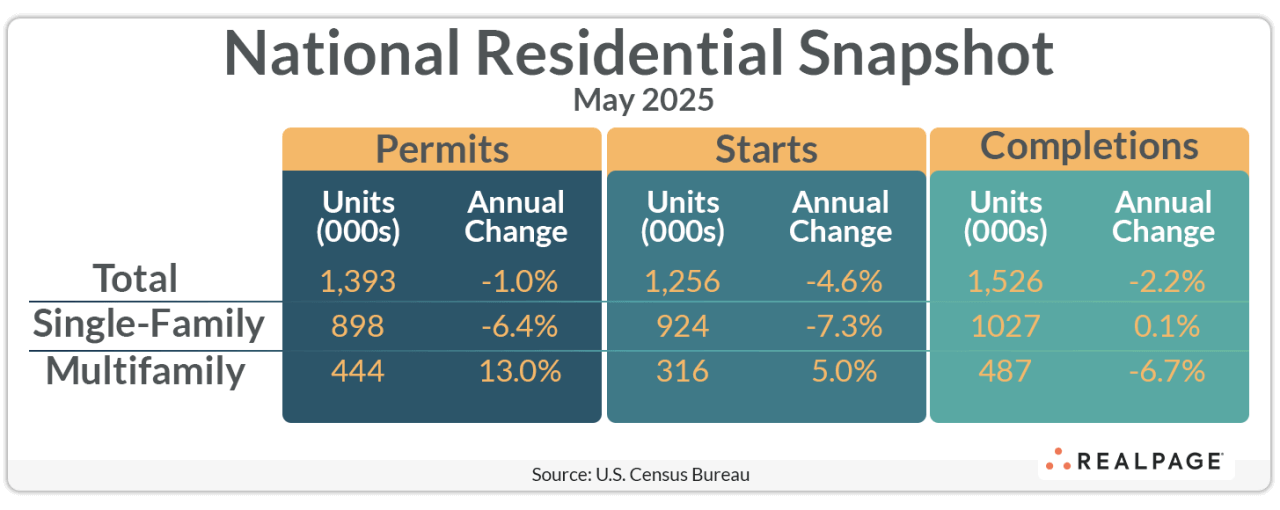

Annualized total residential starts dropped 9.8% in May to 1.256 million units, down from April’s revised rate of 1.392 million units, according to the latest data from the U.S. Census Bureau and HUD.

The month-over-month change in the seasonally adjusted annual rate (SAAR) for multifamily starts accounted for that drop as May’s rate of 316,000 starts fell 30.4% from last month’s pace (although, it’s still up 5% from last year).

The SAAR for single-family starts was virtually unchanged from April at 924,000 units, up just 0.4% for the month but down 7.3% for the year. While single-family starts have been below 950,000 units for the past three months, they have hovered around the one-million mark for the past three years. Rising inventories and costs and falling prices have apparently given some homebuilders pause.

The forward-looking building permit data shows continued softness for single-family construction as the SAAR for May was 898,000 units, down 2.7% from April and 6.4% from last May. However, multifamily permitting inched up 1.4% from last month to 444,000 units, up 13% from last year’s annualized rate. Together with the small plex product, total residential permitting was down 2% for the month and 1% for the year to 1.393 million units.

Despite an increase in multifamily starts compared to last year, the SAAR for multifamily units under construction decreased almost 19% from last May and 1.5% from April to 733,000 units. Single-family units under construction were down 7.6% for the year and 1.3% from April to 623,000 units.

Conversely, single-family completions rose 8.3% from April to 1.027 million units and were unchanged from last year. Multifamily completions were essentially unchanged from April at 487,000 units but were down 6.7% from last May.

Compared to one year ago, the annual rate for multifamily permitting increased in all four Census regions, with the largest increases in the Midwest (up 36.2% to 75,000 units) and West (up 11.9% to 113,000 units). The small Northeast region and much larger South region were both up about 8% to 53,000 units and 202,000 units, respectively. Compared to the previous month, permitting was down in the Northeast, South and West Census regions and up in the Midwest.

Annualized multifamily starts were up by 51% in the Northeast to 37,000 units and were up 12.7% in the Midwest to 40,000 units. The South region experienced a modest increase of 4.8% to 163,000 units, while the West saw starts decrease by 11.1% to 76,000 units. Compared to April’s SAAR, starts were up only in the West region and down in the Northeast, Midwest and South regions.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing residential permits and starts data from the U.S. Census Bureau. For more on this data, read previous posts in the Permits series.