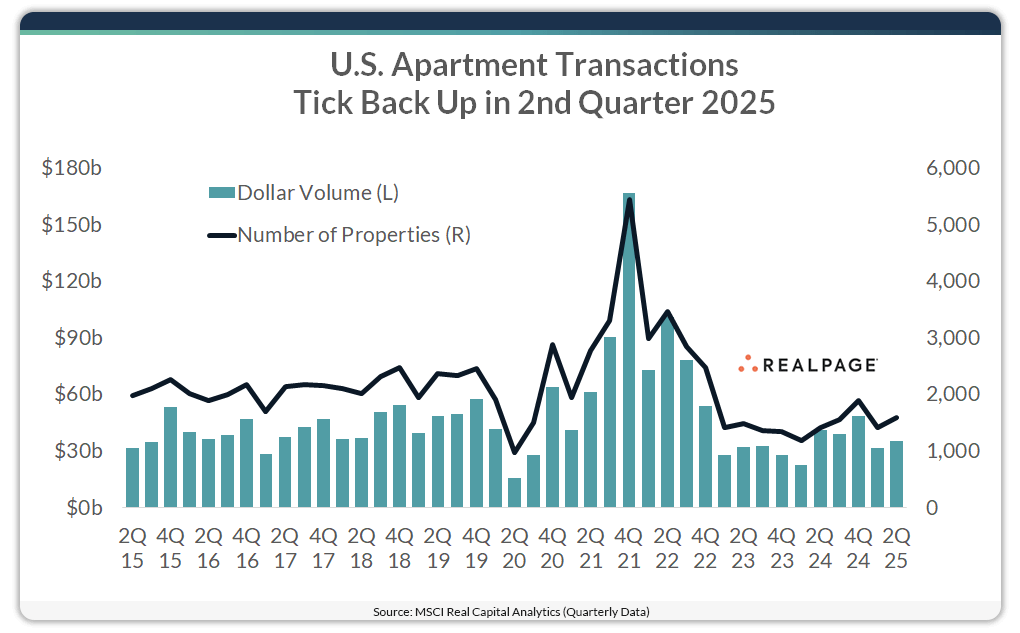

U.S. apartment transactions ticked back up during the April to June 2025 time frame. However, on a year-over-year basis, the total dollar volume of apartment sales were down.

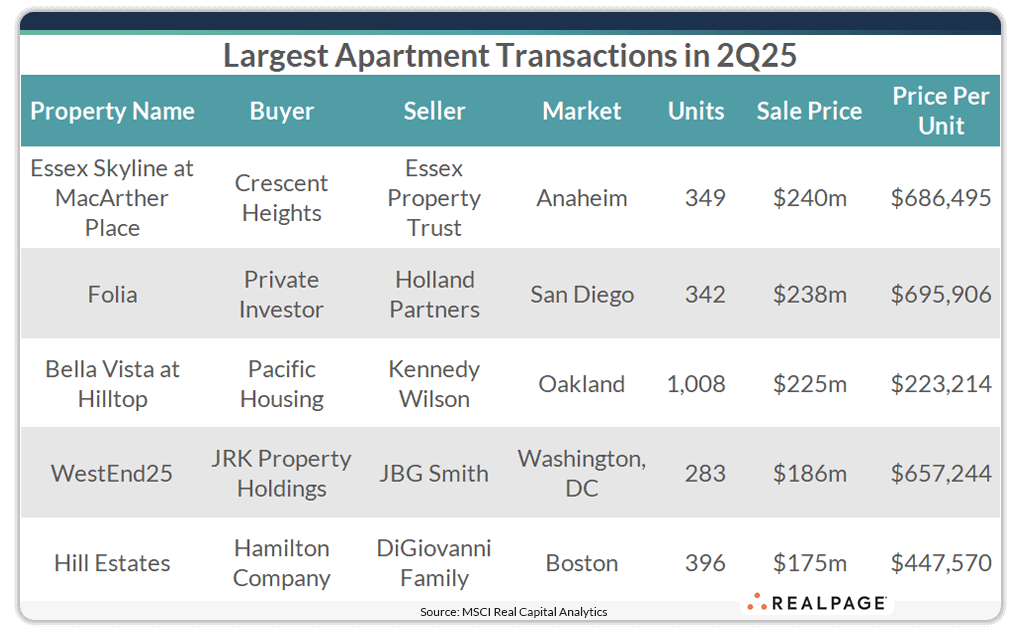

There were some notable sales during 2nd quarter, with five apartment communities trading for $175 million or more.

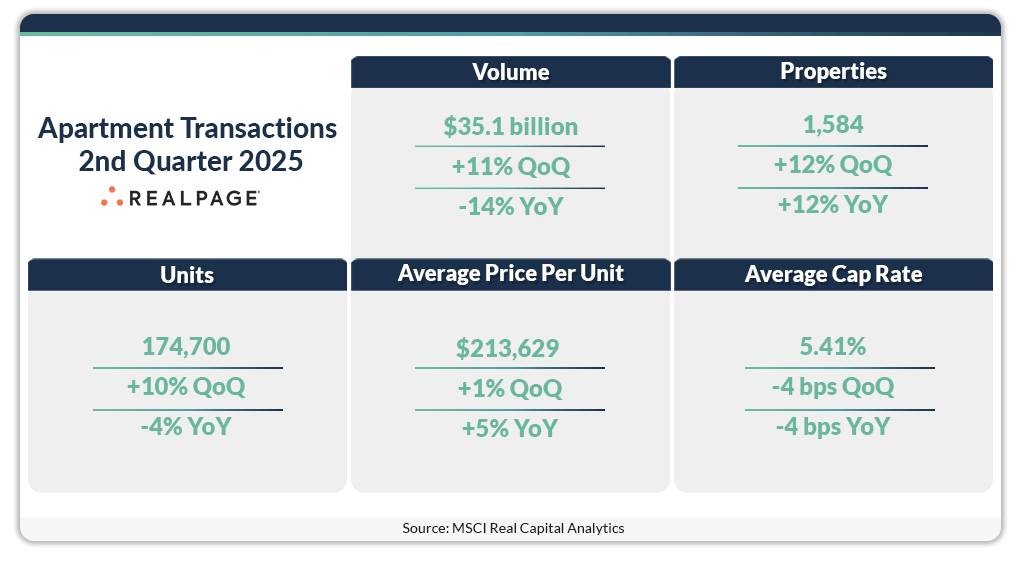

Roughly 1,580 apartment properties changed hands at a value of nearly $35.1 billion during 2nd quarter 2025, according to MSCI Real Capital Analytics. Overall sales volumes were down 14% year-over-year but were 11% above the 1st quarter 2025 level when around 1,410 properties changed hands for roughly $31.5 billion. Still, recent activity was well below the $54.7 billion quarterly average over the past five years.

The average price per unit remained high at $213,629 in 2nd quarter, registering above $200,000 for 14 of the past 16 consecutive quarters. Prior to 2021, the per unit pricing never exceeded that threshold and averaged roughly $151,000 from 2015 to 2019. Meanwhile, cap rates for apartment transactions occurring in 2nd quarter 2025 averaged 5.41%, the lowest cap rate since 3rd quarter 2023 but well above the pandemic-era low of 4.67% from 2nd quarter 2022. Apartment cap rates remain the lowest among major property types, keeping the asset class an attractive commercial real estate investment.

On an annual basis, transactions in the year-ending 2nd quarter 2025 totaled nearly $154.1 billion with 6,445 properties trading hands. That total sales volume was up 24% from the previous 12-month period, while the number of properties sold was up 21%. Looking back over the past few years, sales dipped in calendar 2020 due to the pandemic, when about 7,300 apartment communities were sold for $148.2 billion. That was well below the volume from 2019, when nearly 9,100 properties traded hands for $195.1 billion. In 2021, transactions jumped up due to pent up demand following the onset of the pandemic, with roughly 13,400 properties trading hands at a value of roughly $359 billion, nearly double the 2020 level on both accounts.

Among the five largest single-asset market-rate apartment transactions during 2nd quarter 2025, all sold for $175 million or more. The West region had three of those transactions, while the Northeast and South each had one transaction.

Essex Skyline at MacArthur Place

San Mateo-based Essex Property Trust sold the 349-unit Essex Skyline at MacArthur Place in the Anaheim market to Miami-based Crescent Heights for $239.6 million in April. The purchase price equated to about $686,500 per door. Not only was it the largest single-asset market-rate apartment transaction in the nation during 2025’s 2nd quarter, but it was also the fourth-largest transaction in Orange County over the past 25 years. The development came online in 2008 as a condominium property. Essex bought the asset for $128 million in 2010 and converted it into apartments. The seven-acre property, at 15 MacArthur Pl. in Santa Ana, is comprised of two 25-story buildings. Amenities include a fitness center, swimming pool, resident lounge, bocce ball court, putting green, dog park, spa and on-site car wash. The community has been rebranded Skyline OC.

Folia

In mid-June, Vancouver, WA-based Holland Partners sold the Folia apartment community in San Diego to a private investor. The 342-unit development traded for approximately $238 million, the second-largest apartment transaction in the U.S. during 2nd quarter 2025 and the sixth-largest transaction in San Diego over the past 25 years. The sale price for the five-story community, which completed in 2023, came to roughly $695,900 per unit. The development was built near the edge of Carmel Valley and northeast of Sorrento Valley at 12520 Camino Del Sur in the Far North San Diego submarket. The community features a pool and spa, fitness center, pet spa, bocce ball court, putting green, outdoor grilling areas, fire pits, billiards, coworking space, entertaining kitchen and a playground.

Bella Vista at Hilltop

An alliance of California real estate firms including Sacramento-based Pacific Housing purchased a large apartment complex in the Oakland market in late June. Beverly Hills, CA-based Kennedy Wilson sold the 1,008-unit Bella Vista at Hilltop apartment community for $225 million or roughly $223,000 per door, making it not only the third-largest apartment transaction in the nation during 2025’s 2nd quarter, but also the third-largest apartment transaction in the Oakland area over the past 25 years. The asset previously traded in 2011 for $140.5 million. The property is in San Pablo on Richmond Parkway, within the Northwest Contra Costa County submarket. The three-story community was built in 1988 and renovated in 2016 and includes some income-restricted units. Amenities include four resort-style swimming pools, heated indoor pool with a Jacuzzi, sauna, business center, playground, lighted tennis courts and a fitness center.

WestEnd25

JRK Property Holdings, a Los Angeles-based real estate investment firm, purchased the WestEnd25 apartments in the Washington, DC market in late June from Bethesda, MD-based JBG Smith. The community, which was built in 2009, traded for roughly $186 million. That was the nation’s fourth-largest apartment transaction during 2nd quarter and the 28th largest apartment transaction in the DC market over the past 25 years. The sales price for the 283-unit community came to about $657,000 per unit. The 10-story high-rise apartment building, which was built in 2009, is situated on 25th Street Northwest in the Central DC submarket. JRK plans to make substantial improvements to WestEnd25's common areas and amenities including a new fitness center, redesigned rooftop amenity space, resort-style pool and sundeck, as well as updates to unit interiors when a resident vacates.

Hill Estates

Ranking as the fifth-largest apartment transaction in the nation during 2nd quarter was the sale of Hill Estates in the Boston market. In mid-June, the DiGiovanni Family sold the asset to The Hamilton Company, a Boston-based real estate firm. The development traded for $175 million or nearly $448,00 per unit, making it the 20th largest apartment transaction in Boston over the past 25 years. The 396-unit community is just 15 minutes from downtown Boston on Hill Road in Belmont within the Waltham/Newton/Lexington submarket. The property has been owned and managed by the DiGiovanni Family since they built it in 1965. Hill Estates is comprised of a mix of townhomes and mid-rise buildings spanning a 14-acre site. The Hamilton Company plans to make substantial investments to modernize and add amenities to the community.

Every quarter, Real Estate Writer Charlotte Wheeler details the nation’s five largest multifamily rental transactions. Read the previous posts in the Apartment Transactions series.