San Francisco Apartment Market Leads the Nation for Rent Growth

San Francisco is leading the nation for rent growth, trending in contrast to national price cuts.

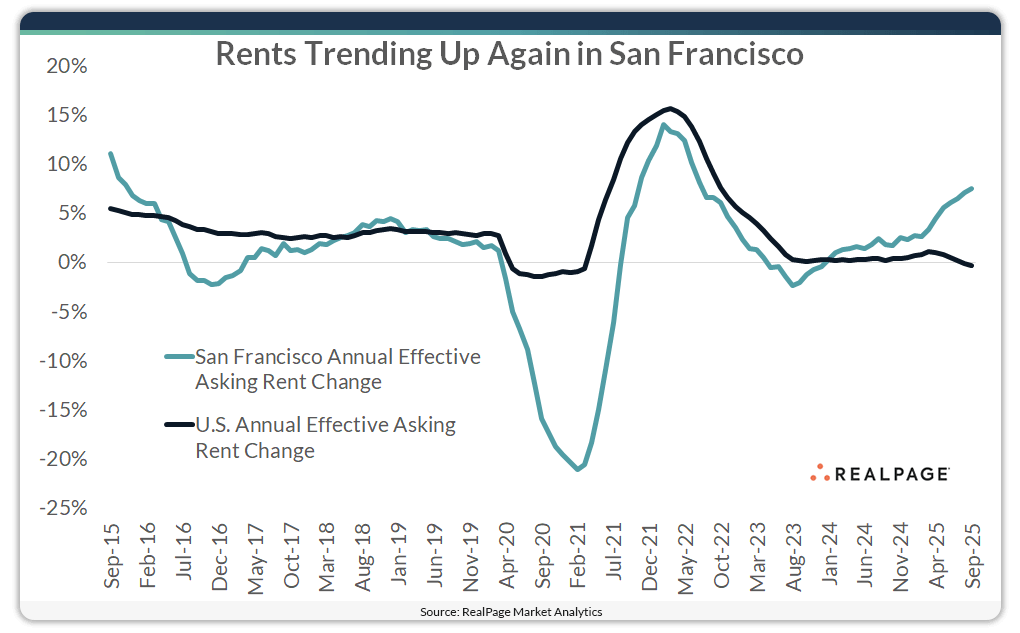

Effective asking rents increased 7.5% in San Francisco in the year-ending September, according to data from RealPage Market Analytics. This movement is in contrast to the national performance, and was well ahead of the market’s decade average.

San Francisco saw a deep decline in rental rates along with the nation’s other gateway markets in 2020 and 2021, during the economic decline of the COVID-19 pandemic. Rents rebounded in 2022 to double-digit territory, which is not uncommon for San Francisco. In fact, the market saw a similar peak in annual rent growth back in 2011, when rates were near 14%.

San Francisco’s latest price increase was well ahead of the nation’s other big rent growth showings in the past year. Among the nation’s largest 150 apartment markets, the other top readings were in the smaller Champaign, Providence and Portland markets, which saw rent growth between 5% and 6% in the past year. Among the largest 50 apartment markets, New York and Chicago were the closest to San Francisco, with annual rent growth around 4%.

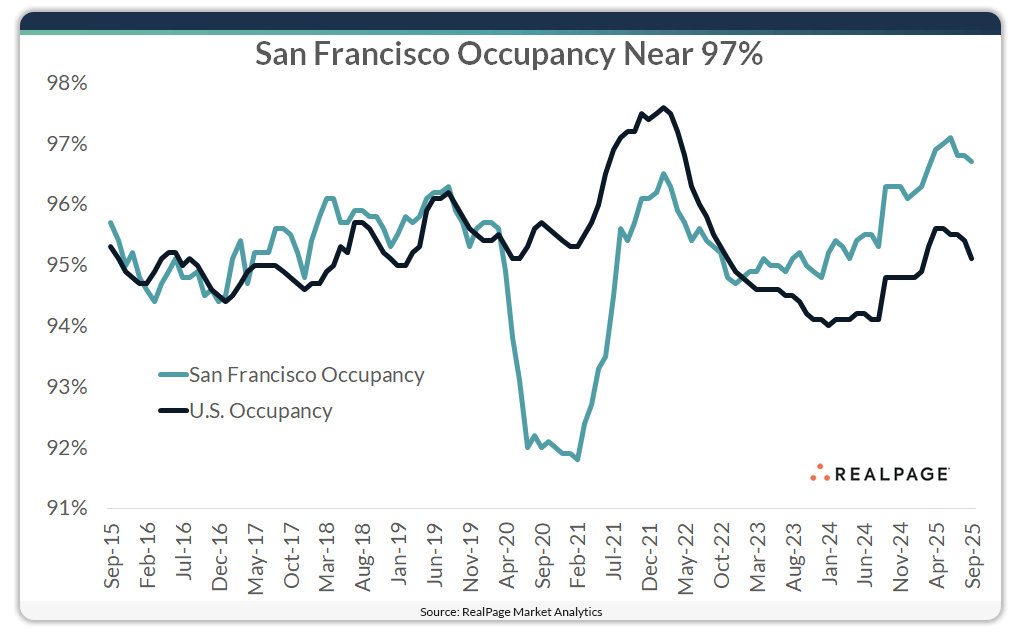

Helping inspire solid rent growth in the past year, apartment occupancy in San Francisco has recovered from its pandemic setback and is up to nearly 97% as of September. This latest showing of 96.7% was well ahead of the U.S. rate of 95.1%.

While San Francisco’s September occupancy rate wasn’t a top 10 showing among the nation’s largest 150 apartment markets, it was a top three reading among the largest 50 markets. Among these major markets, only Newark and New York had tighter showings closer to 97% in September.

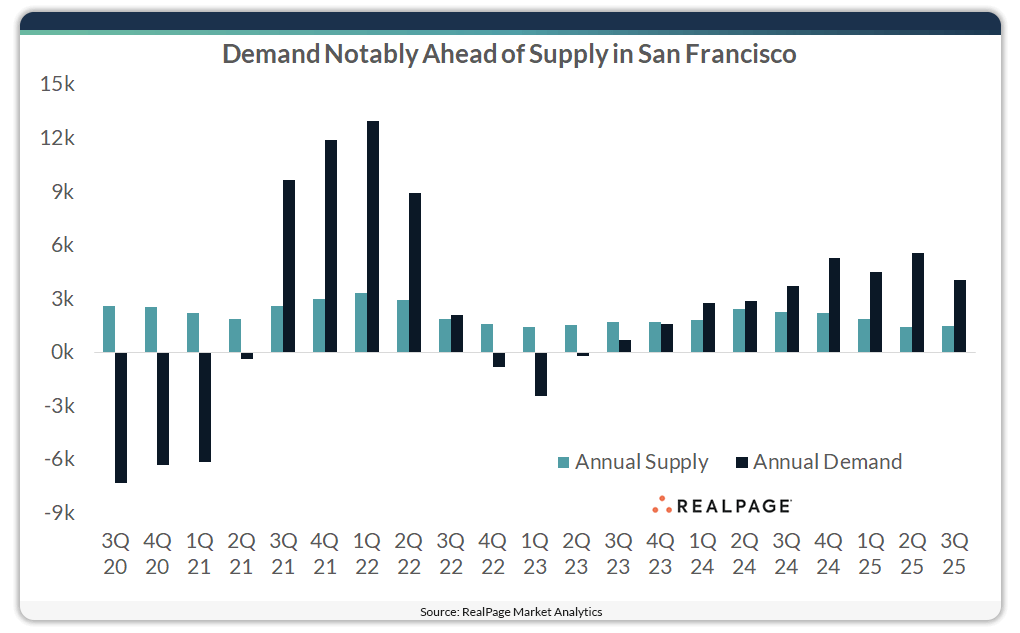

Occupancy tightness in San Francisco is the result of demand pushing well past concurrent completion volumes in recent years. Only 1,443 units were delivered in San Francisco in the year-ending 3rd quarter, which was a little more than half the decade average. Annual demand, meanwhile, was nearly three times the rate of supply, with San Francisco absorption topping 4,000 units in the year-ending 3rd quarter.

Renewed demand in San Francisco seems to stem, in part, from the area’s continuing economic recovery, fueled by optimism surrounding artificial intelligence. While overall job growth may still look modest, strengthening fundamentals in the tech sector are contributing to broader economic momentum and helping to slow the population decline experienced in recent years.