volumes have fallen off every quarter since.

The West region saw nearly 26,900 units deliver in 3rd quarter 2025, which was about 2,000 units more than came online in the region in 2nd quarter 2025. This region also peaked in 3rd quarter 2024, and recent totals are well behind that mark (37,400 units).

Milder delivery volumes were seen in the Northeast (13,100 units) and Midwest (12,100 units) during 3rd quarter 2025. Notably, the Midwest was the only region where 3rd quarter supply hit below the area’s decade average.

Markets seeing the most new deliveries in 3rd quarter were Phoenix, New York and Dallas, where completions were all north of 6,000 units in the July to September time frame.