Introduction

ClientDirect is offered through Realpage, Inc.

ResidentDirect is offered through RealPage Payments Services, LLC (“RPPS”), a RealPage, Inc. subsidiary operating as a licensed Money Services Business.

The ClientDirect/ResidentDirect Cards Only (“CD/RD Cards Only”) is a Product delivered through functionality provided by both ClientDirect and ResidentDirect.

Access and use of RealPage Payments Product Centers and services (“Products”) at a particular Site is governed by an underlying agreement and/or addendum (“Agreement”) with RealPage, Inc. or its affiliates (“Provider”). Provider warrants in the Agreement that each Product will perform the functions applicable to the Product set forth in the then most current version of these specifications.

Capitalized terms herein shall have the meaning ascribed to them in the Agreement, unless otherwise specifically defined herein.

Authorized Users

Subscriber access to and use of the RealPage Payments Products shall, at times, be limited to Authorized Users. The subscriber shall permit only Authorized Users to access and use the RealPage Payments Products. Subscriber must not permit any other entity to access and use the RealPage Payments Products without the permission of Provider. The subscriber shall ensure that all Authorized Users of the subscriber’s passwords comply with these terms and conditions of use. Subscriber shall not permit anyone who has not been designated as an Authorized User to obtain or use an assigned password, nor permit anyone who has ceased to be an Authorized User to continue to use an assigned password.

Passwords

Subscriber will be solely responsible for the confidentiality of the passwords used to access the RealPage Payments Products and will be solely responsible for any and all losses and damages to either Party resulting from the loss, theft, or misuse thereof, or from the subscriber’s failure to maintain, the confidentiality of Subscriber’s passwords.

Product Overview

Product Description

RealPage Payments – CD/RD Cards Only(“the Payments Service”) is a customized product offering functionality provided by two RealPage Payments products: Client Direct and ResidentDirect.

-

RealPage Payments – ClientDirect (“ClientDirect”) is a web-based payment processing system offered by RealPage, Inc. that provides a number of electronic payment options to improve efficiencies in the leasing office and for tenants.

- Payee-Agent: RealPage is providing the Payments Service to the subscriber as payee-agent, and all payments submitted by the subscriber’s customers through RealPage’s Payments Service shall constitute payments to the subscriber.

-

RealPage Payments - ResidentDirect (“ResidentDirect”) is an online bill payment service that allows tenants of apartment communities to conveniently pay their rent and other charges through a tenant web portal.

- Payor-Agent: RPPS is providing the Payments Service to tenants as payor-agent. RPPS contracts with Subscribers to authorize settlement of transactions and integrate with the property tenant web portals. Payments submitted to RPPS through the Payments Service are not deemed payments to the subscriber until the funds have been settled in the Subscriber’s designated operating account.

Product Features & Functionality

RealPage Payments – CD/RD Cards Only functionality includes:

Payment Types1

ACH – Automated Clearing House

- ARC (Accounts Receivable Collection) - Check conversion for tenants checks, consumer checks drawn on U.S. funds

- PPD (Preauthorized Payment and Deposit) - Single debit by means of authorization form received at the point of sale

- Recurring - Recurring debit by means of authorization form received at the point of sale

- WEB (Internet Initiated and Authorized Entries) Internet initiated and authorized single or recurring scheduled payment

1 Credit and debit cards are offered online through ResidentDirect and RealPage Payment Services, LLC. All other payment types are offered through ClientDirect and RealPage, Inc.

IRD – Image Replacement Document

- Check conversion for money orders, business checks, traveler’s checks, government checks, convenience checks, cashier’s checks, etc.

- U.S. checks drawn on U.S. funds

Credit or Debit Card

- Card swipe processing at the point of sale

- Single charge by means of authorization form received at the point of sale

- Recurring charge by means of authorization form received at the point of sale

- Telephone initiated single payments through credit or debit card

- Internet initiated and authorized single and recurring payments through credit or debit card

Payment Methods

-

Bulk Processing (ACH/IRD)

- Ability to convert a batch of paper checks to electronic items using a check scanner

-

Check Conversion (ACH/IRD)

- Ability to convert a paper check to an electronic item using a check scanner

-

Preauthorized Single Payments (ACH/CARD)

- Ability to process a single transaction by means of an authorization form signed by the tenant

-

Preauthorized Recurring Payments (ACH/CARD)

- Ability to process recurring transactions by means of an authorization form signed by the tenant

-

Card Present Transactions (CARD)

- Ability to process a credit or debit card transaction by swiping the card through the card scanner

-

Online Payments (ACH/CARD)

- Ability for a tenant to authorize and process a single or recurring transaction through a secure web site

-

Returns/Adjustments/Chargebacks

-

Returns – ACH or IRD items that are returned for non-payment; most common return reasons are:

- Insufficient funds

- Account closed

- Unable to locate account

- Invalid account number

- Unauthorized debit to consumer account

- Adjustments – IRD items that are returned because of a mis-keyed amount or poor image quality. Clients’ bank account will be adjusted (debited or credited) for the difference in order to correct the item.

- Chargebacks – The return of the original card transaction from the Issuer, when a specific rule or regulation may have been violated.

-

Returns – ACH or IRD items that are returned for non-payment; most common return reasons are:

Additional Functionality

Convenience Fees (optional):

- RealPage Payments - ClientDirect provides PMCs with the ability to charge tenants a convenience fee for online transactions. This feature is offered as an optional Product Center setting that Authorized Users manage. Each PMC must make a decision with regard to whether to charge a convenience fee, at its own risk, based on its evaluation of applicable lease terms and state or federal statutes/regulations.

User Administration

- Ability for a designated user to add, delete, and maintain users’ rights and roles within the Payments Service system. See Exhibit 1 – User Access Permissions & Roles

Reports

- Available for daily transaction monitoring, viewing transaction details, and bank reconciliations

User Access Testing

- A User Access Testing site for RealPage Payments Product Center is available. PMCs will use this site to configure assessment templates, enter sample tenant payments, and validate system functions. The burden for assessment of compliance shall rest solely on the PMC. User Access Testing environments are mirrors of your Payments production site and include all the features of the Payments product listed above.

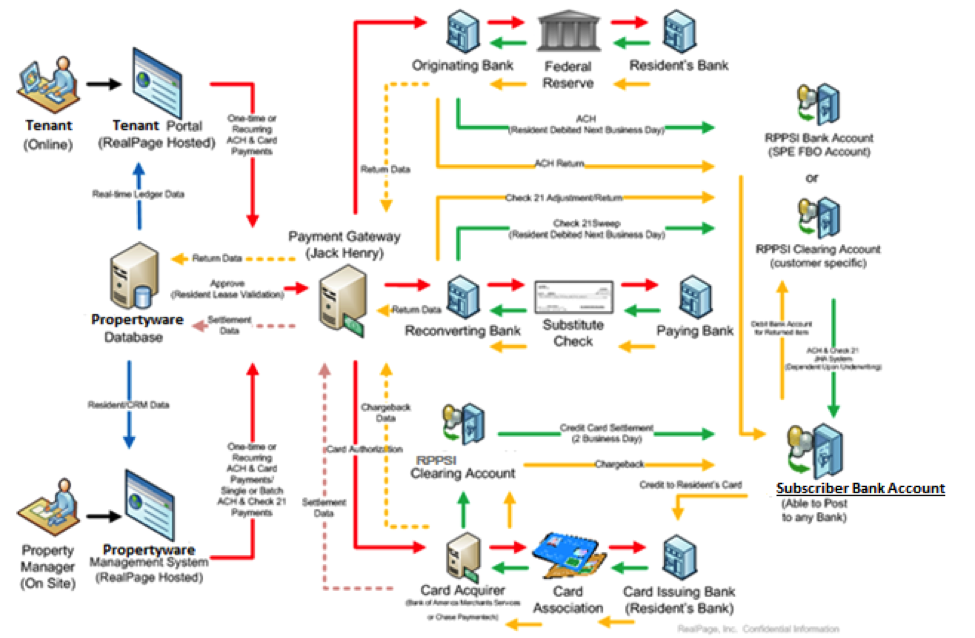

Product Transaction Workflow – ClientDirect On-Site & Online Payments

- Payments are initiated by tenants and on-site staff:

- One-time ACH transactions are initiated by tenants online.

- Recurring ACH payments are automatically processed without user/tenant interaction.

- Checks, Money Orders, and Card Transactions are processed by on-site staff.

- Online and on-site payments are authorized and posted to the tenant ledgers in real time.

- A tenant can view their adjusted balance and see their payment applied the moment it happens whether they pay online or on site.

- Site, regional, and corporate staff can see the payments online in the Payments Product as they happen throughout the day.

- All payments are validated in real time against the tenant data to verify that a tenant is not in eviction or is marked as to not accept checks or other forms of payment.

- ACH and Check images are batched together and transmitted to the sponsor bank for RealPage at 8:00 P.M. Central Time.

- Batches are automatically closed within the Property Management System without any interaction from customer.

- The payments are cleared through the appropriate network: ACH through the Federal Reserve Bank, and Checks/Money orders through bank image clearing networks.

- Debits are charged against tenants bank accounts.

- Funds are received in a RealPage clearing account FBO (for benefit of) RealPage clients for ACH and IRD transactions.

- The RealPage Payment Processing Services, Inc. (RPPSI) clearing account FBO RealPage clients is a bankruptcy remote entity (a Special Purpose Entity) established for the sole purpose of clearing funds.

- The funds in RPPSI are safe from any RealPage creditor claim in the unlikely event that RealPage should enter voluntarily or involuntarily into bankruptcy proceedings.

- Each client has unique identifiers that identify its funds when processing through the clearing account allowing funds to be settled appropriately amongst their property’s bank accounts.

- The RealPage Payment Processing Services, Inc. (RPPSI) clearing account FBO RealPage clients is a bankruptcy remote entity (a Special Purpose Entity) established for the sole purpose of clearing funds.

- Deposits are made to the appropriate property bank account at its existing bank. No new bank accounts are required.

- Separate bank accounts for security deposits and rents are supported.

- In the event that an item is returned by the tenant’s bank for any reason, the amount funded for that particular transaction will be debited from the property’s bank account and a return notification will be available on the property’s Leasing & Rents home page. Returns are received daily in the Payments Product and automatically reflected on the tenant’s ledger; any return fees and late fees will be automatically applied to the ledger based on the property’s settings within Leasing & Rents. For items that are returned for poor image quality, or because the item was processed for an incorrect amount (Money Orders, Cashier’s Checks, Business Checks, etc.), an adjustment (debit or credit) will be made to the property’s bank account for the difference in order to correct the item.

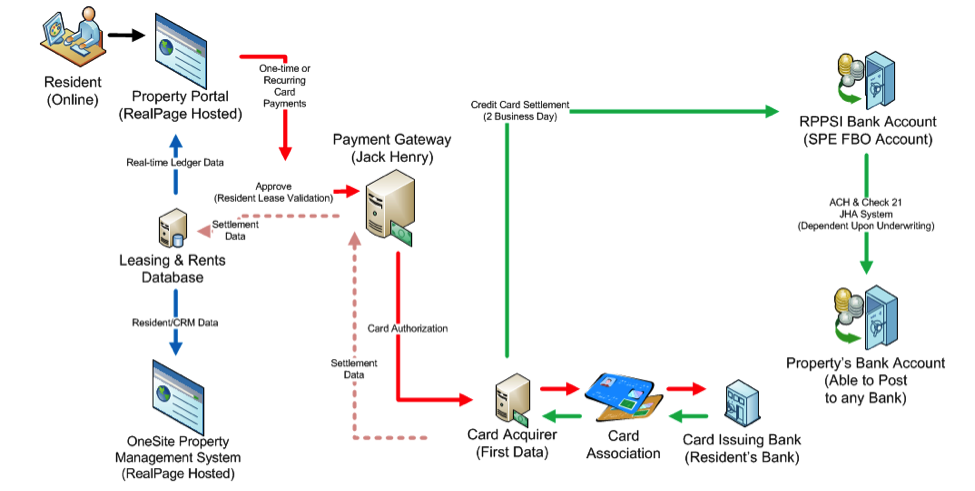

Product Transaction Workflow – ResidentDirect Online Credit and Debit Cards

- Tenant uses Online Tenant Portal product to process an immediate payment to the subscriber

- Tenant chooses to process a Card payment.

- Payments system validates the resident can make a payment

- Payments Product processes the payment:

- Card:

- Payment Gateway sends card data to Card Acquirer

- Card Acquirer sends card data to Card Association (Visa, MasterCard, Discover)

- Card Association sends card data to Tenant’s card issuing bank (ex. Bank of America)

- Card issuing bank approves the transaction and sends approval to Card Association

- Card Association sends approval to Card Acquirer

- Card Acquirer sends approval to Payment Gateway

- Payment Gateway sends approval to Payments Product

- Payments Product provides approval confirmation to Tenant

- Payment is immediately posted to the Tenant’s ledger

- Card issuing bank initiates a transfer of funds to Card Acquirer by ACH credit

- Card Acquirer receives funds and places the funds into a ResidentDirect Entity clearing bank account (FBO RealPage Clients) until the payments are settled

- Payments Product sends a consolidated ACH credit to the site bank account for the card funds.

- Payments Product reconciles the transactions and funds to clients on a daily basis transaction amount minus the service fee

- Card:

Exhibit 1 – User Access Permissions & Roles

| Propertyware Permission Options | Propertyware Roles | ||

| Name of Permission Option | Definitions | ||

| Administrator Privilege | Normal Privilege Level | ||

| Contacts - Edit ePayment/Bank Information | Allows the permitted user to enter and change a tenant or owner's bank account or other | ✓ | ✓ |

| Money Out - Vendors: Edit ePayment/Bank Information | Allows the permitted user to enter and change a tenant or owner's bank account or other | ✓ | ✓ |

| Create ePayment | Provides the ability to create an ePayment on a Tenant or Vendor Ledger | ✓ | ✓ |

| Create Owner Draw | Provides the ability to create an ePayment to an owner from the Management Module | ✓ | ✓ |

| Post all Owner Draws | Provides the ability to create bulk payments to selected owners from the Management Module | ✓ | ✓ |

| *Convenience Fees | Activate and set fee for optional Convenience Fees for online transactions | ✓ | ✓ |

*Convenience fees are implemented and collected by the subscriber at their own risk. Convenience fees may be subject to lease terms or restrictions, as well as applicable federal or state statutes and regulations.