Record apartment demand improved occupancy notably in Myrtle Beach in the past year, but operators continue to cut rents in the face of elevated supply volumes.

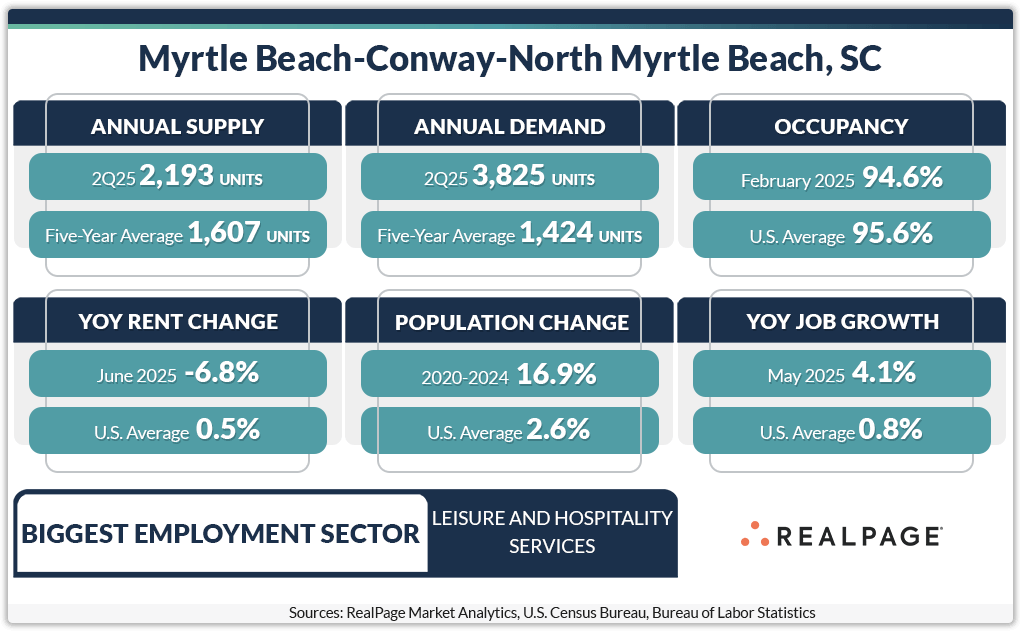

Apartment demand hit an all-time high in Myrtle Beach in the year-ending 2nd quarter, with absorption topping out at 3,825 units, according to data from RealPage Market Analytics. That was more than double the market’s five-year average of over 1,400 units and was nearly five times the decade norm of about 840 units annually.

For reference, Myrtle Beach only had about 45,800 or so existing apartment units as of 2nd quarter. That means the past year’s demand total represents nearly 10% of the existing stock of apartments. For comparison, Anaheim also absorbed about 3,800 units of stock last year, and that market’s existing unit count was much bigger at over 272,000 units.

Supply has also been significant in Myrtle Beach recently, hitting 2,193 in the year-ending 2nd quarter. That was quite a bit ahead of the five-year norm of 1,600 units, and more than double the 10-year average of about 1,000 units delivered annually.

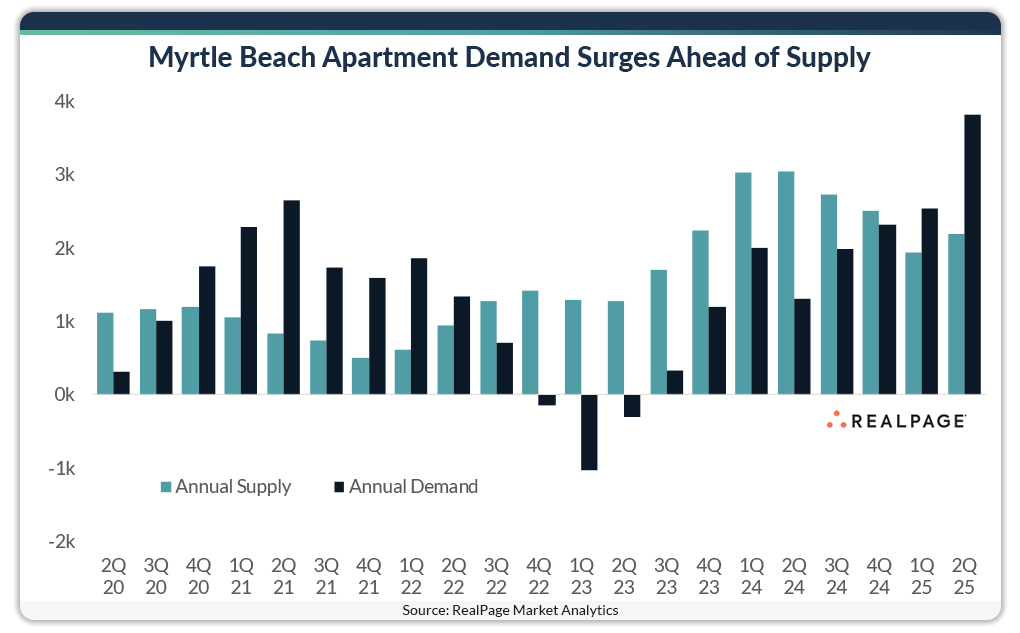

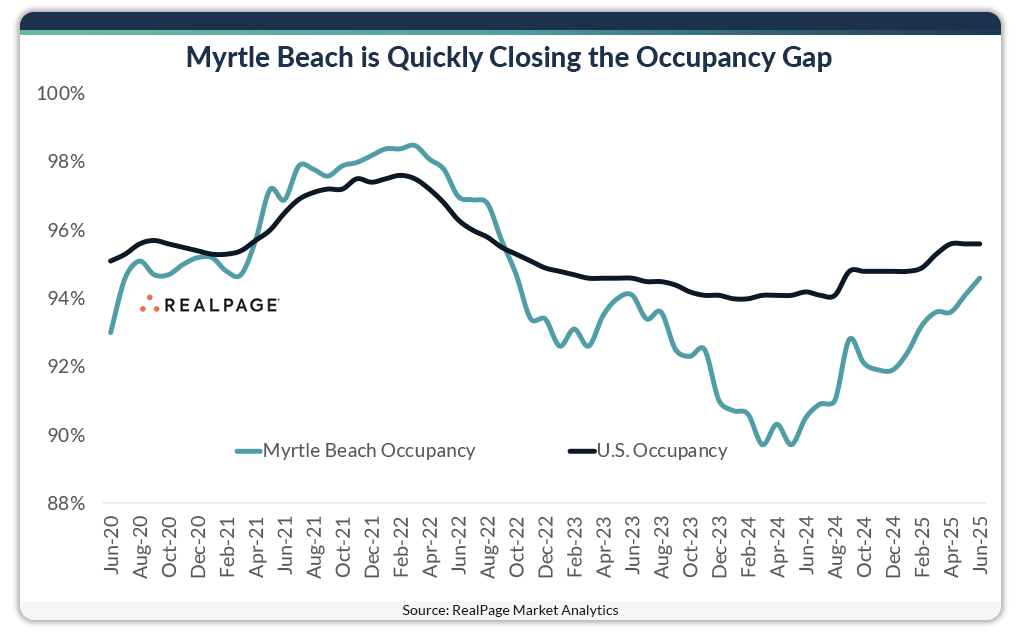

Just one year ago, Myrtle Beach was reacting very differently to elevated supply volumes, displaying one of the nation’s worst occupancy performances, as heavy supply weighed down this small apartment market’s resources. But a quickly growing population and solid demand have boosted occupancy at one of the fastest rates nationwide this year.

While June occupancy in Myrtle Beach remained behind the national average, the market is quickly closing that gap. Occupancy in Myrtle Beach climbed to 94.6% in June after seeing one of the best annual increases nationwide at 420 basis points (bps). Among the 150 largest apartment markets, only the boom-and-bust-prone Shreveport saw more of an increase in the past year.

Pushing occupancy progress, Myrtle Beach grew its population faster than almost any market across the nation in recent years. This small market saw its resident base swell by 16.9% between 2020 and 2024, according to the latest estimates from the U.S. Census Bureau. That was more than five times the national average of 2.6% and was the second biggest growth rate nationwide following only retiree hotspot Wildwood-The Villages, FL. Lakeland-Winter Haven, FL was #3 on that list, making these three small southeast retirement markets some of the fastest growing nationwide.

Myrtle Beach is a seasonal market with a mild climate, and the snowbird population fills the area in the winter months. Additionally, the low cost of living and charming coastal town draw retirees to the area.

For these reasons, employment is not generally the best indicator for health in this market. However, employment growth has been solid recently. Myrtle Beach saw the biggest growth nationwide in the past year, according to data from the Bureau of Labor Statistics. The employment base was up 4.1% in the year-ending May, charging ahead of the #2 growth market, nearby Charleston (3.6%). To be fair, Myrtle Beach’s growth pace equates to the addition of just 6,500 jobs in the past year, which is about a middle-of-the pack performance among the nation’s largest 150 markets.

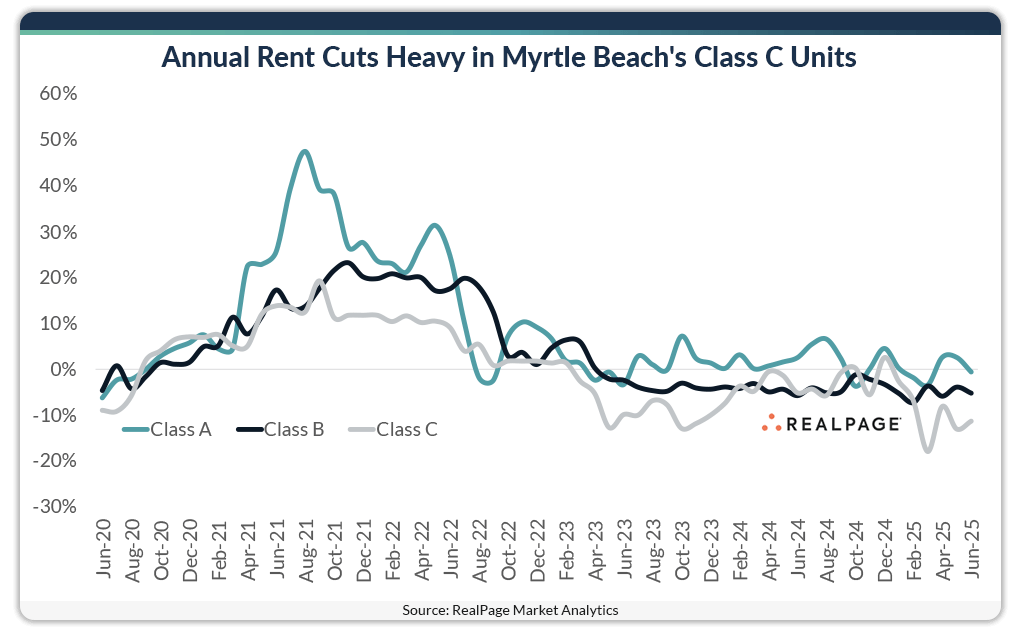

Despite solid demand and increasing occupancy, Myrtle Beach logged one of the nation’s deepest rent cuts nationwide in the year-ending June, with prices declining 6.8%. The only markets to see deeper rent cuts in the past year were Austin and two small Florida markets: Naples and Crestview.

Myrtle Beach remains an affordable option among coastal apartment markets, with effective asking prices averaging at $1,500 as of June. That’s about $115 below the South region average and nearly $400 behind the national norm.

Among the asset classes, June rents were closely clustered between $1,297 in Class C stock and $1,726 in Class A units. While rents are being cut across all product lines, the Class C stock has posted the deepest decline.

Price cuts were steepest at 11.3% in the market’s Class C stock. That was more than double the price cuts in the Class B units (-5.3%). Meanwhile, the cutbacks in Class A rents were negligible at just 0.5%.