Operators Appear to Buy Occupancy as Rent Growth Slows in April

In a strong start to the prime leasing season, U.S. apartment occupancy surged in April. At the same time, rent growth, which had displayed modest momentum in recent months, backtracked slightly.

Combined, these two fundamentals likely indicate that operators in the U.S. apartment market are focused on filling vacant units quickly amid economic uncertainty and a competitive leasing environment at the beginning of prime leasing season.

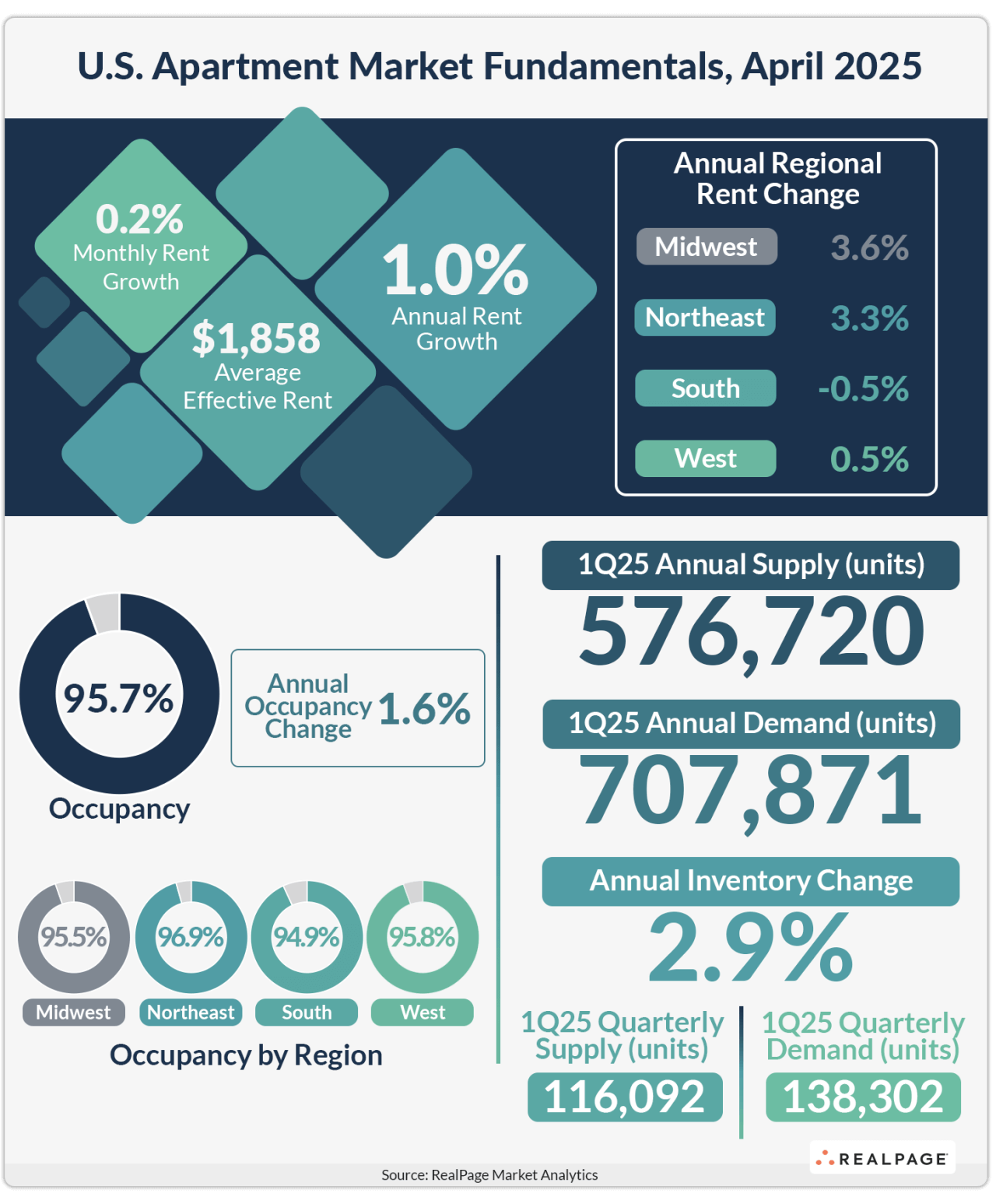

U.S. apartment occupancy registered at 95.7% in April after climbing 40 basis points (bps) month-over-month to mark the strongest monthly boost in an April reading since 2010, according to data from RealPage Market Analytics. April generally marks the start of prime leasing season, though typical seasonality has been disrupted in recent years.

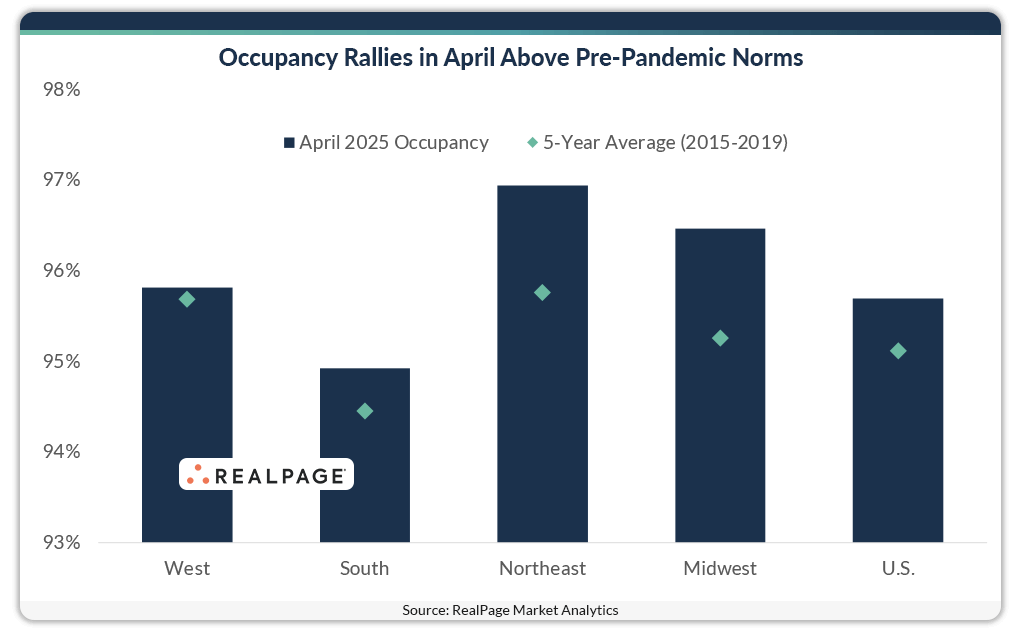

Apartment occupancy now stands above historical norms at the national level and across all regions. As of 1st quarter, most major markets still posted occupancy below historical norms.

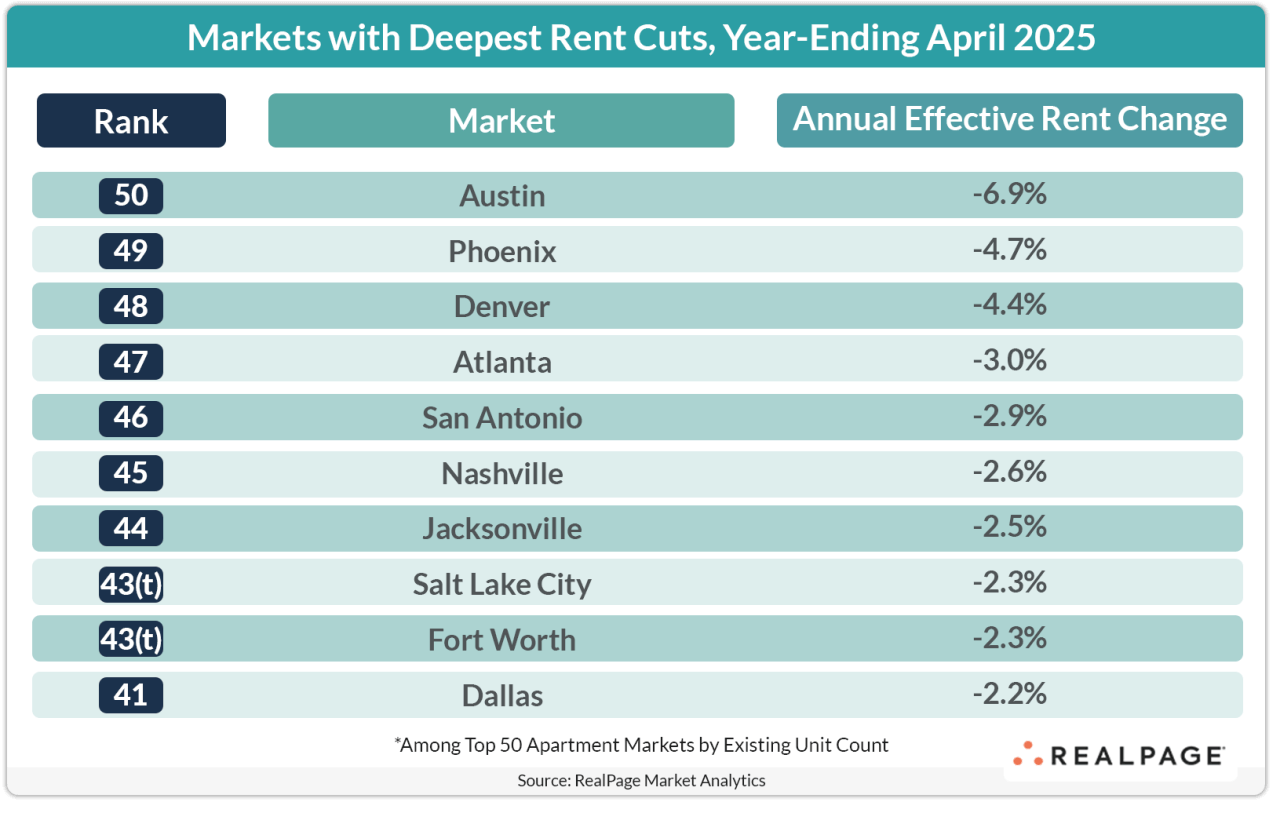

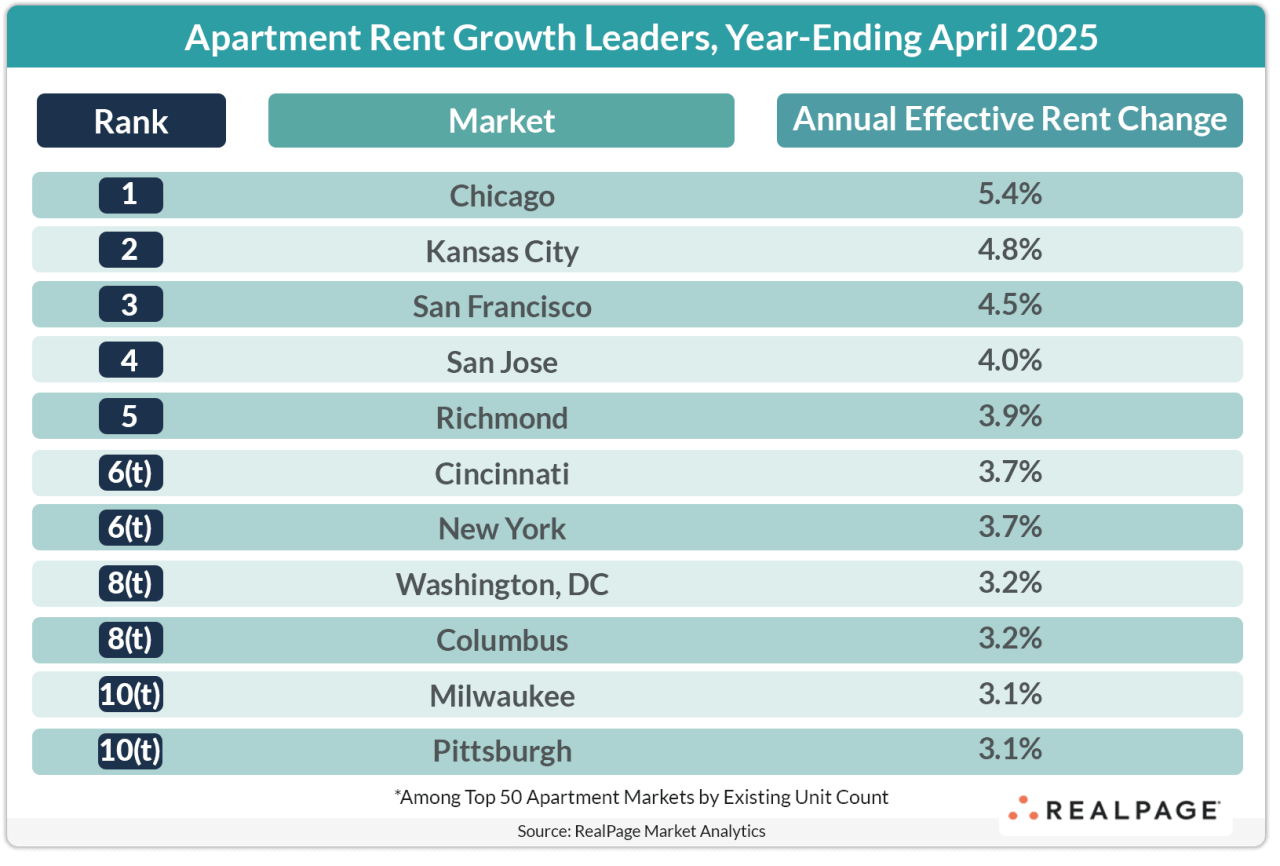

Effective rents grew 0.2% in April, the softest showing in four months, toning down annual rent growth to 1.0% after slightly higher readings in March. The high-supply South continued to be the only region cutting rents on an annual basis (-0.5%), while the West posted near negligible growth (0.5%). The Midwest (3.6%) and Northeast (3.3%) again posted the strongest rent growth among regions in the year-ending April 2025.

Supporting the idea that operators are focused on occupancy, some of the markets that have been seeing the deepest rent cuts posted the most notable occupancy bumps in April. Charlotte and Nashville, which are seeing rent cuts marketwide, recorded the strongest occupancy gains among major markets (+80 bps MoM). Several other high supply markets also posted notable occupancy gains in April, including Raleigh/Durham (+70 bps), Denver (+60 bps), Austin (+50 bps), San Antonio (+50 bps) and Salt Lake City (+50 bps).

Some of the nation’s most seasonal markets appeared to firmly kick off their prime leasing seasons with notable monthly rent gains, including Chicago, New York and Boston. Chicago was the only major market that posted rent growth above 5% on an annual basis as of April.

Meanwhile, renewal rates remained strong in April, ticking up 40 bps month-over-month to just above 55% on a trailing 12-month basis. Lead volume was robust in April, registering slightly below March’s rate and indicating that new lease signings are poised to remain healthy. Median rent-to-income ratios in professionally managed market-rate apartments hovered at 22.3% in April calculated on trailing 12-month basis.