Apartment leasing has historically been reliably seasonal. The vast majority of absorption happens in the summer months, and then the off season accounts for minimal – or even negative – demand. In the last few years as the industry has experienced rapid changes, many operators are looking toward summer 2024 and wondering: How much strength in absorption can we really expect?

In other words, do we still have a prime leasing season?

In short, yes – but lately it’s been less radical than in the past. Historically, a preponderance of 12-month leases turned in the summer months and most renters approximately followed an academic calendar. Generally, those themes still ring true, but the pandemic’s impact on professionals’ ability to work from anywhere has disrupted this seasonality.

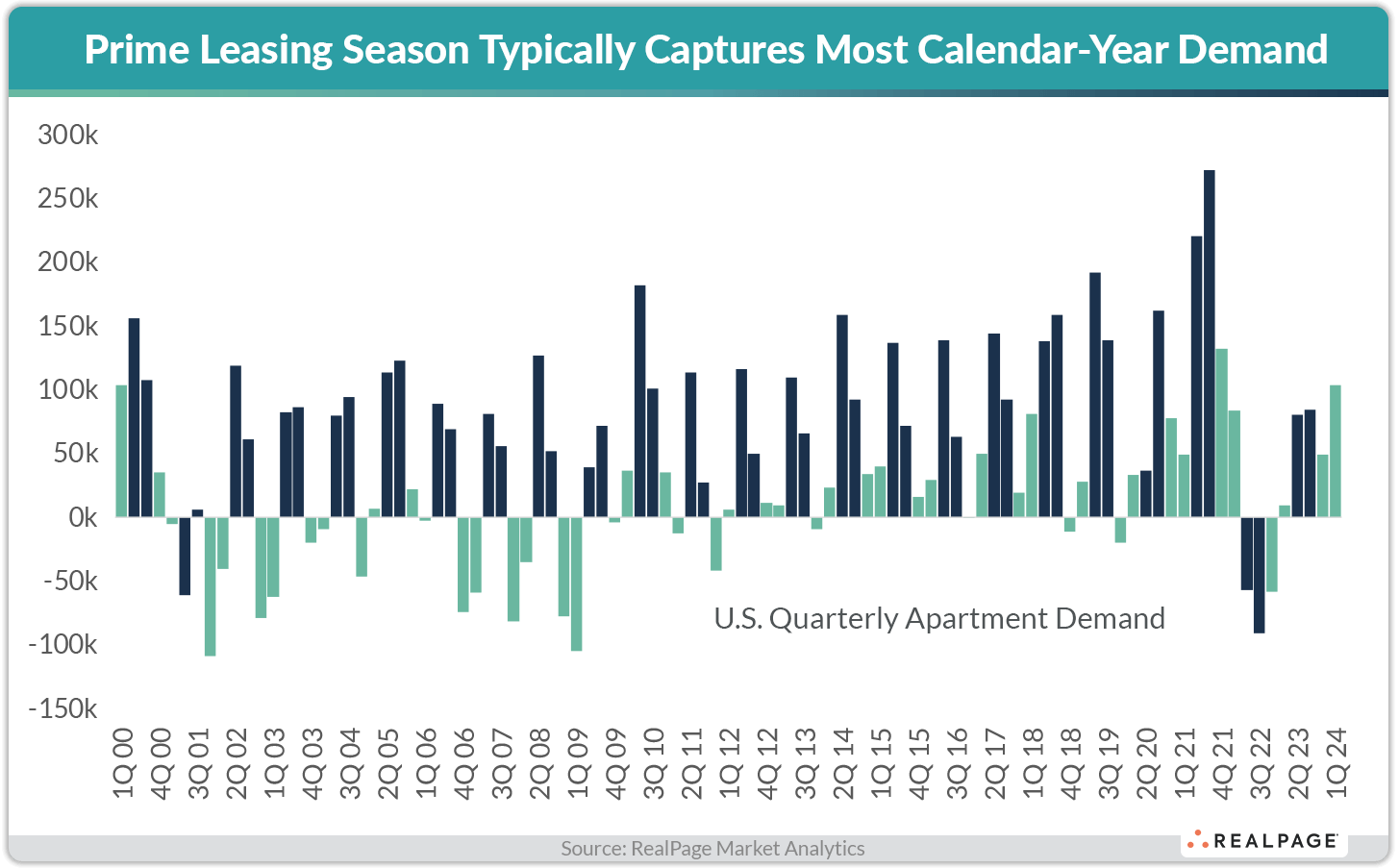

In analyzing quarterly demand going back to 2000, a clear shift in prime leasing season demand patterns emerges, according to data from RealPage Market Analytics. In calendar 2023, demand during prime leasing season (roughly defined as 2nd and 3rd quarters, or April to September) continued to account for the majority of annual demand – but at a far less acute rate.

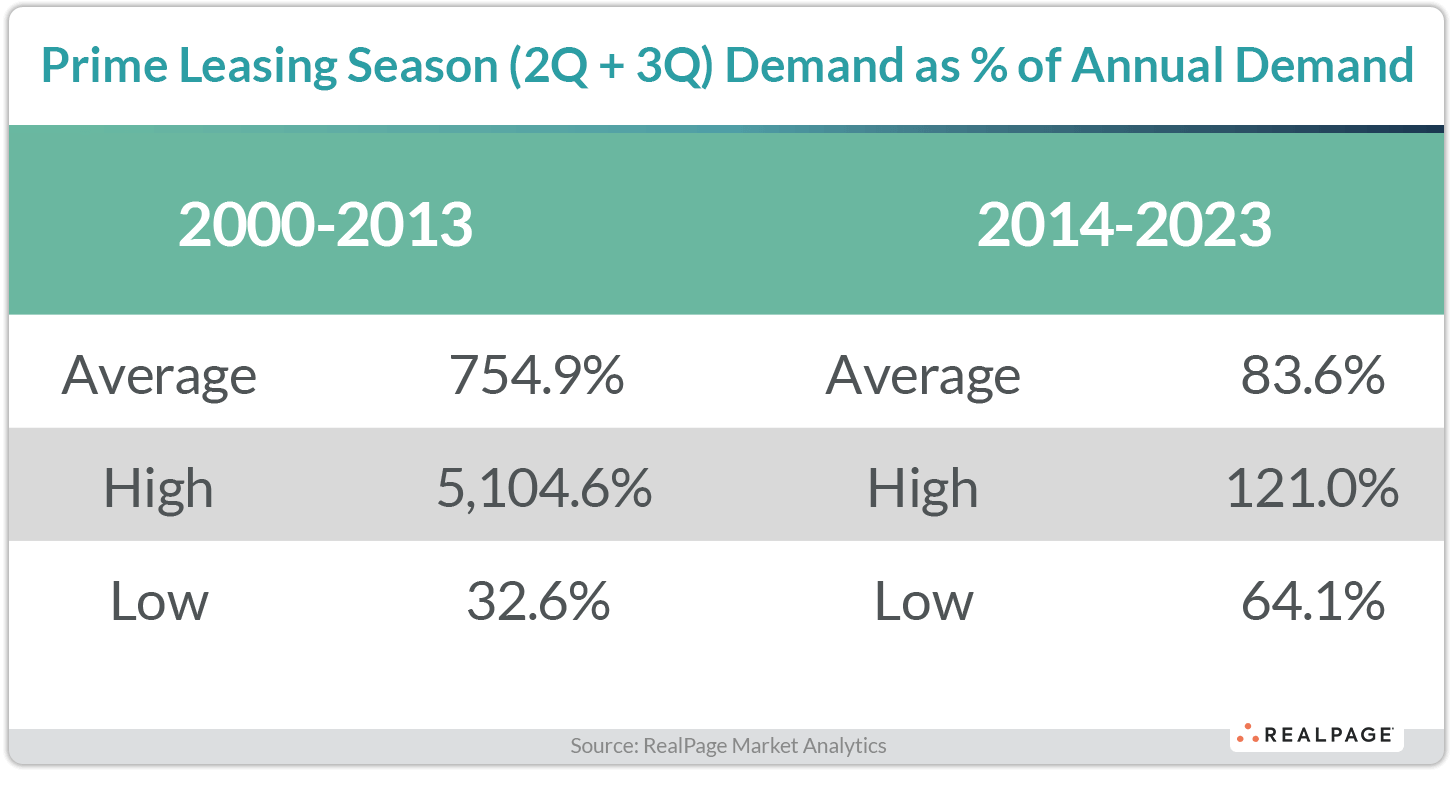

From 2000 to 2013, absorption during prime leasing season easily carried the calendar year for annual demand. In the most intense years from 2006 to 2009, which corresponds to the Great Recession, 2nd and 3rd quarters accounted for the only absorption of the calendar year, while 1st and 4th quarters recorded deep net move-outs. Due to that deep dichotomy during those years, prime leasing season demand ran as high as 5,000% higher than annual demand. Also throughout this time period, it was far more common that 1st and 4th quarters recorded net move-outs, making any demand during prime leasing season seem severe by comparison.

From 2000 to 2013, only four years (about 28%) recorded positive absorption in all four quarters of the calendar year. From 2014 to 2023, by comparison, positive absorption in any given quarter was more common. In six of the last 10 years (60%), positive absorption has been recorded in all four quarters of the calendar year – most recently in 2023.

Even in years where all four quarters recorded some absorption (which happened in 10 of the last 23 years), prime leasing season demand could account for over 90% of annual demand. That happened in 2012 when annual demand clocked in just below 184,000 units – about 166,000 units of which were absorbed in 2nd and 3rd quarters.

Seasonality still exists, but it looks more muted than in previous decades. Over the last decade, 1st quarter demand continued to account for a relatively small share of annual demand, averaging just 12% of annual demand (if negating the extreme outlier year of 2022).

If assuming that 2024’s 1st quarter demand should account for approximately 12% of annual demand, that translates to another 760,000 units to be absorbed in the remaining three quarters of 2024. That seems a tall order as concurrent apartment supply from 2nd, 3rd and 4th quarters should total about 530,000 units.