For the third year in a row, many multifamily market performance stats have shown anything but “normal” trends. Still, 3rd quarter 2023 did show the market continues to work back toward a more normal, stabilized trend.

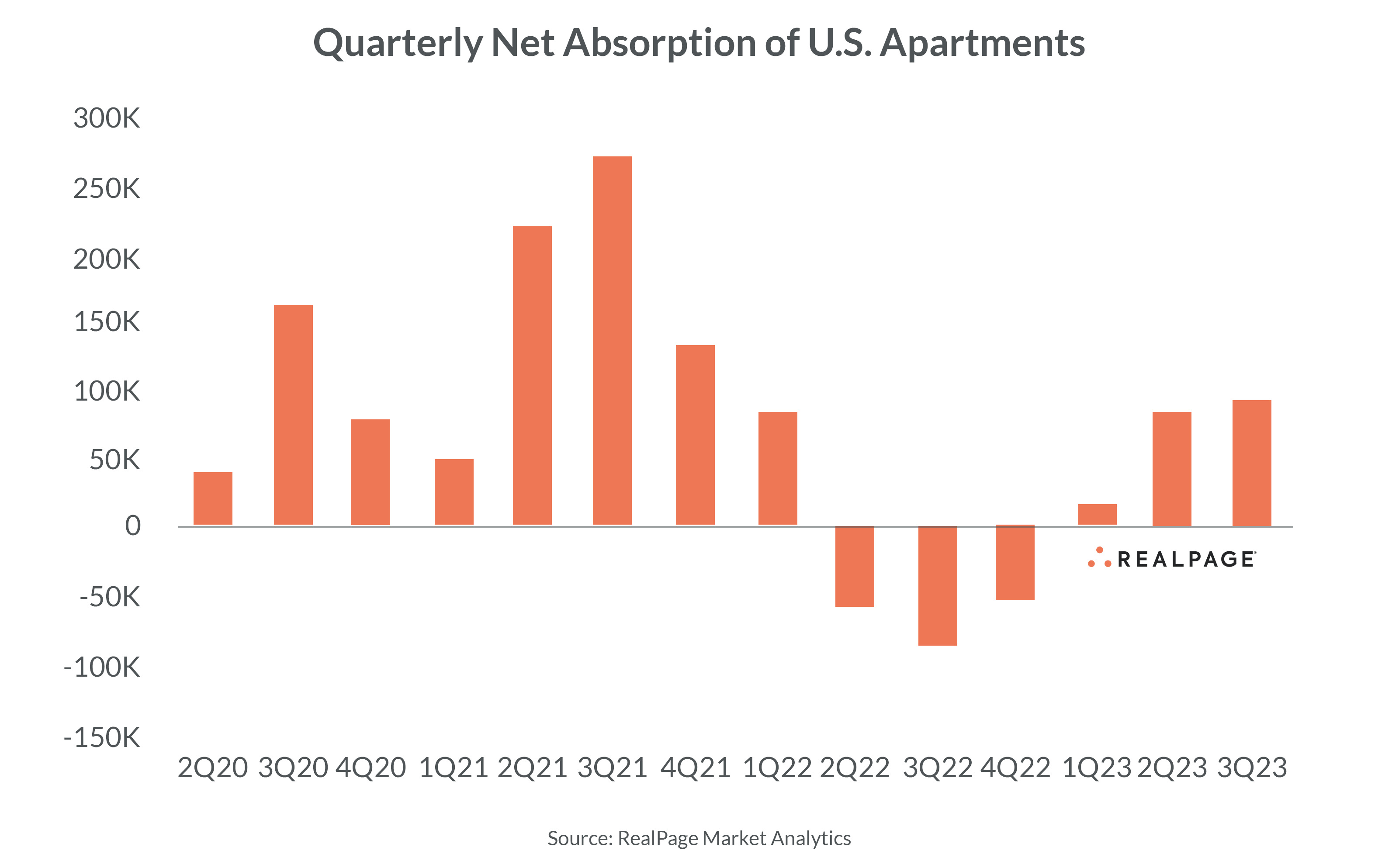

Apartment absorption has been positive in each of 2023’s three quarters. Three straight positive quarters of absorption pushed annual absorption to 127,000 units – the first positive annual figure dating back to 3rd quarter 2022, according to data from RealPage Market Analytics.

Occupancy has effectively stabilized at 94.5%, with September 2023 marking the third-straight month in which that occupancy rate held across the U.S. And while occupancy rates are down about 50 basis points from the start of 2023, this modest contraction pales to the 2022 year-to-date figure of 190 basis points. Further, 94.5% occupancy is just 20 basis points below the 2010s average which suggests further market normalization.

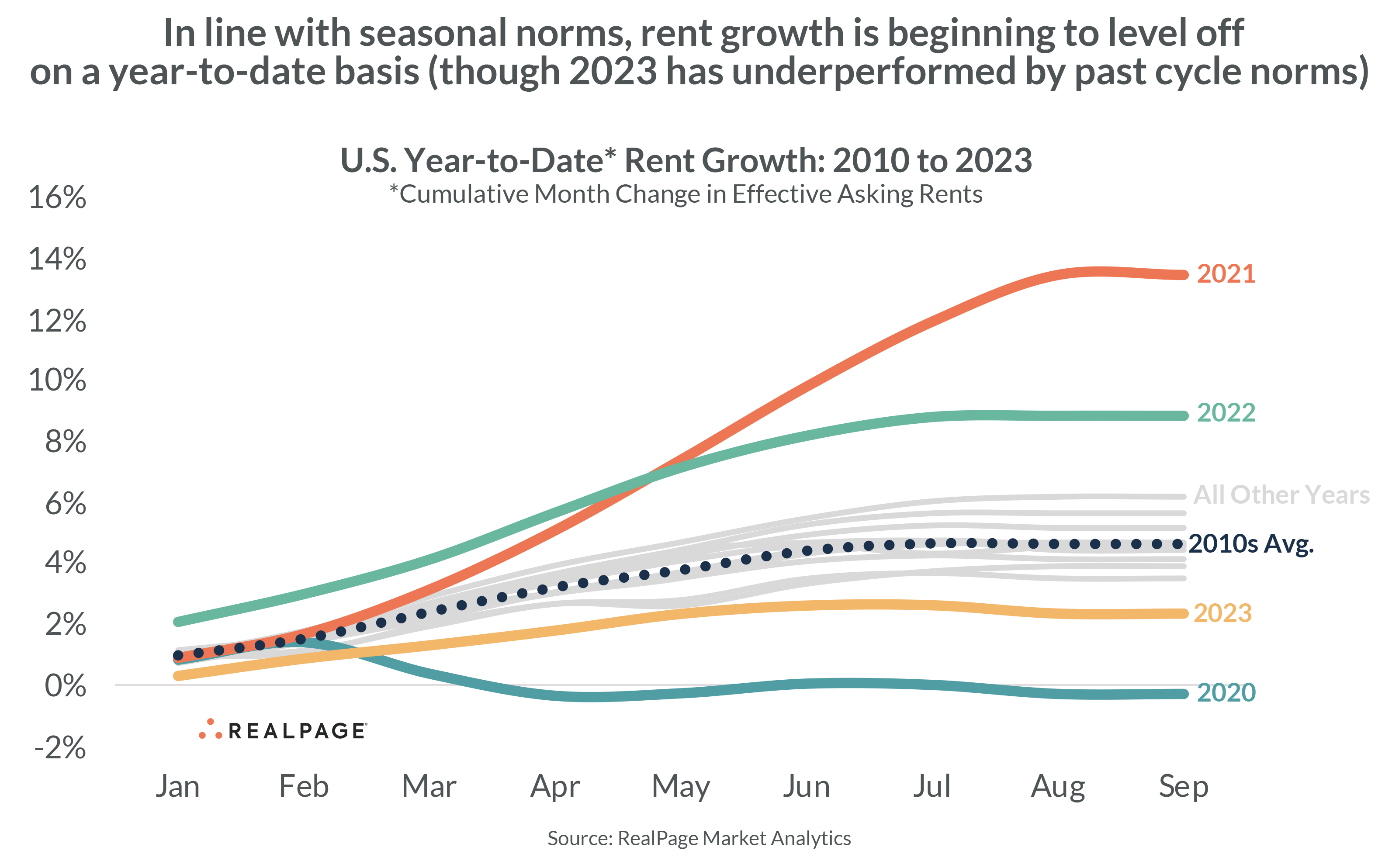

Rent growth has struggled to gain consistent momentum in 2023 as operators have focused on stabilizing occupancy in lieu of larger rent increases. Rents are up about 2% year-to-date, though normal seasonal trends suggest that the year-end 2023 figure will come in below that 2% figure.

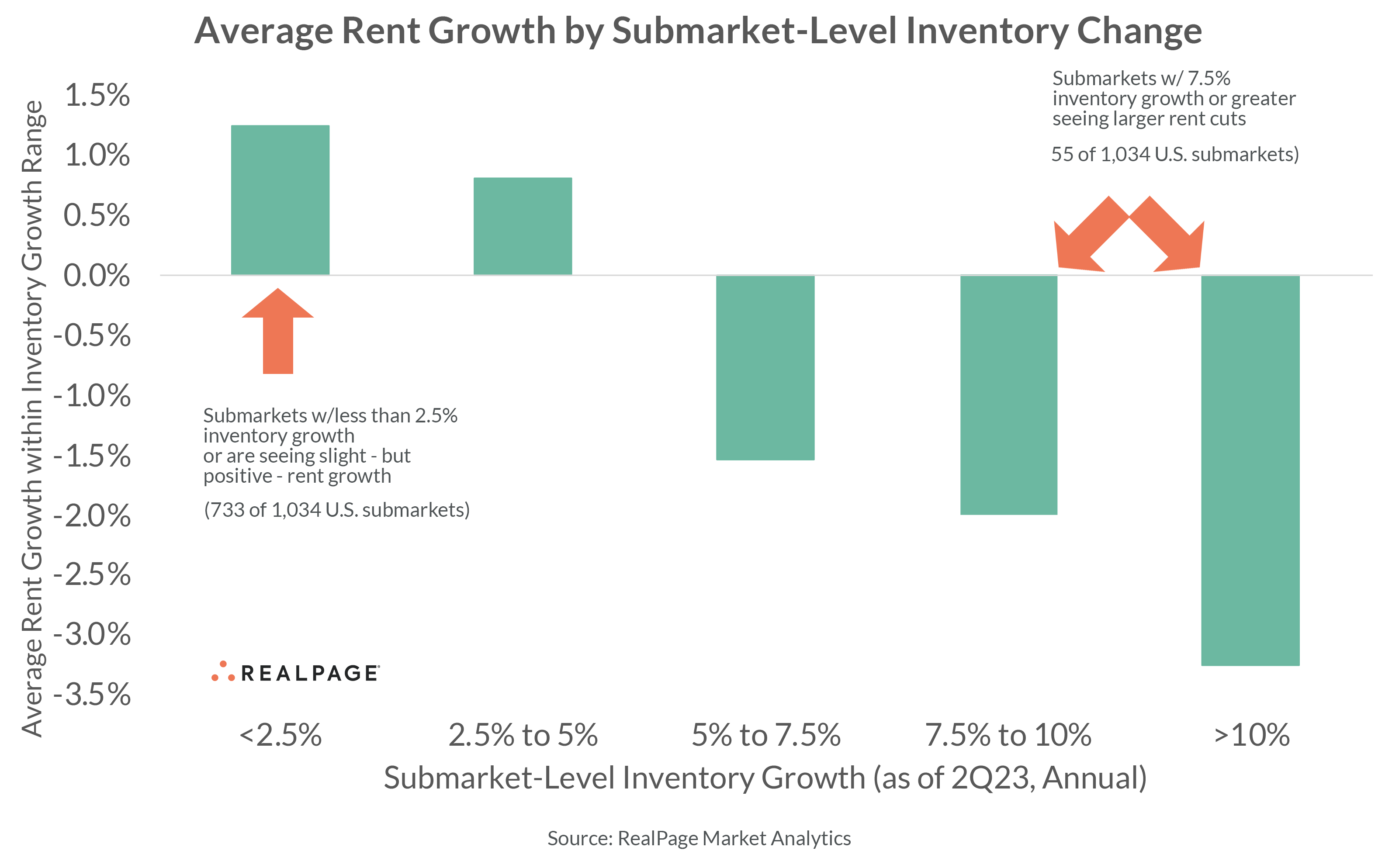

New supply appears to be the strongest deterrent of rent growth at a market (and especially submarket) level. Submarkets delivering the highest share of supply show a clear relationship for weaker rent performance. Conversely, areas delivering less supply have seen larger rent increases.

Forecast Update: 4th Quarter 2023 Expectations for Calendar Year 2024

A few changes worth mentioning characterize the updated 2024 forecast expectations, though some baseline assumptions (e.g. continued steady demand) remained consistent.

Demand

Apartment demand showed improvement in 2023, driven largely by still-strong (although slowing) job growth and improving consumer sentiment. Though job growth is expected to continue slowing through 2024, the hoped-for economic “soft landing” appears to have largely been achieved thus far. As a result, the expectation from a demand perspective is that the economy will continue to generate enough momentum to provide some tailwinds for household formation. Additionally, as inflation has cooled below prior year norms while wage growth remains strong, the end result is “real” wage growth for the first time in a number of years. Altogether, this should inform fairly strong apartment demand in 2024.

Though positive influences largely color the 2024 demand outlook, potential headwinds are worth considering. Most notably, the resumption of federal student loan repayments could be something that erodes the share of wallet that American households are allocating towards debt repayment. Market-rate metrics from RealPage show a still-balanced median rent-to-income ratio (23.2% year-to-date in 2023) however, which does help curb some of this broader concern. Other negative influences on the U.S. economic outlook include turmoil in global markets (particularly in China and Germany).

Supply

The biggest influence on the 2024 forecast is supply. About 1 million apartment units remain under construction, though this number has steadily dropped in the past few quarters. Still, 2024 is slated to remain a banner-year in terms of realized apartment deliveries. RealPage data shows that north of 600,000 market-rate multifamily units should complete in calendar year 2024. Even if supply delays become more commonplace, it’s certain that 2024 will see more multifamily units deliver than any other part of the past four decades.

As such, rents will face considerable downward pressure despite otherwise-steady demand. This is a perfect case study in economics 101. When supply trends ahead of demand, pricing adjusts downward. As a result, the 2024 forecast shows modestly downgraded expectations for rent growth.

Yet the biggest shift in the updated forecast is the 2025 and 2026 delivery expectation. National estimates suggest that supply delivering in 2025 will drop between 15% and 20% in most major U.S. markets. This is primarily driven by a sharp adjustment in identified starts activity. For example, there were 51,000 fewer market-rate apartment units started in 2nd quarter 2023 than 1st quarter 2023. This was a 41% change in just 90 days.

At the start of 2023 (also the peak), about 1.1 million market-rate apartment units were under construction. Those units will complete and deliver at some point in the future. But the properties not yet started are the ones where the future becomes murkier.

Looking at data provided by the National Multifamily Housing Council (NMHC) in their quarterly survey of cited reasons for construction delays shows that “project not economically feasible at this time” and “inability to secure construction financing” are cited as two of the most common reasons for construction delays. These reasons in addition to continued uncertainty from the financing side of the construction equation inform the considerable pullback in expected 2025/2026 apartment deliveries.

Rent/Occupancy

With supply increasing the total number of available units in individual markets, operators are largely focusing on stabilizing their rent rolls and maintaining historically normal occupancy in lieu of increasing rents in line with historically normal levels.

Expectations for 2024 occupancy rates are that demand should help keep headline occupancy readings generally consistent with historical norms; that is, the U.S. figure in the lower 94% range. While there is some concern that occupancy rates could further slip if demand falters considering the level and scale of new apartment deliveries, other influences such as resident retention suggest that a considerable occupancy contraction is unlikely (barring a black swan event that severely impacts demand).

Annual effective rent growth in many markets is expected to hover in the 1% to 2% range. In some lower-supply markets with steady demand (Midwest/Rust Belt, Mid-Atlantic, and select coastal markets) are expected to slightly outperform, with 3%+ rent growth forecast. On the lower end, Desert/Mountain markets where demand has stalled and supply remains robust are likely to underperform, with a ceiling of 1% rent growth anticipated.

Forecast Summary for 2024

All considered, demand indicators suggest the industry should see stable demand in 2024. This may not inform historically normal rent growth due to sheer volume of supply, however, and if expense growth remains stubbornly high, there could be a risk of NOI dipping into negative territory in the weakest markets.