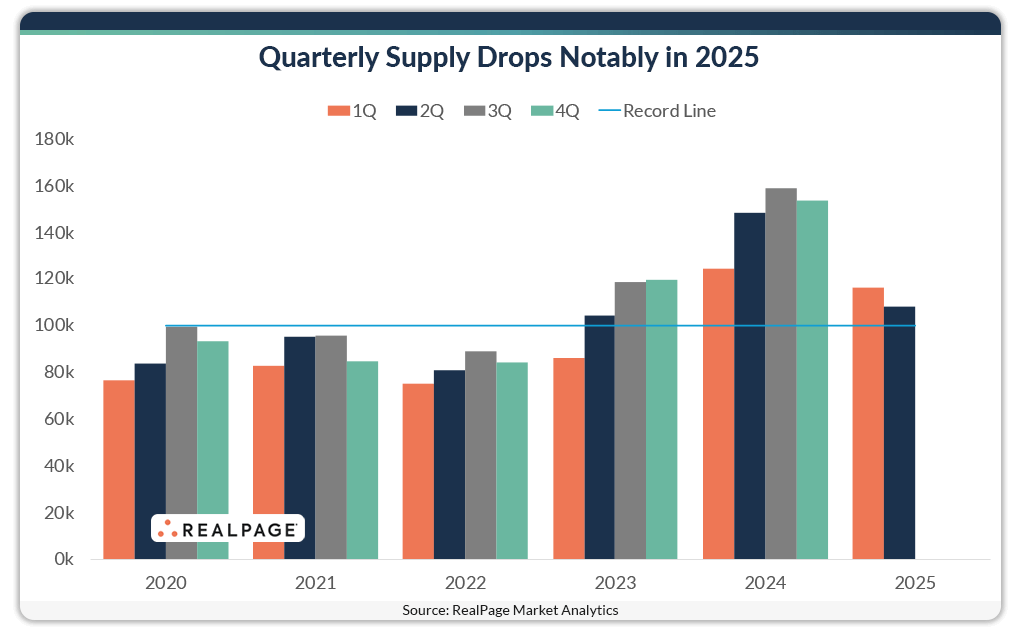

Though Still at Record Levels, Quarterly Apartment Supply Keeps Falling

Apartment supply volumes remain elevated, though completions continued to drop in 2nd quarter 2025.

Though 2025 represents the end of a very strong apartment supply run, the U.S. apartment market hit a ninth consecutive quarter of record completion volumes in 2nd quarter 2025. Quarterly completion volumes broke past the 100,000-unit mark in 2nd quarter 2023 for the first time since RealPage Market Analytics began tracking the U.S. apartment market in the 1990s. Delivery totals then increased for five straight quarters, peaking in 3rd quarter 2024 before ebbing slightly in the last three months of 2024. The drop in the first half of 2025, though, has been steep.

Developers completed nearly 108,200 units in the April to June time frame. That was well behind 3rd quarter 2024 (159,000 units) and a bit below 1st quarter 2025 (116,000 units), but still just ahead of the 100,000-unit mark record.

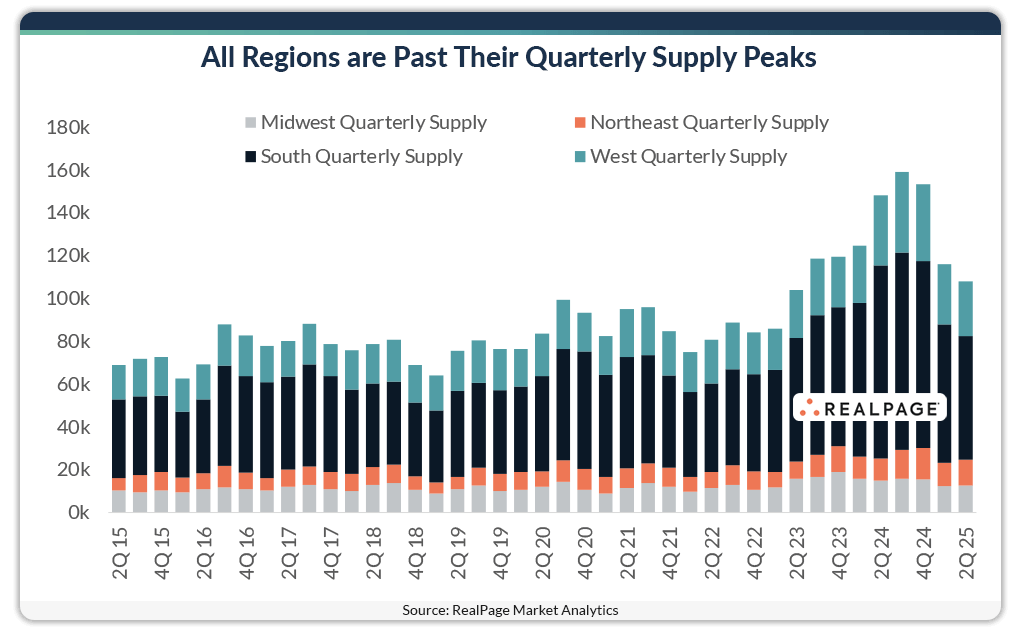

Not every region of the U.S. saw supply volumes fall in 2nd quarter, though all are down from recent peaks. New apartment deliveries continued to be most prolific in the South region of the U.S., as nearly 57,800 units wrapped up there in 2nd quarter 2025. But the South also saw the steepest pullback, delivering roughly 6,900 units less than in the first three months of 2025 and even fewer than the peak achieved in 3rd quarter 2024.

The West saw nearly 25,700 units delivered in 2nd quarter, which was about 2,500 units fewer than came online in the region in 1st quarter. This region also peaked in 3rd quarter 2024, and recent totals are well behind that mark.

More mild deliveries were seen in the Midwest (12,600 units) and Northeast (12,200 units) in 2nd quarter 2025. Those completion totals were both up a bit from last quarter, but were still down from recent peaks. The Northeast peak came later than other regions in 4th quarter 2024, when nearly 14,600 units were delivered. Quarterly supply in the Midwest peaked a year before the other regions, hitting at about 18,900 units in late 2023.

Markets seeing the most new deliveries in 2nd quarter were Dallas, New York, Phoenix and Austin. These markets each saw completions total north of 5,000 units in the April to June time frame, resulting in nation-leading annual delivery volumes topping 22,000 units. In each of these markets, however, the volume of product delivered in 2nd quarter has come down from recent peaks.