Elevated Apartment Supply in Salt Lake City Weakens Market Fundamentals

Salt Lake City has historically been an outperforming apartment market, but fundamentals have weakened in recent months due to mounting supply volumes.

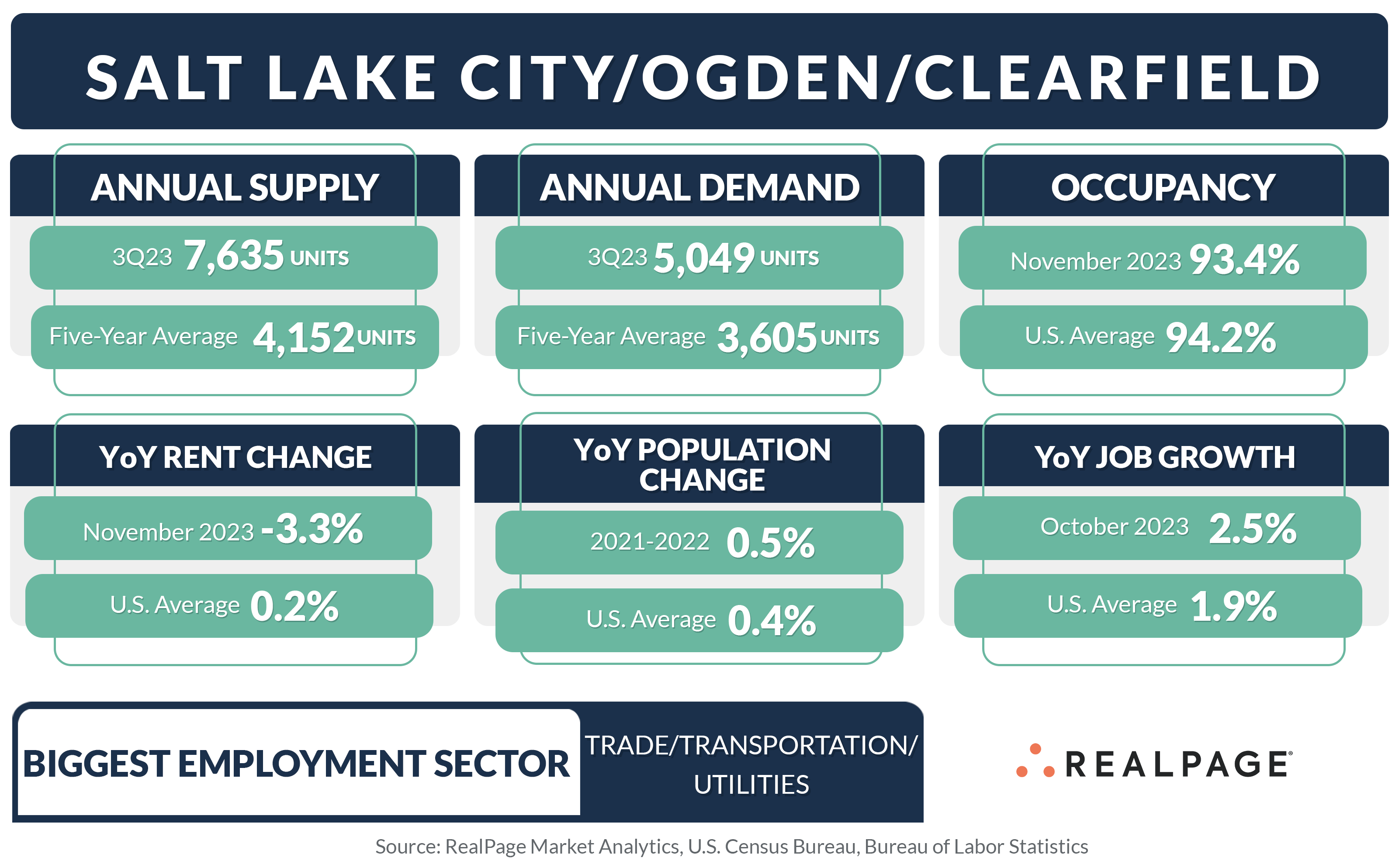

No other major apartment market in the U.S. added more units on a relative basis than Salt Lake City in the year-ending 3rd quarter 2023. And next year's supply wave will be even bigger. Although demand has been solid, it hasn’t been enough to keep pace with supply, pushing occupancy and rents down.

Salt Lake City, in northern Utah, is the state capital. The area is bounded by the Great Salt Lake to the northwest, the Wasatch Range to the east, the Oquirrh Mountains to the west and the Provo-Orem metro area to the south. The Salt Lake City/Ogden/Clearfield metro area has a population of nearly 2 million and the apartment market had roughly 129,500 existing units as of November, making it the 46th largest apartment market in the nation, according to RealPage Market Analytics.

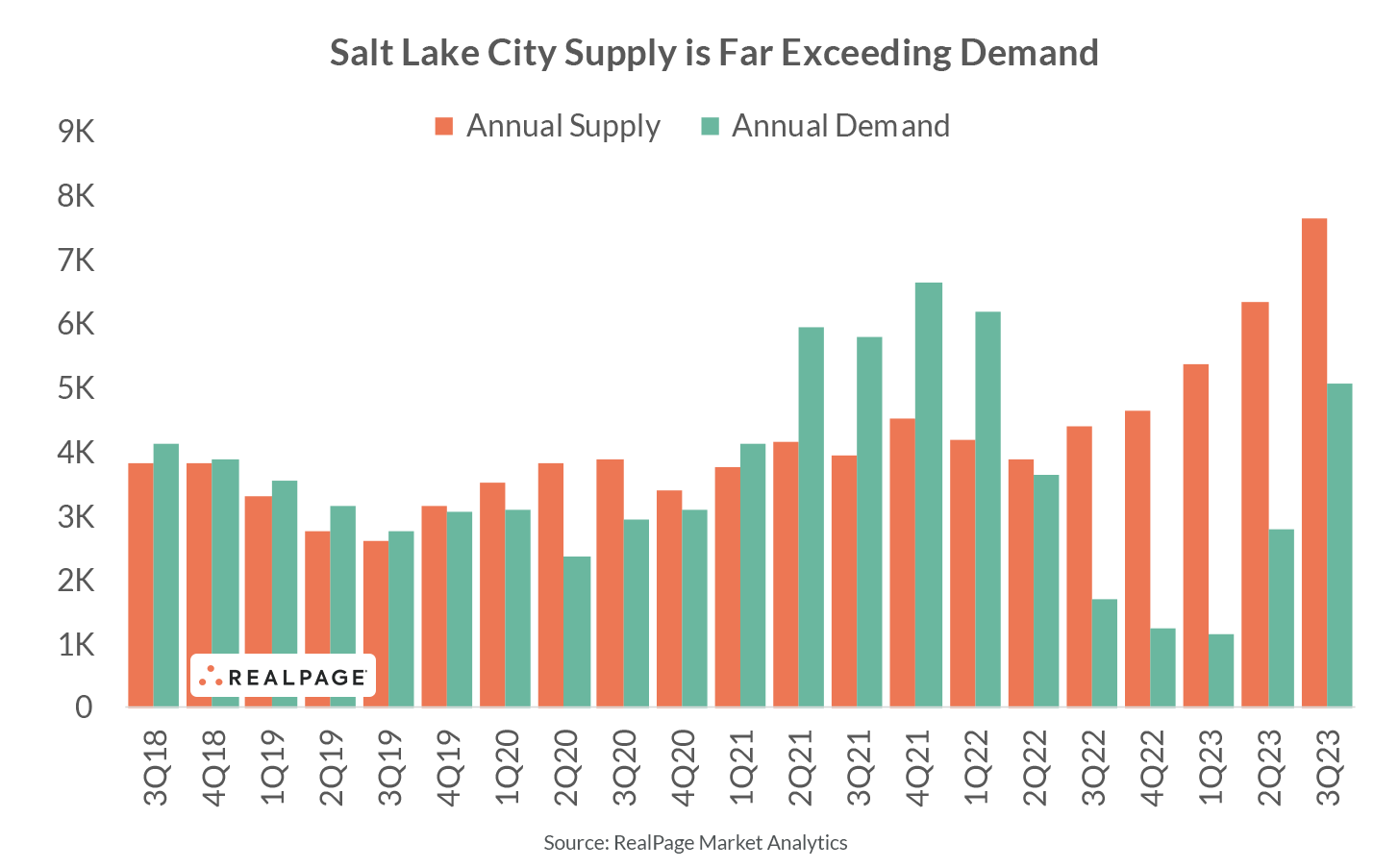

Apartment completions in Salt Lake City have been soaring. The market added a record-high delivery volume of more than 7,600 units in the year-ending 3rd quarter 2023. Those completions grew existing stock 6.4%, triple the national norm and the most rapid expansion pace among the nation’s 50 largest apartment markets. For perspective, Salt Lake City added an average of roughly 3,500 units annually over the past 10 years and an annual average of 2,300 units over the past 20 years.

Apartment construction is scheduled to continue at a rampant pace in Salt Lake City. Completions in the coming year are expected to rise 57% above the recent volume, to nearly 12,000 units in the year-ending 3rd quarter 2024, setting a new record for the market. That supply volume will grow the market’s existing stock 9.4%, the fourth-fastest expansion among major markets, behind only Austin-Round Rock (11%), Raleigh/Durham (9.9%) and Charlotte-Concord-Gastonia (9.6%).

Among Salt Lake City’s submarkets, Downtown Salt Lake City/University and Layton/Davis County posted the largest deliveries in the year-ending 3rd quarter 2023, adding 2,454 units and 1,555 units, respectively. Those additions expanded existing inventory in both submarkets by roughly 12%, by far the highest net inventory growth rates in the market over the past year. Only the Layton/Davis County submarket will see meaningfully less units delivering in the coming year, while scheduled completions in Midvale/Sandy/Draper and Downtown Salt Lake City/University are in line with the current annual delivery volume. The remaining submarkets will see considerably more deliveries in the coming year. The West Valley City submarket will likely to see nearly five times its current annual supply, while South Salt Lake is expected to have three times as many units deliver in the coming year compared to this past year.

Although demand has been improving in recent months, it has fallen well short of concurrent new supply over the past five quarters. After faltering throughout most of 2022 and into early 2023, apartment demand in Salt Lake City continued to rebound in the year-ending 3rd quarter with absorption of 5,049 units. That was a significant improvement from annual absorption of only 1,143 units recorded in 1st quarter.

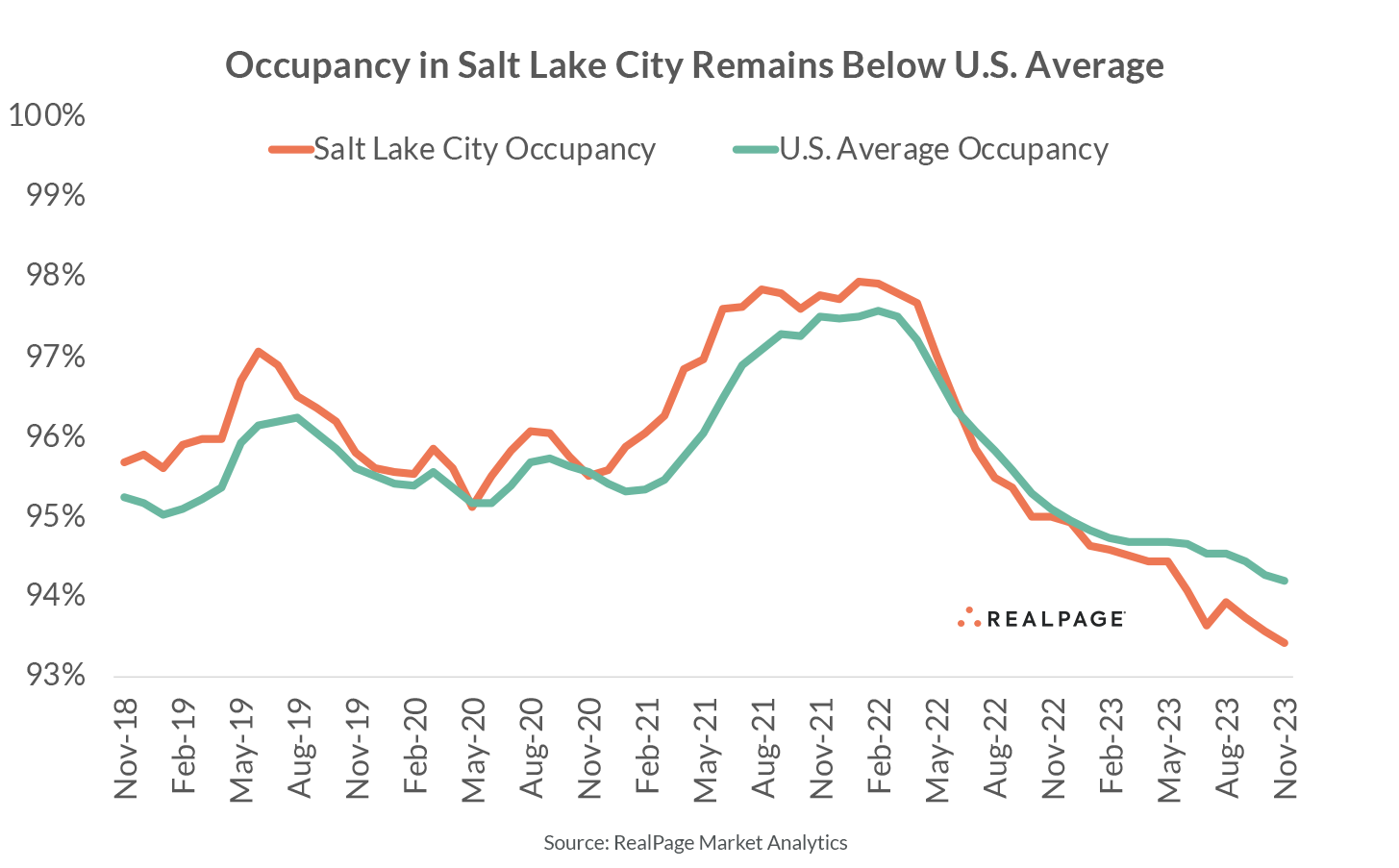

With new supply outpacing demand, Salt Lake City’s occupancy rate dropped 160 basis points (bps) year-over-year to stand at a 13-year low of 93.4% as of November. That reading registered 80 bps below the national average of 94.2% and was the 15th weakest reading among the nation’s 50 largest markets. Occupancy in Salt Lake City has registered in line with or below the national average since mid-2022, reversing a historical trend. In the 10 years leading up to the COVID-19 pandemic, occupancy in Salt Lake City remained at or above the national norm, averaging 95.6% compared to the U.S. average of 94.7%.

Across Salt Lake City’s product classes and submarkets, occupancy has fallen roughly 100 to 300 bps over the past year, with November rates ranging from 91% to 94%. Among product classes, Class C assets recorded the worst year-over-year pullback of 290 bps, taking occupancy to 93.2% in November. Class A units posted a 160-bps occupancy contraction, taking the rate to 93.2%. Class B assets, meanwhile, recorded a 100-bps decline over the last year, with November occupancy registering at 93.7%. Historically, Class C product generally leads the market, with occupancy averaging 96.8% over the past decade. The decade average for Class B was 95.8%, while Class A averaged 95.5% occupancy.

Among Salt Lake City’s seven submarkets, the deepest occupancy contraction in the year-ending November was recorded in Ogden/Weber County (-280 bps), taking occupancy to a market low of 92.1%. Other steep occupancy contractions were in Downtown Salt Lake City/University (-210 bps) and West Valley City/Airport Area (-200 bps), with rates registering at 92.7% and 93.1%, respectively. The tightest submarket occupancy rate of 94% was in Southwest Salt Lake City.

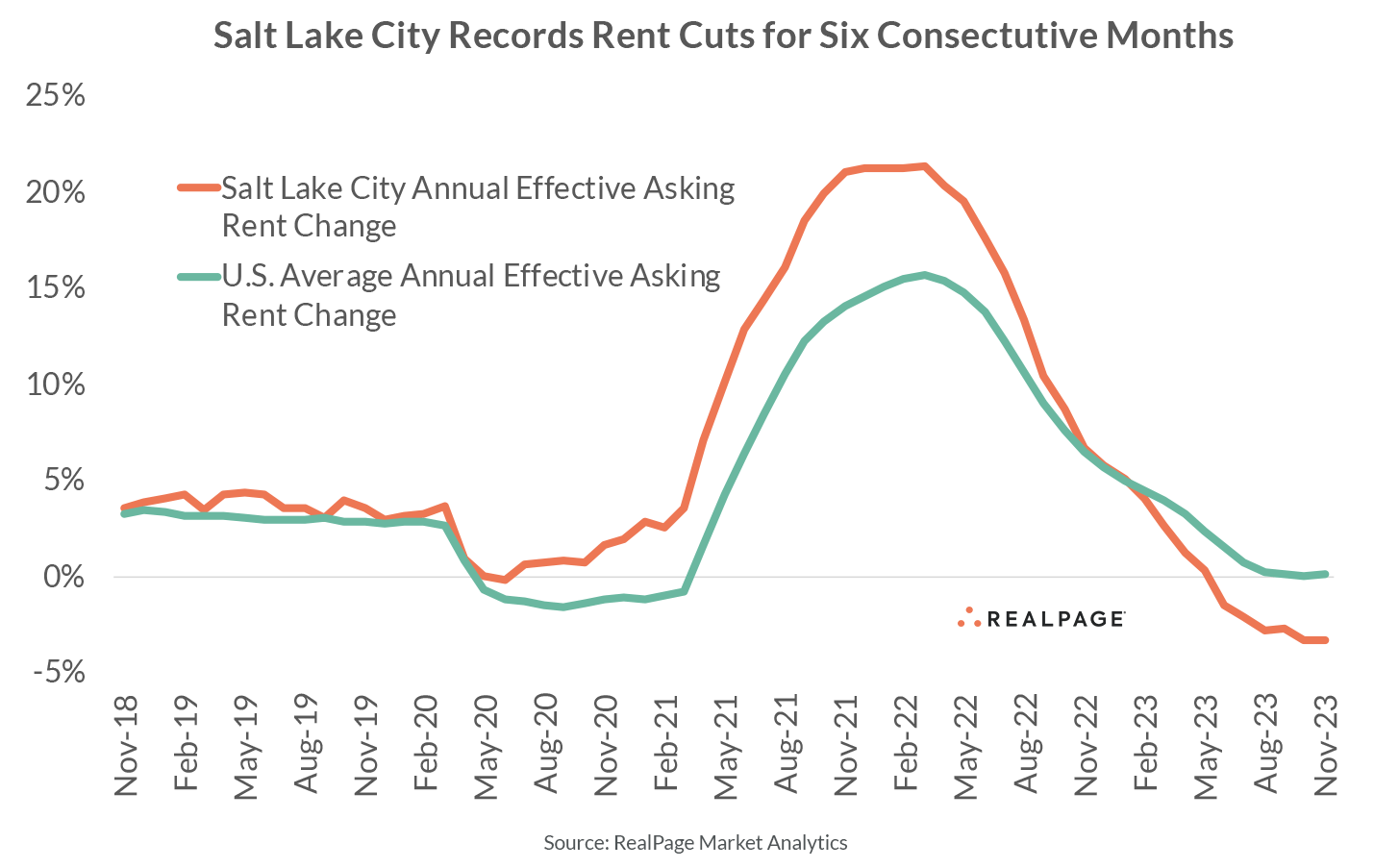

As a result of weakened occupancy, operator pricing power has waned in Salt Lake City. Effective asking rents dropped 3.3% in the year-ending November, the sixth-worst pullback among the nation’s 50 largest markets. Similar to occupancy, that rent cut was the market’s weakest annual performance in 13 years. Aside from the past six months and a small dip at the onset of the pandemic, rents in Salt Lake City have not been cut on a year-over-year basis since August 2010.

Looking at rent performance among product classes, Class C units saw the deepest year-over-year rent cuts in November (-4%), while Class B (-3.6%) and Class A (-2%) units registered meaningful reductions as well. All seven of Salt Lake City’s submarkets posted rent cuts, ranging from a mild 1% downturn in Midvale/Sandy/Draper to a steep 6.2% cut in the supply-heavy Downtown Salt Lake City/University submarket.

Salt Lake City has historically had little trouble absorbing large supply volumes and will likely continue to see impressive demand, but the market will be challenged in the short term. However, the region’s strong underlying demand drivers such as a strong economy, a rapidly growing population and solid income levels will continue to provide a solid tailwind to long-term performance fundamentals. Going forward, expect rent change and occupancy in Salt Lake City to remain muted until the current supply wave moderates. After that, Salt Lake City should once again return to its outperforming nature.