Multifamily Momentum Shifting in Top U.S. Markets

While the leading markets for multifamily permitting have remained relatively consistent over the past year, the trajectory of apartment starts within these markets has shifted.

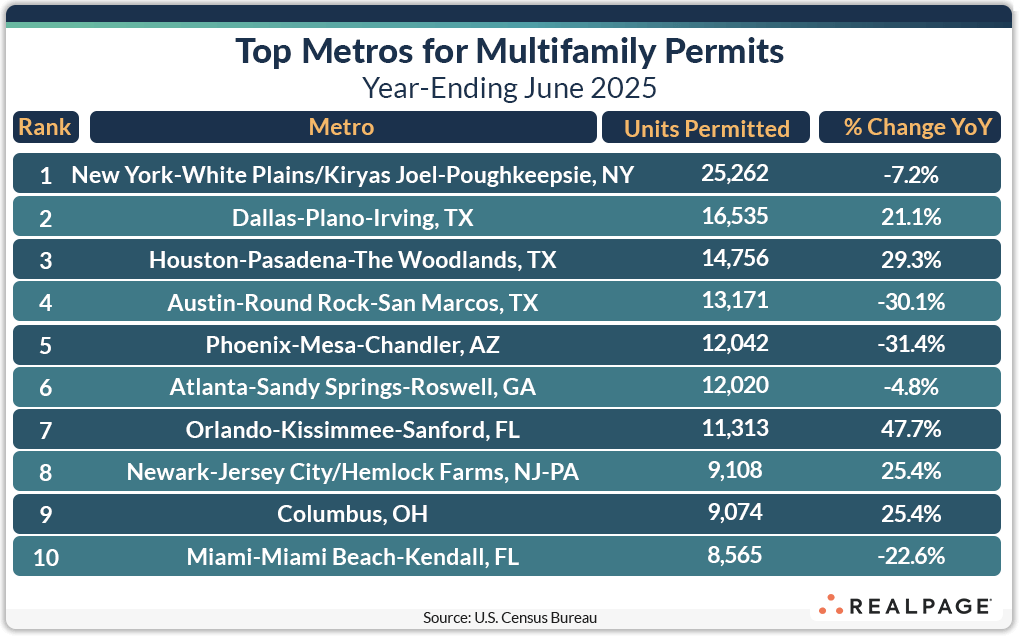

Nine of last month’s top 10 markets for multifamily permitting returned in June with the top five remaining in order. New York, Dallas, Houston, Austin and Phoenix were again at the top in total units permitted for the year, but compared to their annual totals one year ago, Dallas and Houston have increased while New York, Austin and Phoenix have slowed sharply.

Atlanta and Orlando switched places on June’s top 10 list and Miami replaced Los Angeles at #10 after Newark and Columbus.

However, looking at their annual apartment starts data from RealPage’s Market Analytics database, eight of the top 10 permitting markets saw a decrease in annual starts in 2Q25 compared to 1Q25, indicating their starts momentum is still slowing. Only Miami and Houston experienced an increase in annual starts from quarter to quarter.

Compared to one year ago, annual apartment starts were down by almost 8,000 units in New York and from 2,900 to 7,200 units in Columbus, Newark, Austin, Phoenix and Atlanta. Orlando was little changed, but Dallas and Houston are showing signs of growing momentum for new apartment construction with increasing permitting and starts.

Miami has had a late spurt of annual multifamily permitting (up more than 1,500 units from May to June) even though permits are still down year-over-year by 2,500 units. Additionally, Miami’s annual apartment starts increased by 1,186 units quarter-over-quarter and 2,471 units year-over-year.

Returning to June’s metro-level multifamily permitting, half of the top 10 permitting markets increased their unit totals from last June by an average of 2,700 additional units, while the other five markets decreased by an average of 3,250 units.

Other markets with significant year-over-year decreases in annual multifamily permitting in the year-ending June were Washington, DC (-3,805 units), Los Angeles (-2,981 units), Tampa (-2,923 units), San Jose (-2,549 units) and Minneapolis-St. Paul (-2,125 units). Eleven other markets had decreases of 1,000 units or more.

In addition to Orlando, Houston, Dallas, Newark and Columbus, markets with significant year-over-year increases in multifamily permitting include Chicago (+2,434 units), Des Moines (+1,862 units), Fayetteville-Springdale-Rogers, AR (+1,624 units), Detroit (+1,551 units), Bridgeport-Stamford-Danbury, CT (+1,494 units), and Anaheim (+1,317 units).

Permitting by Place

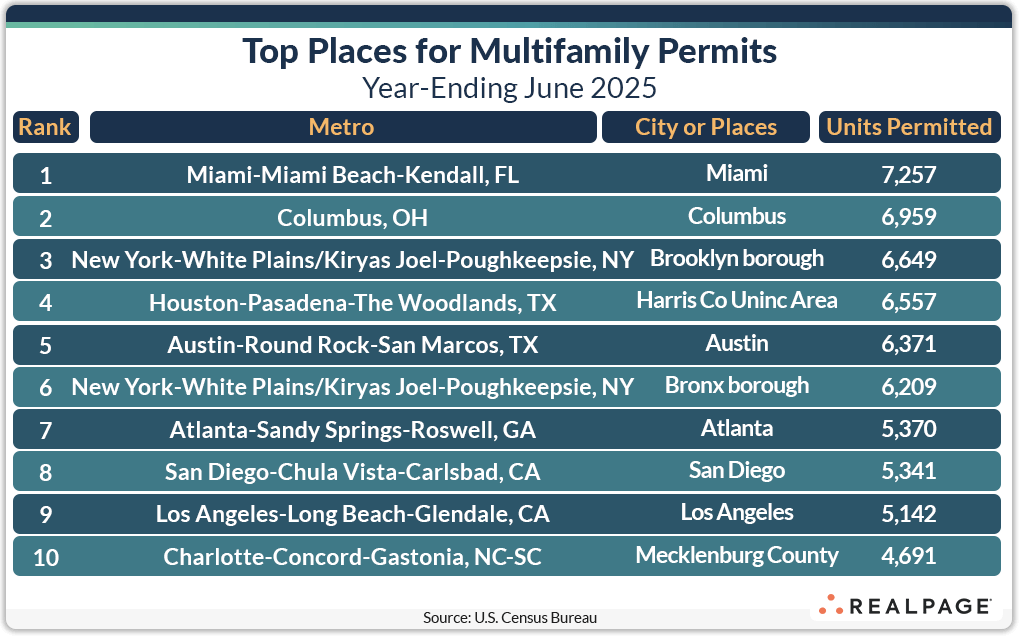

Below the metro level, all of last month’s top 10 permit-issuing places returned to this month’s list with only one remaining in the same place. The list of top individual permitting places (cities, towns, boroughs, and unincorporated counties) generally include the principal city of some of the most active metro areas.

With a surge of almost 2,500 units in June alone, the city of Miami leapt to the #1 spot for annual multifamily permitting by place from #7 in May. The city of Columbus returned at #2 with almost the same level of annual units permitted as last month. The borough of Brooklyn fell two spots and Unincorporated Harris County (Houston) moved up one spot as the city of Austin slipped to #5 to round out the top five on this month’s list.

The Bronx borough and the cities of Atlanta, San Diego and Los Angeles, together with Mecklenburg County (Charlotte) comprised the last five of June’s top 10 permitting places list. Seven of the top 10 increased their permitting totals from May’s figures.

Although their central city or permitting entities continue to be among the top 10 permitting places, San Diego and Charlotte’s metro areas rank only among the top 20 metros for annual permitting. Conversely, the core cities of Dallas, Houston, Phoenix, Newark and Orlando are not on the top 10 permitting places list but are in the top 10 for metros.

Six of the top 20 permitting places are in Texas with two each in California, Florida, North Carolina and New York. The cities of Columbus and Chicago represent the only two Midwest region permitting places among the top 20.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing residential permits and starts data from the U.S. Census Bureau. For more on this data, read previous posts in the Permits series.