Several of the nation’s tech hubs have seen job gains slow sharply or have turned to job losses due to a combination of various factors, including the tech industry correcting for pandemic-era over-hiring, general economic uncertainty and the transformative effects of AI. This has led to declining employment and a talent exodus in some hubs, while other cities continue to see tech sector growth.

According to the latest release from the Bureau of Labor Statistics, annual job losses continued in the Bay Area (13,600 jobs lost in San Francisco-Oakland-San Jose), while Denver’s job change turned negative in August (3,800 jobs lost).

Deep declines in year-over-year employment gains occurred in Atlanta, Dallas, Austin, Seattle and Raleigh/Durham (positive but weaker growth). Compared to last year, these tech hubs created about 100,000 fewer jobs in their respective economies.

However, other tech markets like Boston and Salt Lake City saw job gains increase from last August. Those markets combined for an addition of 26,300 more overall jobs than the year before.

Of particular note during this employment slowdown are Dallas, Seattle and Austin. All three were among the top 10 markets for job creation as recently as January, but in August, Dallas ranked #26, Seattle was #28 and Austin ranked behind Honolulu at #30, just ahead of Myrtle Beach.

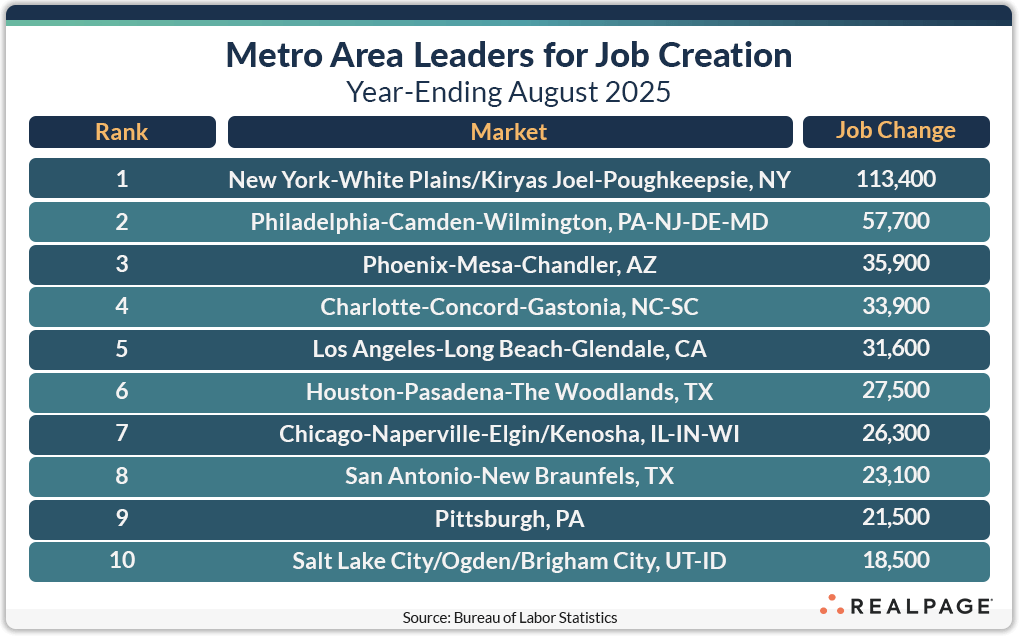

Among RealPage’s top 10 job creation markets for the year-ending August, New York continued its dominance with a gain of 113,400 jobs. Philadelphia ranked #2 for the fourth straight month and Phoenix moved up to #3 from #7 in July.

Charlotte, Los Angeles, Houston, Chicago and San Antonio returned among the top job creation markets, while Pittsburgh and Salt Lake City replaced Orlando and Detroit to round out the top 10 for August.

Together, the top 10 markets added 389,400 jobs in the year-ending August, about 85,000 more than the same 10 markets last August (up 28%), but 71,000 less than last month. Even the top job creation markets are slowing. Additionally, the next 10 markets (#11 - #20) of RealPage’s top job gain markets saw their total gains decrease 8.3% from last year to 156,000 new jobs.

Only New York gained more than 100,000 jobs and only Philadelphia gained between 50,000 and 99,999 jobs in August while just seven markets gained 20,000 jobs or more for the year, six fewer than last month. A total of 26 of our top 150 markets reported annual job losses for the year, seven more than last month. In addition to the aforementioned job losses in the Bay Area and Denver, several Midwest or Northeast markets experienced job cuts such as Washington, DC, St. Louis, Milwaukee, Madison, Atlantic City, Kansas City and Des Moines. Two markets reported no employment change.

Job Growth

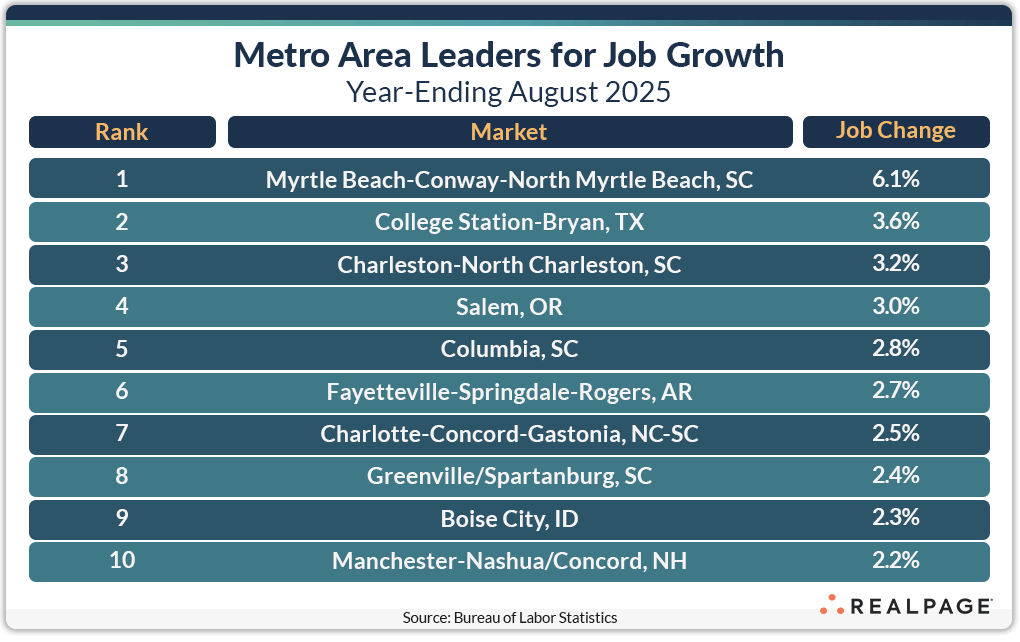

Unlike the top job gain markets, which tend to be large in population and employment, smaller markets usually dominate the top markets for annual percentage change in employment. As we typically see, state capitals, college towns and resort or tourist destination cities dominate this list. Nine of July’s top markets for job change returned in August with the first three remaining in order.

Myrtle Beach remained in the top spot on this month’s list with a slight decrease in their percentage growth of 10 basis points (bps). The college towns of College Station, TX, Columbia, SC, Fayetteville, AR, Boise, ID and Greenville/Spartanburg, SC remained among the top job growth markets as did state capitals Salem, OR and Manchester-Nashua/Concord, NH. With the addition of Charleston, SC and Charlotte, NC, the Carolinas took half of this month’s top 10 job growth markets.

Eight of the top 10 job growth markets had greater growth rates than one year ago, led by Myrtle Beach with a 530-bps increase. Outside of the top 10 growth markets, Honolulu, Richmond, Allentown and Syracuse, NY had employment growth rates between 2% and 2.2%. Including the top 10, a total of 71 markets exceeded the national not seasonally adjusted growth rate of 0.8%, which was 15 fewer than last month.

This post is part of a series by RealPage Senior Real Estate Economist Chuck Ehmann analyzing employment data from the Bureau of Labor Statistics. For more on this data, read previous posts on Job Growth.