The annual benchmark revisions from the Bureau of Labor Statistics (BLS) reduced employment levels in almost half of the top 150 markets RealPage tracks in 2023. December’s top 10 job gain markets totaled 698,100 new jobs pre-revision but only 504,700 after, a reduction of almost 28%.

After revisions, three of last month’s top 10 would not have made the list (Los Angeles, Atlanta and Boston). Houston would have topped the list instead of Dallas and Washington, DC, Orlando and Austin would have been in the top 10.

Turning to job gains tallied through the 12-months ending January 2024, despite a mix of up or downward revisions, job gains remain relatively strong throughout the nation. However, there are continuing signs of slowing from the rebound and recovery levels seen after the pandemic disruption.

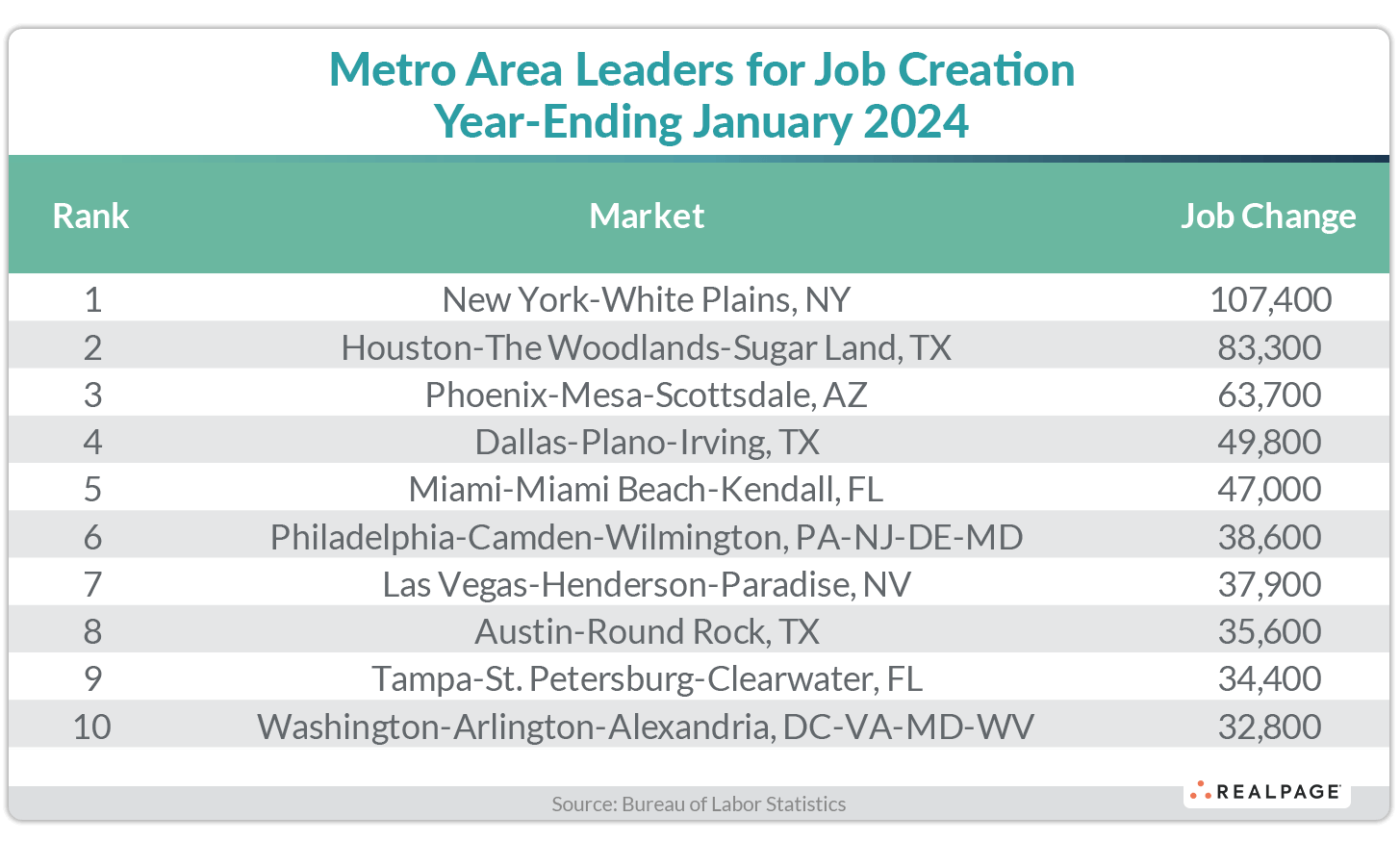

January’s top 10 job gain markets totaled 530,500 new jobs, down 11.7% from December for the same 10 markets. Nine of December’s revised top 10 markets returned in January and several changed places.

New York regained the top spot for job gains with 107,400 jobs added, an improvement of almost 20,000 jobs from December’s total but down almost 200,000 jobs from last year. Houston slipped to the #2 spot, adding 83,300 jobs, down 19,600 jobs from December and 91,700 jobs from last January.

Phoenix came in at #3 with 63,700 jobs gained, down about 8,000 from last month and 30,500 from last year. After revisions, Dallas dropped to the #4 spot, gaining 49,800 jobs through January, down significantly from the revised December total of 73,100 jobs and the pre-revision December total of 101,000 jobs.

Miami remained in the top 10 at #5 with 47,000 jobs gained, down only 14,700 jobs from last year and up slightly from December. At #6, Philadelphia added 38,600 jobs for the year, down 7,200 jobs from December and almost 68,000 jobs from last year.

Las Vegas added 37,900 jobs to reach #7 on the list but Sin City saw a decrease of 4,400 new jobs compared to December and 24,400 jobs from last year. Austin made January’s top 10 list at #8 with 35,600 jobs gained, about 6,000 fewer than December and 48,400 fewer than last January.

Tampa made the top 10 list in January at #9, adding 34,400 jobs, despite adding 4,700 fewer jobs than last month. Washington, DC rounded out the top 10, adding 32,800 jobs for the year-ending January, although that was 18,200 jobs less than 2023’s total.

As mentioned, the total number of jobs gained for the year-ending January for the top 10 markets was down about 70,300 jobs from their collective total last month. However, the next 10 markets (#11 through #20) saw their combined annual jobs gains increase by 28,200 jobs.

Only New York exceeded 100,000 jobs gained for the year while only two gained between 50,000 and 99,999 jobs, two fewer than last month. Fourteen markets reported annual job losses for the year, seven more than last month.

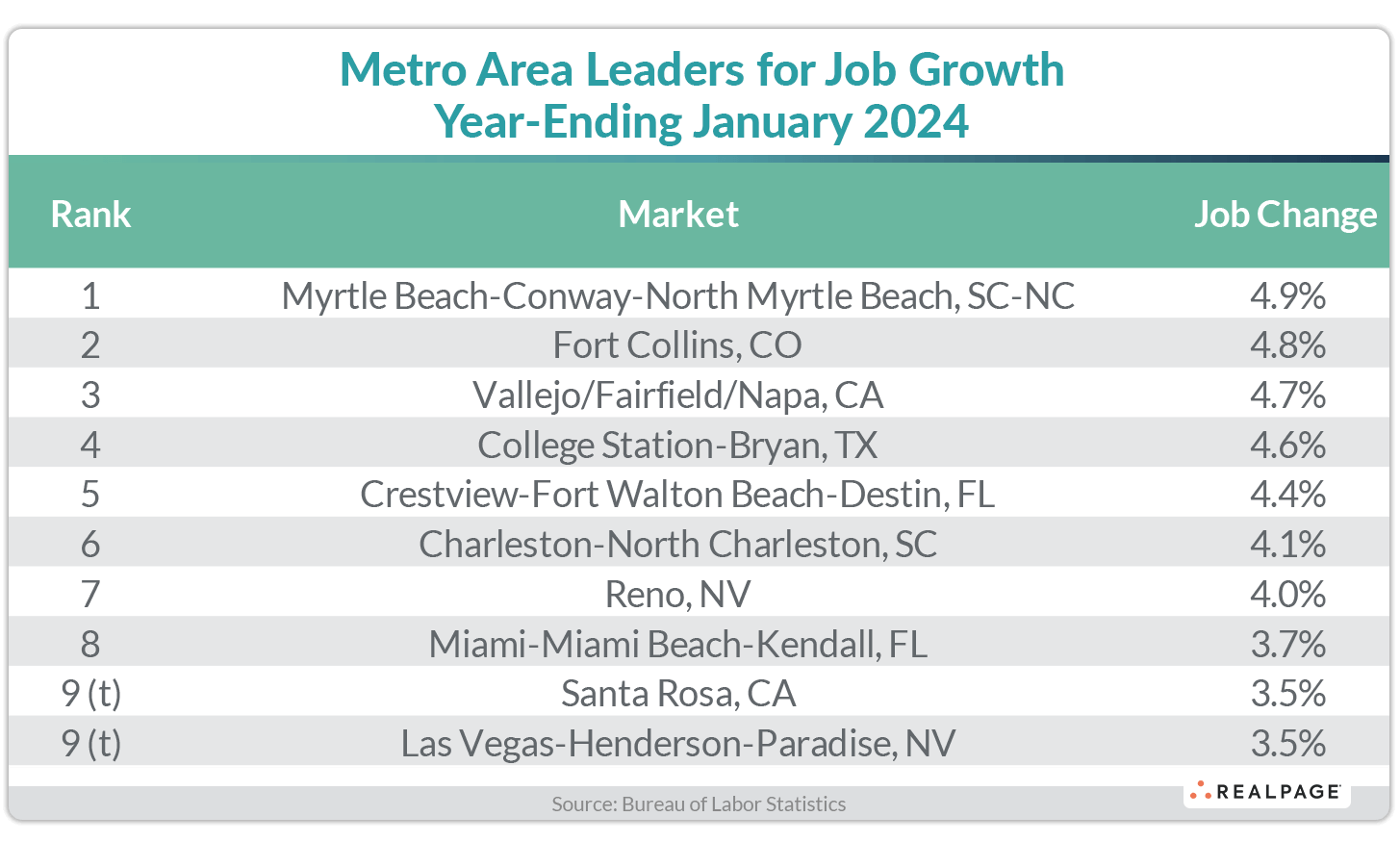

Like annual job gains, the annual percentage change in employment saw some post-revision changes as well. December’s top 10 job growth market list changed significantly after BLS revisions. Seven of last month’s revised top employment growth markets returned in January and several changed places.

Myrtle Beach, SC returned at #1 with 4.9% employment growth, 10 basis points (bps) above last month’s rate. Fort Collins, CO came in at #2 with 4.8% growth, an improvement of 60 bps from December. Vallejo/Fairfield/Napa, CA ranked #3 with 4.7% growth, up one full percentage point from December’s employment growth.

College Station-Bryan, TX was a tick back at #4 with 4.6% employment growth, jumping by 160 bps from last month. Crestview-Fort Walton Beach-Destin, FL saw their job growth rate improve by 20 bps from December to 4.4% and landing at #5 on the list.

Charleston slipped from one of the top spots last month to #6 in January with 4.1% employment growth while Reno, NV debuted at #7 with 4% growth, improving by 70 bps for the month. Miami remained on the top 10 list at #8 with 3.7% growth, up 20 bps for the month but down 150 bps from last year.

Santa Rosa, CA and Las Vegas tied for the #9 spot with 3.5% job growth, but Santa Rosa jumped an incredible 180 bps from December while Las Vegas slipped 30 bps.

Among the top 10, several smaller markets saw stronger job growth than last January, led by Vallejo/Fairfield/Napa, CA with an improvement of 250 bps. Fort Collins and Reno jumped 210 bps each while Santa Rosa jumped 200 bps. While still registering solid job growth, Charleston, Miami and Myrtle Beach slowed by about 140-150 bps from last year.

Outside of the top growth markets, Spokane, WA, Santa Maria-Santa Barbara, CA, Columbus, GA, Stockton-Lodi, CA and Champaign-Urbana, IL saw their job growth rates increase by 100 bps or more from last year. Meanwhile, Midland/Odessa, Chattanooga, Portland, OR, New Orleans, Orlando and Austin fell by at least 400 bps from last year’s job growth.

Major markets with employment declines are Memphis, Portland, OR, New Orleans, Milwaukee, San Francisco, Baltimore, Detroit, San Jose and Chicago. Sub-1% growth markets include Boston, Minneapolis, Seattle, Los Angeles, Denver, Cleveland, Cincinnati, Atlanta, Kansas City and Pittsburgh. Sub-1.5% growth major markets include Washington, DC, Nashville, St. Louis, Philadelphia, San Diego, Oakland, Charlotte and Riverside. Sixty-nine markets had annual job growth rates above the not seasonally adjusted national average of 1.8%, the same as in December.