RealPage AI Revenue Management

Unlock Revenue Potential Across Your Portfolio

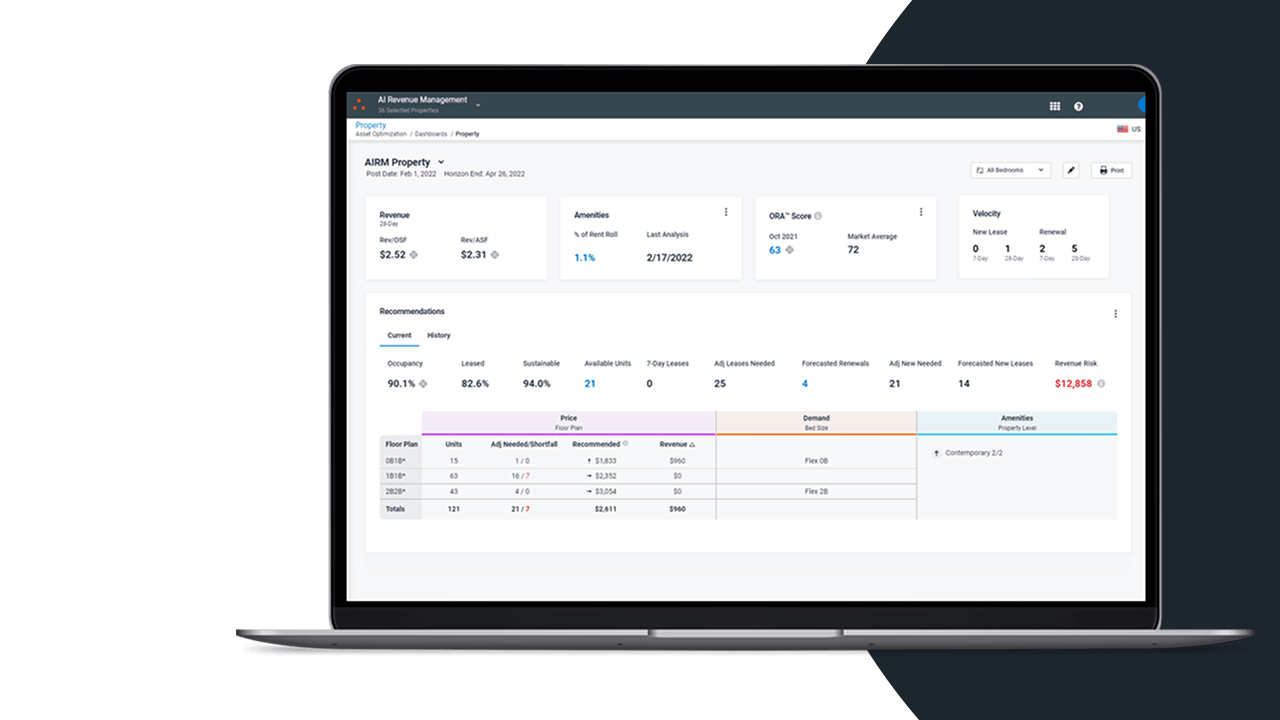

Executing your asset strategy, especially with fluctuating market conditions, seasonal trends, and resident turnover, requires real-time decision making. RealPage AI Revenue Management offers a proven solution to consistently drive revenue outperformance across all properties, regardless of class, lifecycle phase, location, or strategy.

Why Choose RealPage AI Revenue Management?

- Revenue Outperformance: Proven 2-4% outperformance to market across all economic cycles.

- Optimize with Confidence: Transparent and straightforward recommendations that leverage AI modeling to strategically balance rent and occupancy.

- Minimize Vacancies: Align lease expirations and pricing strategies to reduce vacant days.

- Align with Asset Strategy: Configurations tailored to each site’s specific strategy.

- Empower Unit Amenities: Appropriately set amenity values to allow units to move at similar velocity and reduce vacancy.

- Adapt to Market Dynamics: Stay agile with data insights and advanced forecasting tools.

Everyone Benefits

Prospects & Residents

Enjoy transparency, flexibility, and certainty in leasing options.

Leasing Teams

Enable a user-friendly leasing process that empowers teams and streamlines workflows.

Managers & Operations

Elevate efficiency through detailed analytics and decision support.

Owners

Execute asset strategies effectively to achieve consistent outperformance.

User-Controlled Decision Making

Empower users with full control while enhancing efficiency and visibility into revenue opportunities.

Manage by Exception

Focus on key revenue-impacting areas without getting lost in the details.

Identify and Address Outliers

Quickly detect and take proactive action.

Advanced Reporting

Gain deep insights and track performance.

Your Decision, Your Way

Maintain flexibility and cohesion with asset strategy and property operations.

Efficiency & Visibility

Configurable dashboards direct your attention and foster faster decision making.

Key Capabilities to Drive Results

Revenue Optimization

Amenity Revenue Management

Lease Expiration Management

Portfolio-Level Insights

Partner with RealPage's Advisory Team

Our team of seasoned experts—each with an average of 10+ years in the industry—ensures tailored analytics and day-to-day execution support to align your strategy with your goals.

- Daily advocacy for revenue and oversight of recommendations

- Identify opportunities and align configurations with your property’s specific strategy

- Deliver on unique strategies - including lease-up, affordable housing, student, or renovations

- On-going support to ensure continued success

It’s not just a tool; it’s your strategic advantage.

“Our clients need to leverage timely, actionable insights to maximize their revenue potential. We developed AI Revenue Management by listening to our clients and applying innovative analytics and AI to help them unlock revenue in any market.”

Frequently Asked Questions about Revenue Management Software

What is revenue management software?

- Revenue management software is a tool that apartment providers use to dynamically adjust the prices at which they offer apartments for rent based on supply (available units) and demand (prospective and current residents) at the particular apartment complex.

- Revenue management technology was introduced in the multifamily housing industry in the early 2000s. The technology is similar to revenue management approaches that were originally adopted by the airline industry and today are regularly used by service providers in a diverse set of other industries, from hotels to grocery stores.

How does revenue management affect renters?

Revenue management software generates a pricing matrix that allows prospective renters the flexibility to choose among multiple lease term options with transparent pricing. Prior to the introduction of revenue management software, renters rarely had options beyond a 12-month lease and little visibility into pricing options. Today, renters at communities with revenue management software are often given a matrix of options for move-in dates and lease terms. This approach provides consumers seeking to rent an apartment transparency so they know they are receiving the same pricing available to all others in the market and optionality so they are able to find and select the term/price option and move-in date that best meet their personal needs. This flexibility also affords apartment providers the ability to say “yes” in some cases when they previously would have had to decline a renter with non-standard term length or pricing requirements.

What is the difference between “revenue optimization” and “rent maximization”?

- “Revenue optimization” is different from “rent maximization.” RealPage Revenue Management software supports “revenue optimization” at a property rather than “rent maximization” of any individual apartment unit. The goal of “revenue optimization” is to set rents at the optimum balance to ensure units do not sit vacant due to being overpriced, but also are not underpriced given the applicable supply of and demand for those units at the particular property. If an apartment provider sets rent too high, then the available apartment units sit vacant. Vacant units generate zero revenue and that results in less overall income for the apartment provider.

- Each apartment provider has its own unique strategy for managing a particular property. Some providers may execute a strategy to quickly lease-up or minimize vacancies at a particular property, and thus configure their software to align with that strategy by establishing lower rents to quickly reach or consistently maintain very high or full occupancy. Others may tolerate more or longer vacancies in order to obtain higher rents and thus configure their software to support that strategy. (Note, however, that occupancy rates nationally have trended upward over the last 10+ years as revenue management software has grown in adoption.) Revenue management software is a tool that is configurable to support an apartment provider’s particular goals at a particular property.

- In addition to being a configurable tool, the pricing recommendation output from RealPage Revenue Management may be followed, modified, or ignored by an apartment provider in any particular case. Ultimately, it is up to each apartment provider to execute a pricing strategy that it determines to be appropriate for its property.

- While software tools are wonderfully useful in aiding better operational decision-making, RealPage recognizes that in certain circumstances apartment providers may be aware of important factors that are not considered by the software’s algorithmic model, such as road construction, units not made ready, construction at the property, or a new community being built across the street. Another example could be a natural disaster or other external factor. We saw this after Hurricane Harvey hit the Houston metro area in 2017. The storm led to significant demand for apartments from displaced households, and many apartment operators chose to voluntarily cap rents during that period. This is where an apartment provider’s expertise blends with the math and science of RealPage Revenue Management in executing the property’s unique strategy. For these reasons, it is both common and expected that over time an apartment provider will follow the system’s pricing recommendations on approximately 80-95% – not 100% – of its pricing decisions. In fact, RealPage strongly advises its customers that agreement with the model 100% of the time may indicate ineffective use of the solution.

Does revenue management software ever recommend lowering rent prices?

- Yes, of course. Every day, revenue management software recommends both increases and decreases in rent prices depending on the applicable internal supply and demand dynamics at the property. RealPage Revenue Management software frequently recommends adjusting rent downward whenever supply and demand dynamics at a property so indicate. For example, if a certain type of unit (such as a 2-bedroom unit) at a property is not leasing quickly, then the software will routinely recommend that the rent price be adjusted downward.

- RealPage Revenue Management software will recommend price increases at a particular unit type for a particular property ONLY when there are more renters willing to pay a higher price than available units (that is, demand exceeds supply). If renters are not willing to pay a published price, then the system will very quickly recommend lowering that price.

What does it mean to “outperform the market?”

- RealPage Revenue Management software helps apartment providers make intelligent pricing decisions and perform better than they would without employing the tool. However, because RealPage Revenue Management software does not consider or have visibility into availability (supply) at other properties (and only considers internal availability at the property in question when recommending rents), the solution does not in any way control or influence market conditions, nor does it permit apartment providers who use the solution to do so. RealPage Revenue Management solutions react to changes in conditions quickly and proactively, providing property owners the ability to optimize revenue by balancing both rent and occupancy.

- This does not always mean higher rents at any given property. In fact, rents may be adjusted downward for individual units or unit types in order to increase occupancy and thus optimize revenue over the property as a whole. By doing so, RealPage Revenue Management seeks to aid its customers in “outperforming the market” through better decision-making. In periods of declining demand or excess supply, “outperforming the market” often entails rent reductions to help maintain higher occupancy rates – which, in turn, helps the property maintain revenue or experience lesser revenue losses when compared to market averages.

How does revenue management software impact rental affordability?

- Revenue management software helps property owners set rents at levels that fill units at rates that renters are willing and able to pay, without overpricing or underpricing.

- Harvard’s Joint Center for Housing Studies points out that nearly half of all U.S. renters are “rent burdened” – spending more than 30% of income toward rent. By comparison, the median renter household in apartments leveraging RealPage software spends 23.2% of income toward rent when signing a new lease. See blog post.

- Harvard also noted that as of early 2022 15% of U.S. renters were behind on rent, while unpaid rent in market-rate apartments leveraging RealPage software typically measures only about 4%.

- RealPage Revenue Management software does not impact rents in subsidized, low-income affordable housing, which are typically set based on area median incomes. However, RealPage recognizes that the U.S. has had a decades-long severe shortage of low-income affordable rental housing and actively supports efforts by industry groups and housing advocates to increase the supply of such housing. Studies have estimated that deficit to be as many as 7 million units. (For context, there are fewer than 1 million available market-rate units in the U.S. as of fall 2022, with the average vacant unit leasing within less than 30 days.) The White House recently proposed more than $200 billion in funding for building and maintaining affordable housing, but the plan has stalled in Congress.

How has revenue management impacted apartment vacancy and turnover?

- Revenue management software helps prevent rents from reaching unaffordable levels. If rents are set too high, vacancy spikes and apartment providers generate no revenue on vacant units. Over the last decade, vacancy, and resident turnover both steadily decreased, while revenue management software usage increased.

- In early 2022, both vacancy and resident turnover reached the lowest levels on record, and the median rent-to-income ratio measured 23.2% among residents of apartments leveraging RealPage software. Revenue management software can help reduce vacancies, and minimize a unit’s down time, by lowering rents during periods of seasonally weak demand.

What data does RealPage Revenue Management software use in its algorithm?

- RealPage Revenue Management software is fundamentally built on the disruptive idea that a property’s internal supply/demand dynamics are much more important than a competitor’s rents. Therefore, RealPage Revenue Management software prioritizes a property's internal rent data (what renters are willing to pay for their community) and internal availability data (unit and unit types that are or will be coming available to rent at that community) when determining whether a rental price should be increased, decreased, or remain at the current level. If such information indicates that a price should be adjusted either upward or downward, then the software uses aggregated, anonymized rent data from a variety of sources to help determine price elasticity of demand—that is, how sensitive demand is to upward or downward adjustments in price—and thus the appropriate magnitude of change in price. This approach is critical to helping ensure that rents remain affordable and that units do not sit vacant.

- While competitor rent data is one of several data inputs, RealPage Revenue Management does not use specific competitor rent data in its algorithm – only aggregate data. RealPage clients do not have visibility into a competitor’s actual rents.

- RealPage Revenue Management’s algorithm does not use or consider any personal or demographic data.

How publicly transparent is the asking rent data that is generated from RealPage Revenue Management?

- RealPage Revenue Management solutions help make apartment pricing more publicly transparent through a pricing matrix provided by apartment providers to prospective renters. This pricing matrix is usually published on publicly available websites, often including both internet listing services and the property’s own website.

- Furthermore, RealPage Revenue Management encourages properties to use bottom-line pricing (that is, publishing non-negotiable, market-appropriate rent prices) rather than rent negotiating for a variety of reasons, including to help ensure compliance with fair housing rules. When bottom-line pricing is used, the actual transacted lease rent is more likely to match the rent published via the pricing matrix.

- Sometimes apartment providers are willing to negotiate off the pricing matrix. If a renter agrees to a negotiated rental rate, the actual transacted lease rent is likely to be lower than the published rent. In such cases, by factoring in these discounted actual rent rates, RealPage can capture a truer picture of price elasticity and affordability, which helps set recommended pricing at levels that reduce the chance of overpricing a unit and helps ensure that units do not sit vacant.

How do apartments without revenue management software set rents?

Many apartment providers set pricing without using commercially available revenue management solutions. When apartment providers use manual pricing methods to set rents, they typically conduct “comp surveys” to collect asking rents from competitors, and then use that data to set rents at their own properties. In contrast, RealPage Revenue Management solutions prioritize a property’s own internal supply/demand dynamics over external factors such as competitors’ rents, and therefore help eliminate the risk of collusion that could occur with manual pricing.

How does RealPage Revenue Management help housing providers comply with fair housing laws?

- RealPage Revenue Management solutions produce a matrix of options that give renters flexibility to pick their preferred term length and associated rent. Our solutions help ensure compliance with fair housing rules by increasing pricing transparency and giving all potential renters equal access to that matrix of rent options, including the lowest available rent.

- Revenue management software also helps eliminate inconsistent rent negotiations and bidding wars that can occur in manual pricing, thus reducing the possibility of discriminatory pricing in violation of fair housing rules.

- RealPage Revenue Management’s algorithm does not use or consider any personal or demographic data.

How does revenue management software impact low-income affordable housing?

- Rents in subsidized low-income affordable housing are subject to regulatory rules and are typically set at levels based on area median incomes; therefore, the rents paid by lower-income residents at such properties are completely unrelated to – and unaffected by – rents paid by upper-income renters or by market dynamics of supply and demand.

- The U.S. has a severe shortage of low-income affordable housing, and RealPage actively supports efforts by industry groups and housing advocates to increase the supply of low-income rental housing.

- Housing advocates have estimated the shortage of housing at as many as 7 million units, with the majority being for lower-income households. By comparison, there have been fewer than 1 million vacant market-rate units available throughout 2022; and the average vacant unit nationally is leased within less than 30 days, according to RealPage data. This highlights the need for significantly more public investment in low-income affordable housing, such as the Low Income Housing Tax Credit program.

What are RealPage User Groups and what do they do?

- Like many software companies, RealPage listens to its customers when deciding what to prioritize on its product development roadmap and how to improve product features. For a number of its software offerings, including RealPage Revenue Management solutions, RealPage brings together interested customers on a periodic basis in the form of product-specific “user groups” to suggest potential product enhancements, give feedback about software operation, and discuss industry-wide issues relevant to rental housing.

- User group meetings give members a forum to express opinions and discuss topics that bear upon software direction and innovation. They are not designed or used as a vehicle to discuss rents, assets or markets, or to share proprietary user data or other competitively sensitive information.