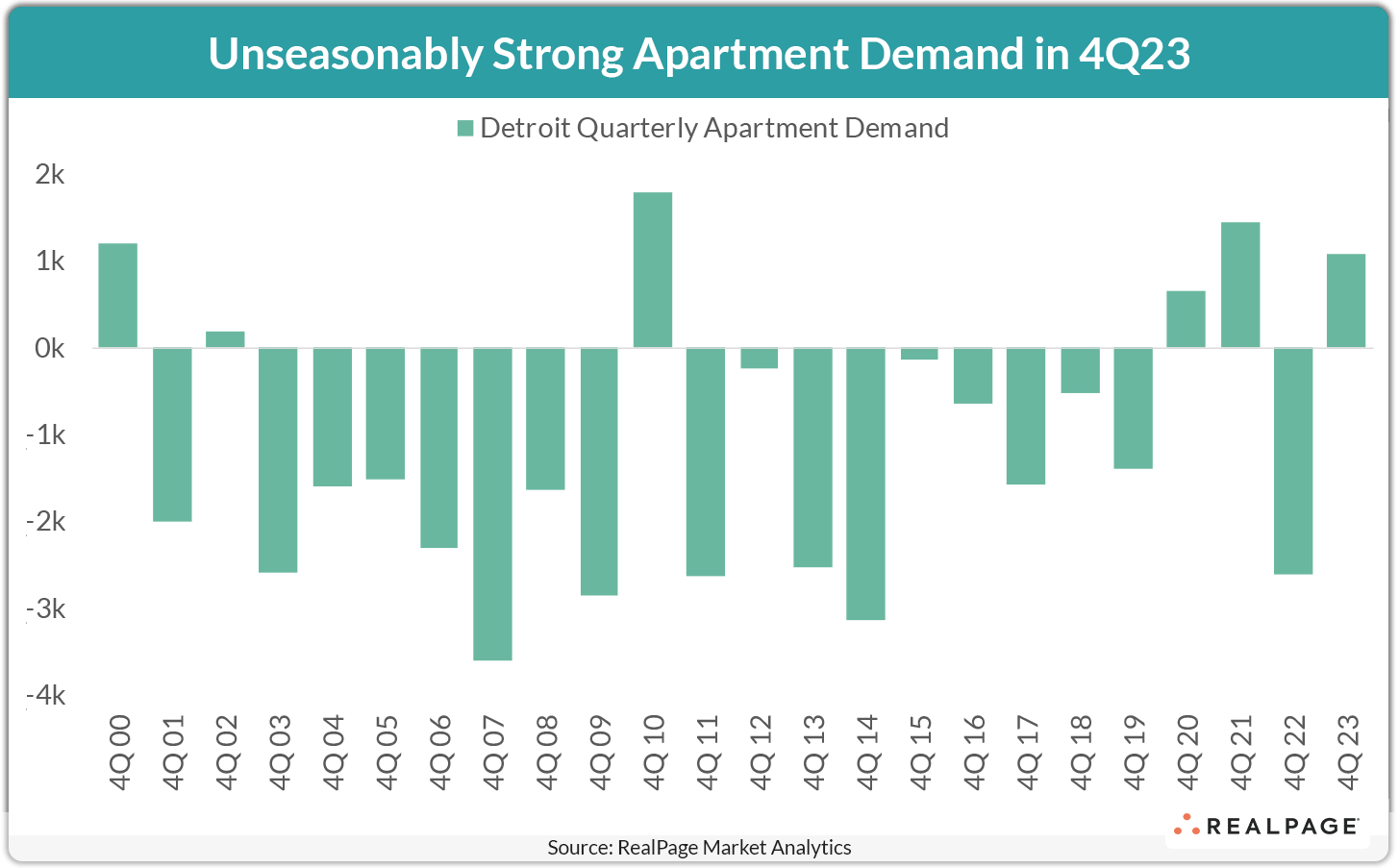

Although apartment demand in Detroit is generally nonexistent in the final quarter of the year, often resulting in net move-outs, 2023’s 4th quarter marked a stark and welcomed contrast from that trend. Prior to the COVID-19 pandemic, Detroit typically recorded seasonally weak apartment demand in the October to December quarter. But not in 2023.

Roughly 1,100 units were absorbed in Detroit in the last three months of 2023, marking the second-best showing in the Midwest after only Minneapolis. This solid performance almost entirely wiped out net move-outs seen in the first half of 2023, leaving annual demand still negative, but barely at -104 units. However, even that annual loss was a notable improvement from the deep net move-outs of about 6,400 units Detroit suffered in 2022.

In fact, any apartment demand at all in Detroit in 4th quarter is quite the feat. Absorption was positive in the last three months of the year only five other times in the last 23 years throughout the RealPage Market Analytics dataset.

Detroit was one of only a few markets where 4th quarter demand outpaced pre-COVID norms. While absorption in Detroit wasn’t as strong as some other markets nationwide in 4th quarter, it was still quite a change from the net move-outs for about 1,100 units the market saw on average in the last three months of the year during the 2010 through 2019 time frame.

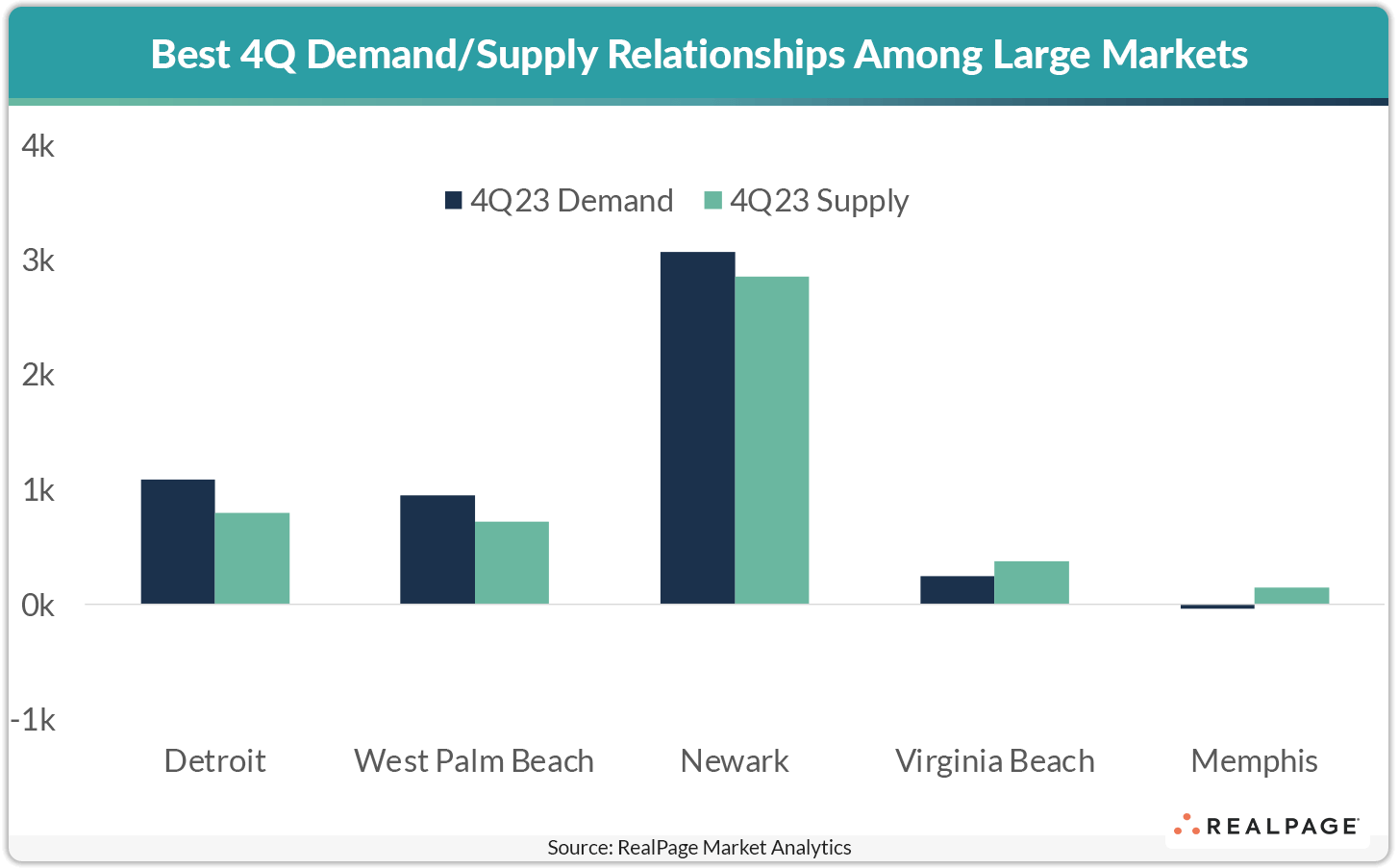

Additionally, Detroit was one of three major markets – along with West Palm Beach and Newark – where demand outpaced supply in 4th quarter. Nearly 800 units were delivered in Detroit in the last three months of the year, registering below demand by about 280 units.

Detroit’s apartment rents could be attracting new residents. This is a very affordable market compared to other metropolitan areas about the same size. Detroit is the #14 most populated city with about 4.3 million residents. That’s about the same size as San Francisco and Seattle, with a vastly smaller price tag. At $1,281, February rents here are about half the price of Seattle and about one-third of the price in San Francisco. Detroit prices are also some of the most affordable across the Midwest, topping only Indianapolis and Cleveland.

And though Detroit ranks among the nation’s worst performers for employment change recently, contracting by 2,400 jobs in the past year, employers are working hard to transform the local economy into one that can sustain itself in the future. The market’s economy has come a long way from the rough years of the past, as local officials are transforming downtown and leading the nation in electric vehicle manufacturing, in preparation of future economic stability.

Limited supply pressure has also aided Detroit’s apartment market. Only about 9,000 new units have been delivered here in the past five years, increasing the inventory base by about 3.4%. That was one of the smallest increases among the nation’s largest 50 apartment markets. The increase was smaller in only Pittsburgh, Cleveland and New York.

While Detroit still has some challenges to work through, solid demand in 4th quarter is a good sign for things to come for this underrated apartment market.