For only the second time since the end of the pandemic recession, the metro division of Dallas-Plano-Irving did not place among the top 10 markets for job creation in July 2025.

With 22,200 jobs gained for the year, Dallas ranked #12 after Salt Lake City and just ahead of Miami on RealPage’s list of top markets for job gains. Excluding pandemic-related job losses, that is the lowest annual job gain figure for Dallas since August 2010, when the nation was coming out of the Great Recession. Adding in Fort Worth, D/FW would place #4 on the top 10 list after Houston.

Only two of Dallas’ 10 major employment sectors experienced job losses for the year. The primary cause of these recent employment decline has been workforce reductions within the Manufacturing and Professional/Business Services sectors, reflecting a broader trend observed at the national level. Prominent employers in the Dallas area such as IBM, FedEx, Allied Aviation Fueling and TT Electronics have either implemented layoffs or paused hiring in response to uncertain economic conditions.

Over the 12 months ending in July, the Dallas metro area experienced a net loss of approximately 3,700 manufacturing jobs and 8,200 positions within professional services. The most affected subsectors included Computer Systems Design and Related Services, as well as Administrative and Support Services. Additionally, job growth has moderated across the Construction, Financial Activities and Other Services sectors.

However, despite weakening employment growth nationally, many of RealPage’s top markets continue to see solid job growth. Seven of June’s top job creation markets returned in July.

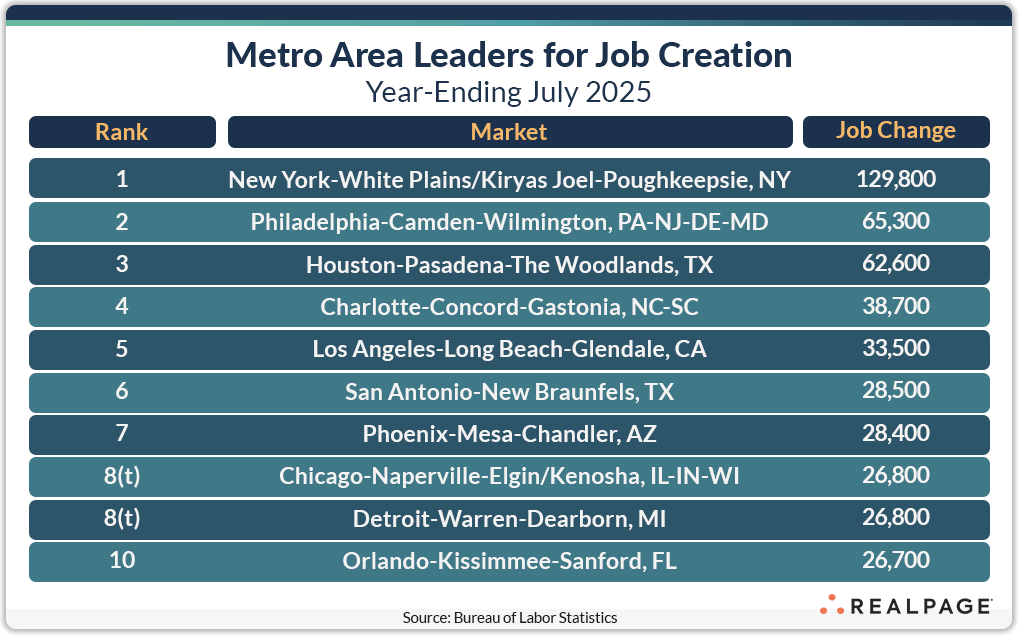

New York once again led all major markets for employment gains in the year-ending July 2025 with 129,800 new jobs, an increase of more than 30,000 jobs from June’s annual total. Philadelphia and Houston also had very strong gains with 65,300 and 62,600 jobs created, respectively. Houston actually doubled annual gains from last month.

Charlotte and Los Angeles remained close to each other again this month with gains exceeding 32,000 jobs, while San Antonio and Phoenix jumped on to this month’s list with job gains close to 28,500 each.

Midwestern markets showed some strength with Chicago returning to the top 10 in July, tied with newcomer Detroit with annual job gains of 26,800 jobs. Orlando also returned this month but fell to #10 from #5 with a gain of 26,700 jobs, ranking just behind Chicago and Detroit.

Together, the top 10 markets added 467,100 jobs in the year-ending July, about 191,000 more than the same 10 markets last July (up 69%) and 111,000 more than last month. Additionally, the next 10 (#11 through #20) of RealPage’s top job gain markets saw their total gains increase 5% from last year to 208,200 new jobs.

Only New York gained more than 100,000 jobs, while two markets (Philadelphia and Houston) gained between 50,000 and 99,999 jobs in July. The next 13 markets gained 20,000 jobs or more for the year, equal to last month. However, 19 of our top 150 markets reported annual job losses for the year, one fewer than last month. Job losses continue in the Bay Area (excluding San Jose) and in several Midwest or Northeast markets such as Washington, DC, Milwaukee, Madison, Atlantic City and Des Moines. Two markets reported no employment change.

Job Growth

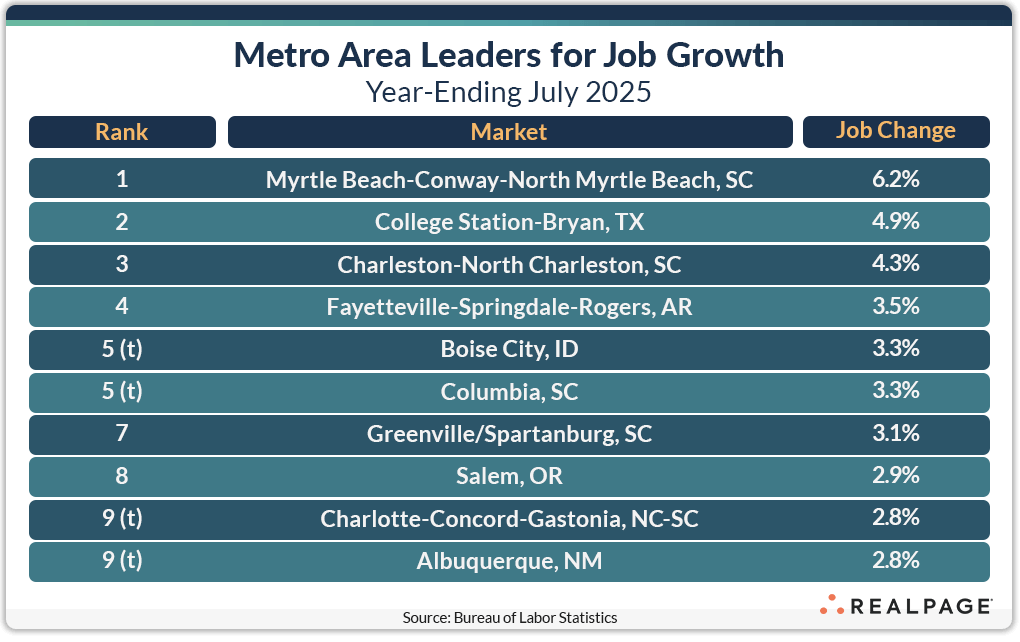

Unlike the top job gain markets, which tend to be large in population and employment, smaller markets usually dominate the top markets for annual percentage change in employment. As we typically see, state capitals, college towns and resort or tourist destination cities dominate this list. Eight of June’s top markets for job change returned in July with the first six remaining in order.

Myrtle Beach remained in the top spot on this month’s list with improvement in their percentage growth of 100 basis points (bps). The college towns of College Station, TX, Fayetteville, AR and Charleston-North Charleston, SC remained in the top four.

Boise, ID also returned to this month’s list, along with another college town Columbia, SC. The two tied for #5 with 3.3% job growth. Greenville/Spartanburg, SC moved up three spots to #7 and Salem, OR joined this month’s list with 2.9% job growth. Returning market Charlotte tied with newcomer Albuquerque to round out the top 10 with 2.8% growth.

Nine of the top 10 job growth markets had greater growth rates than one year ago, led by Myrtle Beach with a 500-bps increase. Outside of the top 10 growth markets, Syracuse, NY, Springfield, MO, Stockton-Lodi, CA, San Antonio and Toledo had employment growth rates of between 2.4% and 2.7%. Including the top 10, there were 86 markets that exceeded the national not seasonally adjusted growth rate of 0.9%, which was 19 more than last month.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing employment data from the Bureau of Labor Statistics. For more on this data, read previous posts on Job Growth.