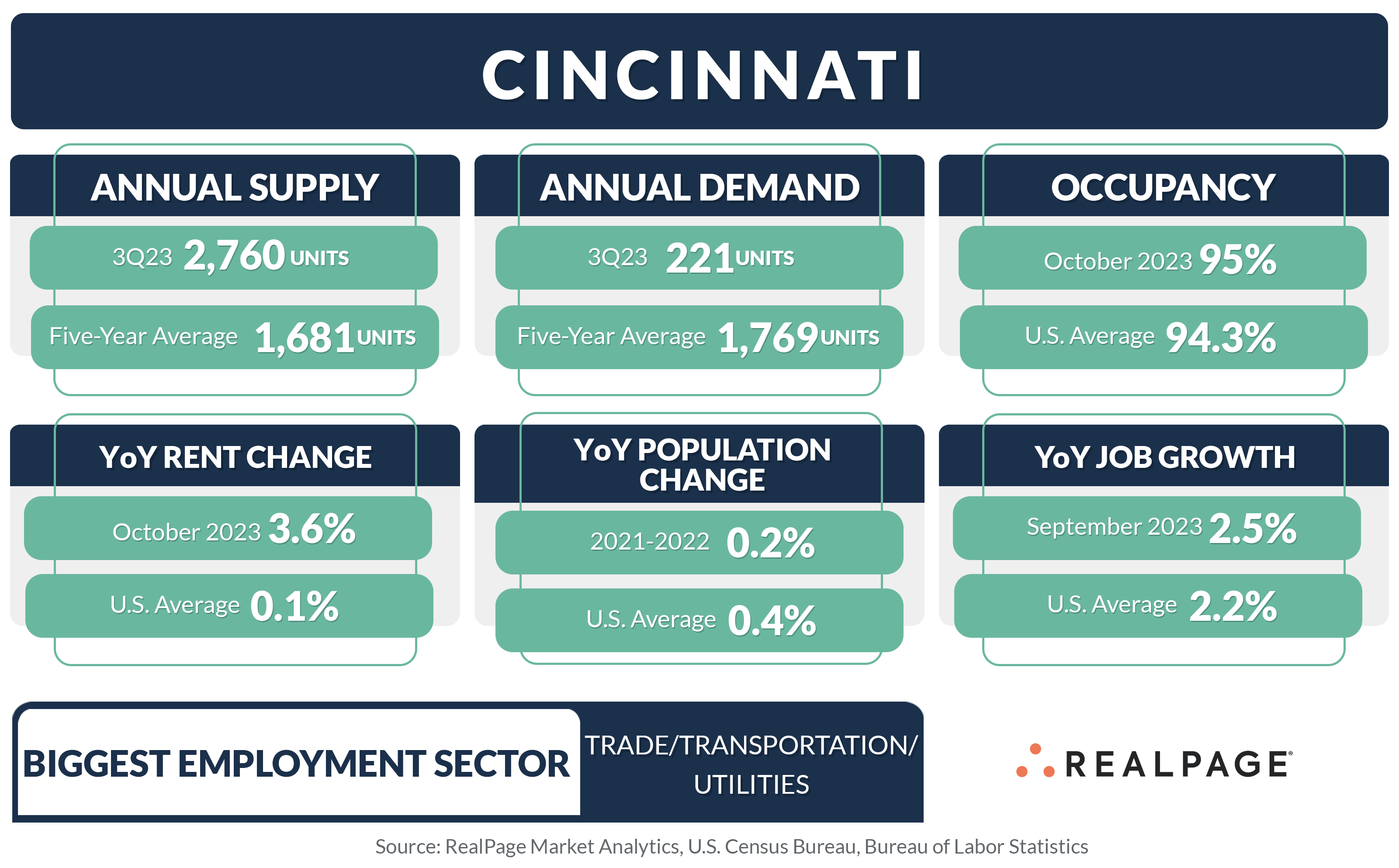

Apartment market fundamentals have held up relatively well in Cincinnati among elevated yet manageable new supply levels.

Like most apartment markets across the country, Cincinnati has been experiencing deflating market fundamentals after a surge in occupancy and rents in 2021 and 2022. However, the Cincinnati apartment market has been exceeding U.S. norms for both occupancy and rent growth recently, beating out U.S. norms for both.

Cincinnati is equidistant to Columbus, Indianapolis and Louisville, all less than a two-hour drive away. The Ohio River, which forms the border between Kentucky and Ohio, runs through the middle of the Cincinnati apartment market which has nearly 168,000 existing units. Cincinnati is the county seat of Hamilton County, OH and is home to five Fortune 500 headquarters including Kroger, Procter & Gamble, Western & Southern Financial Group, Fifth Third Bancorp and Cintas, providing a solid economic base and demand driver. The city is also home to the University of Cincinnati, which is the city’s largest higher education institution, with an enrollment of roughly 50,000 students.

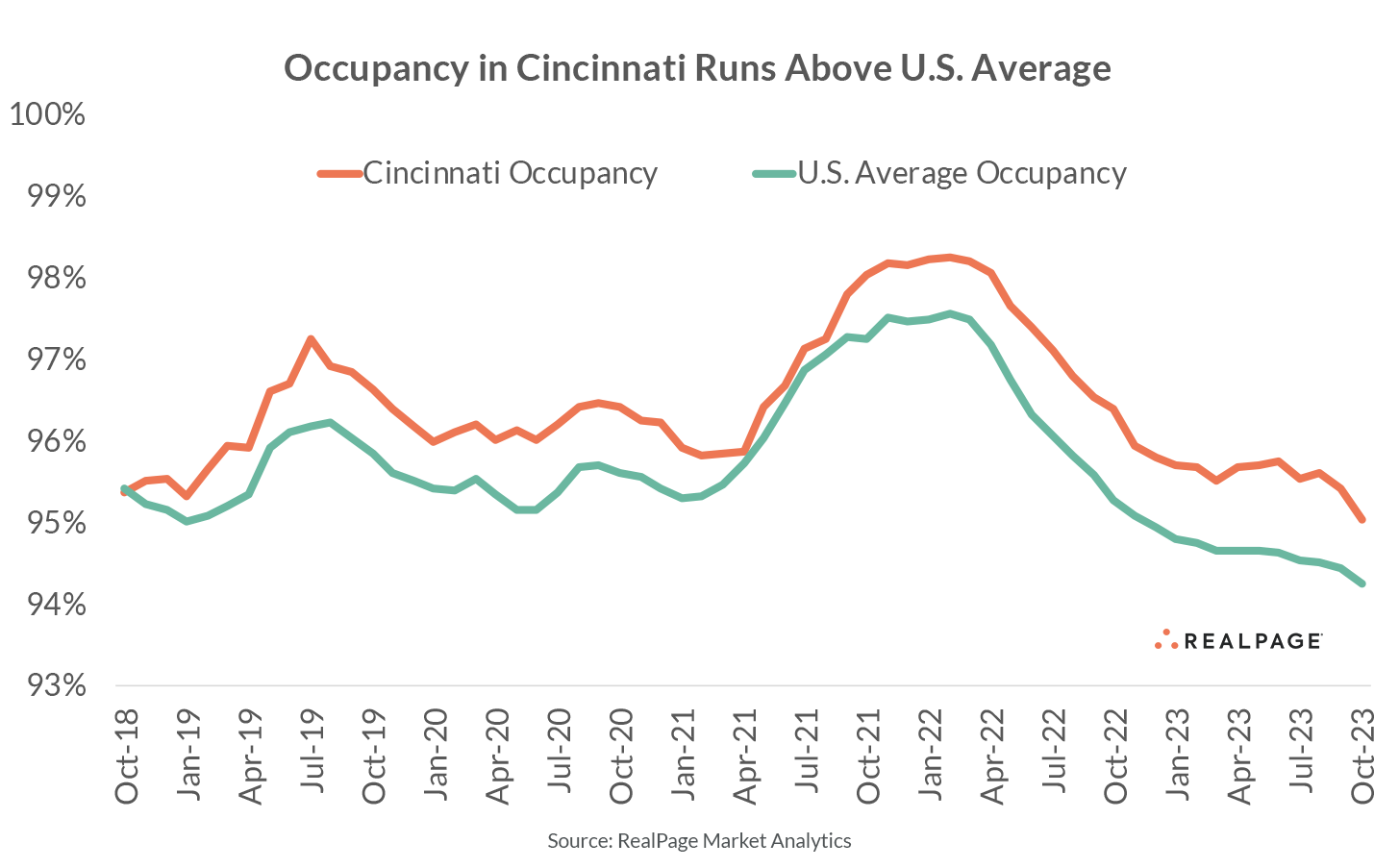

Apartment occupancy in Cincinnati has registered at or above 95% for five years now. This is quite the feat, as only five other major U.S. markets have managed this, the others being Anaheim, Milwaukee, Newark, Philadelphia and San Diego.

Even so, occupancy in Cincinnati peaked at 98.2% from November 2021 to March 2022 and has since been trending down. With new supply exceeding demand, occupancy backtracked 140 basis points (bps) in the past year, with the rate landing at 95% in October, according to data from RealPage Market Analytics. While that was a five-year low for the market, it was just slightly under Cincinnati’s pre-pandemic average from 2015 to 2019 (95.4%). In addition, Cincinnati’s October occupancy rate was 70 bps higher than the national average (94.3%) and ranked #13 among the nation’s 50 largest markets.

Looking at asset classes in Cincinnati, Class C properties logged the tightest occupancy rate, at 95.5% in October. Rates were a little bit weaker in Class B properties at 95.1%. The market laggard was Class A units, with October occupancy at 94.4%. Among submarkets, only Central Cincinnati (92.5%) logged a rate under 94%. Meanwhile, five of the nine submarkets in Cincinnati posted occupancy rates at or above 95.5%, with the tightest reading of 96.3% in Southeast Cincinnati.

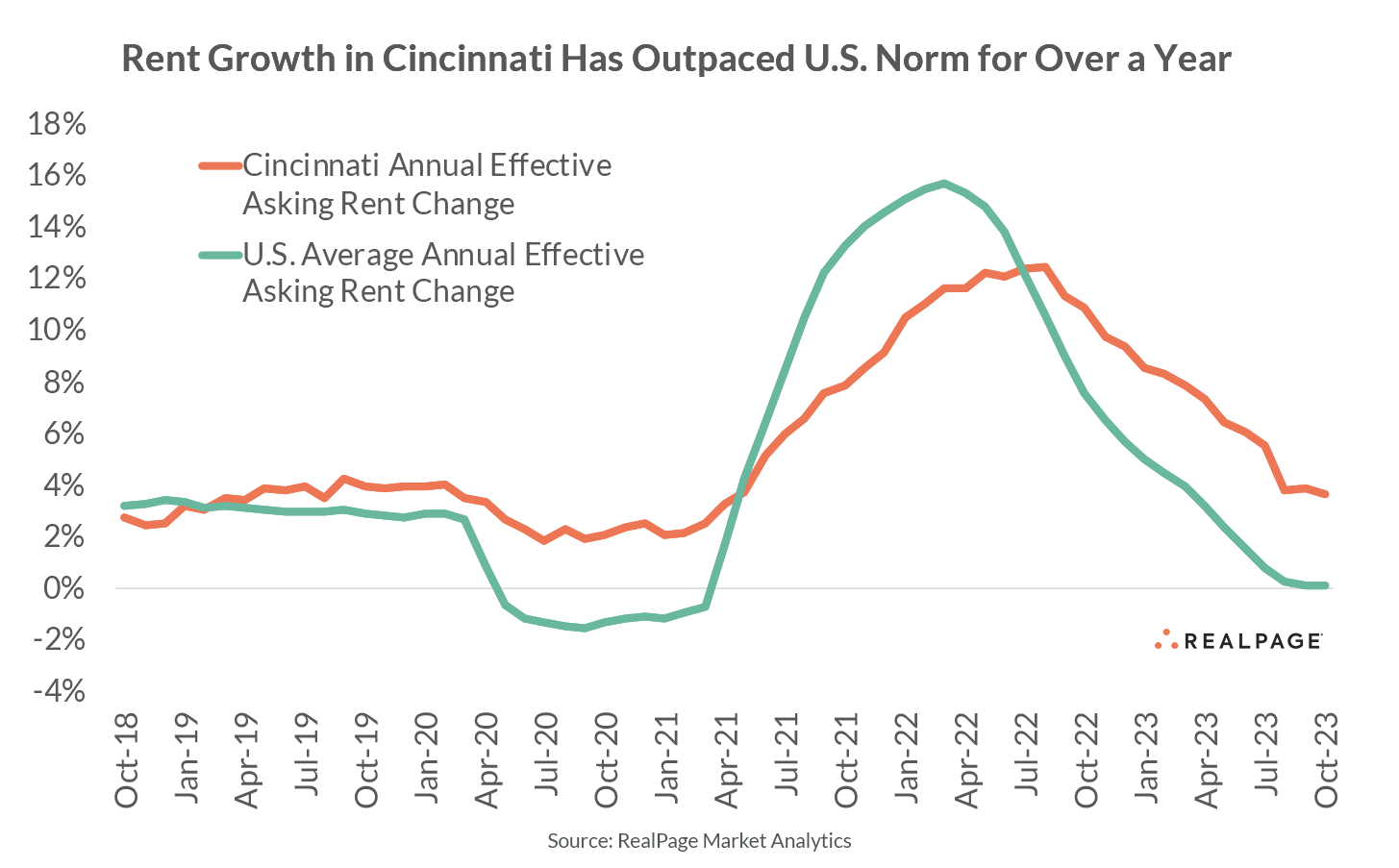

With occupancy trending down and more supply on the way, apartment operators in Cincinnati have eased up on rent hikes. After reaching unsustainable double-digit annual rent growth throughout much of 2022, prices have been rising at slower and slower rates. Still, the 3.6% year-over-year rent growth the market achieved in October ranked second among the nation’s 50 largest apartment markets, bested only by Newark (3.7%). Cincinnati’s recent annual rent growth was also slightly above the market’s pre-pandemic average of 3.1% from 2015 to 2019.

With occupancy remaining comparatively tight in Cincinnati’s Class C product, operators of that asset class were able to achieve rent growth of 6.6% in the year-ending October. Annual rent growth was milder in Class A and B stock, at 2.2% and 3.2%, respectively. Among submarkets, Central Cincinnati, which trailed the market for occupancy in October also trailed for annual rent growth. That submarket, which has been growing its existing inventory at three times the market average over the past five years, logged rent growth of just 1.4% in the year-ending October. West Cincinnati and North Cincinnati recorded the biggest annual price hikes of 6.4% and 5.1%, respectively.

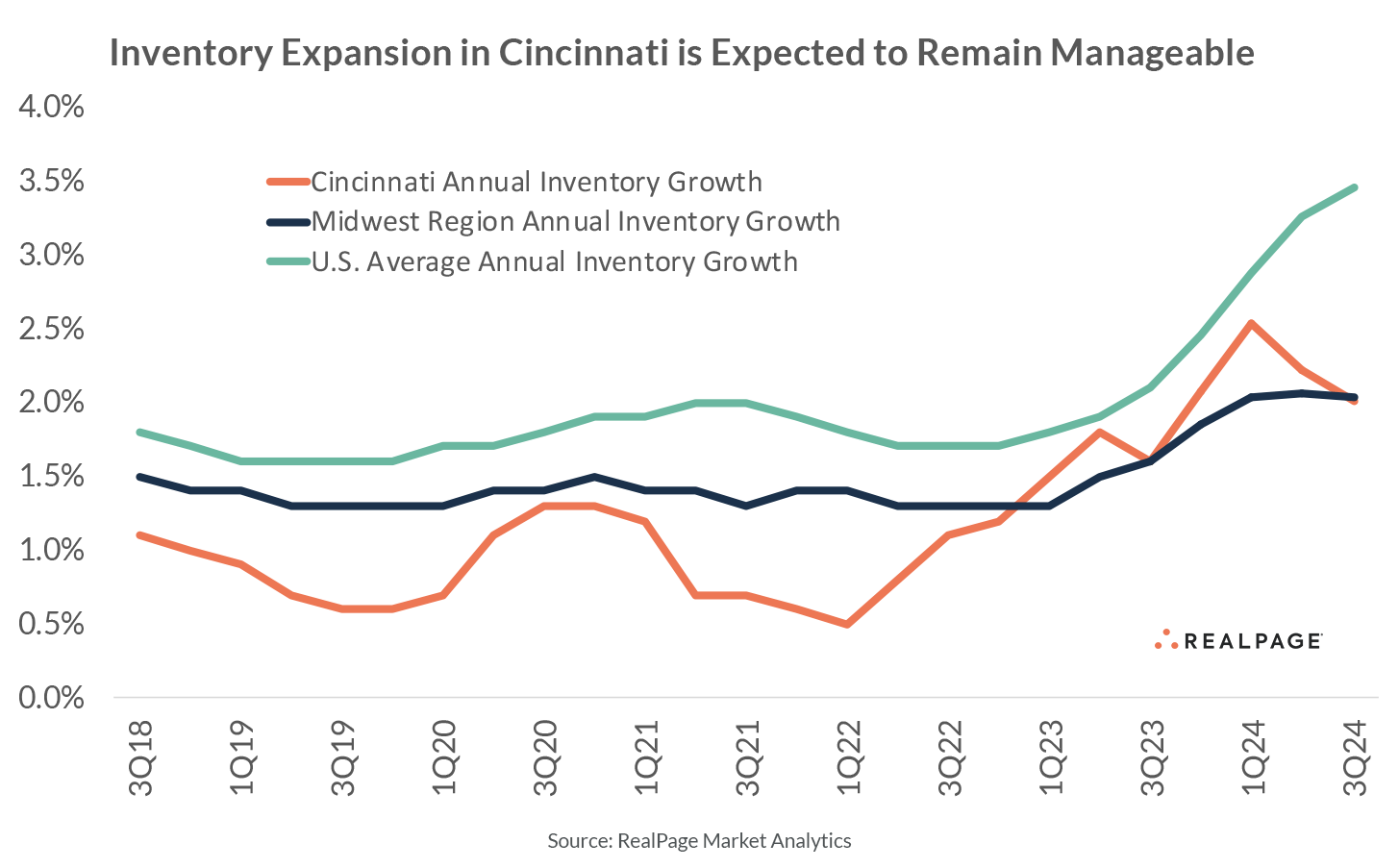

Contributing to Cincinnati’s solid apartment market fundamentals, new supply has remained at manageable levels. A total of 2,760 units delivered in the year-ending 3rd quarter 2023. Although that was one of the market’s largest annual delivery volumes since RealPage began tracking the market in 1999, it expanded the local inventory base just 1.6%. And while deliveries are expected to set a record high of 3,342 units in the coming year, that supply volume should continue to remain manageable, as it represents 2% of existing stock. For comparison, U.S. average inventory expansion in the year-ending 3rd quarter 2024 is expected to register at 3.4%.

While inventory is expected to pick up in the coming year, demand is also anticipated to increase, allowing for occupancy to remain at or above the essentially full mark of 95%. Meanwhile, operators are expected to sacrifice some additional rent growth to help maintain occupancy, with price increases trending back to historical norms.