Updated Forecast Amid Declining Supply and Increasing Economic Uncertainty

The 2nd quarter 2025 brought a fresh round of uncertainty to the U.S. economy, largely driven by external developments. In early April, the administration announced a series of reciprocal tariffs on several major trading partners. The move triggered a sharp selloff in equity markets and added new pressure on an already cautious Federal Reserve. While Chair Jerome Powell indicated that rate cuts were on the table earlier in the year, he acknowledged that the tariff announcement shifted the Fed’s near-term outlook. As of now, the Fed still expects to cut rates twice before the end of the year, but has offered no timeline, emphasizing that decisions will be guided by incoming data.

Inflation trends have been somewhat uneven. The Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation measure, rose just 2 basis points (bps) in March, but picked up in April and May, climbing 11 and 14 bps, respectively. On a year-over-year basis, the PCE stood at 2.3% in May (slightly below where it ended in 2024), but still above the Fed’s 2% target. With tariffs potentially pushing prices higher in the months ahead, the Fed has opted to wait for clearer signals before making any moves.

Despite these headwinds, the labor market held up better than expected. Between April and June, the U.S. economy added roughly 449,000 jobs, with most of the gains coming from the private sector. That’s 13% growth over the same period last year, when job growth came in under 400,000. However, when looking at the first half of the year as a whole, job creation is down 21% compared to the first half of 2024. Over the past 12 months, the economy added just over 1.8 million jobs, down from more than 2 million the year before. Slower hiring may reflect both the economic drag from tariffs and the growing adoption of AI across a range of industries.

Given these developments, we’ve updated our multifamily outlook for the next 12 months (3Q25-2Q26). Nationally, we’re forecasting effective rent growth of around 2.3%. Among the top 50 markets, performance is expected to vary. Just two markets – San Jose and Pittsburgh – are projected to see growth above 4%. About 26% of markets are expected to post gains of 3.0% to 3.9%, while 40% fall in the 2.0% to 2.9% range. Another 26% of major markets are forecasted to see more modest growth of 0.1% to 1.8%. Only two markets – San Antonio and Denver – are expected to see rents decline over the next year, though the downturns are less than 1%.

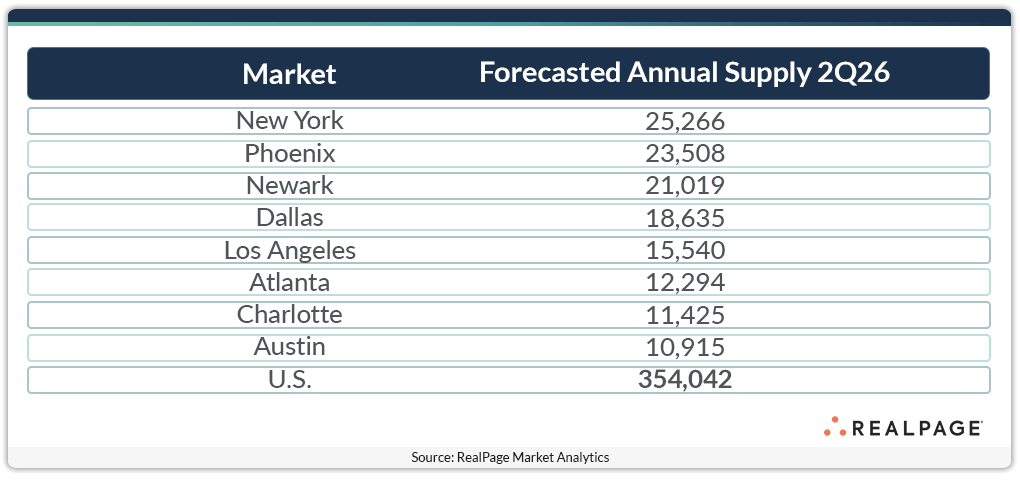

Although the national supply is expected to slow over the next 12 months, more than 100,000 new apartment units are scheduled for delivery in just five markets: New York, Phoenix, Newark, Dallas and Los Angeles, with New York leading for total delivery volume.

For more economic insights that influence the multifamily industry, follow our Economy Express series.