May Occupancy Holds as Rent Recovery Falters

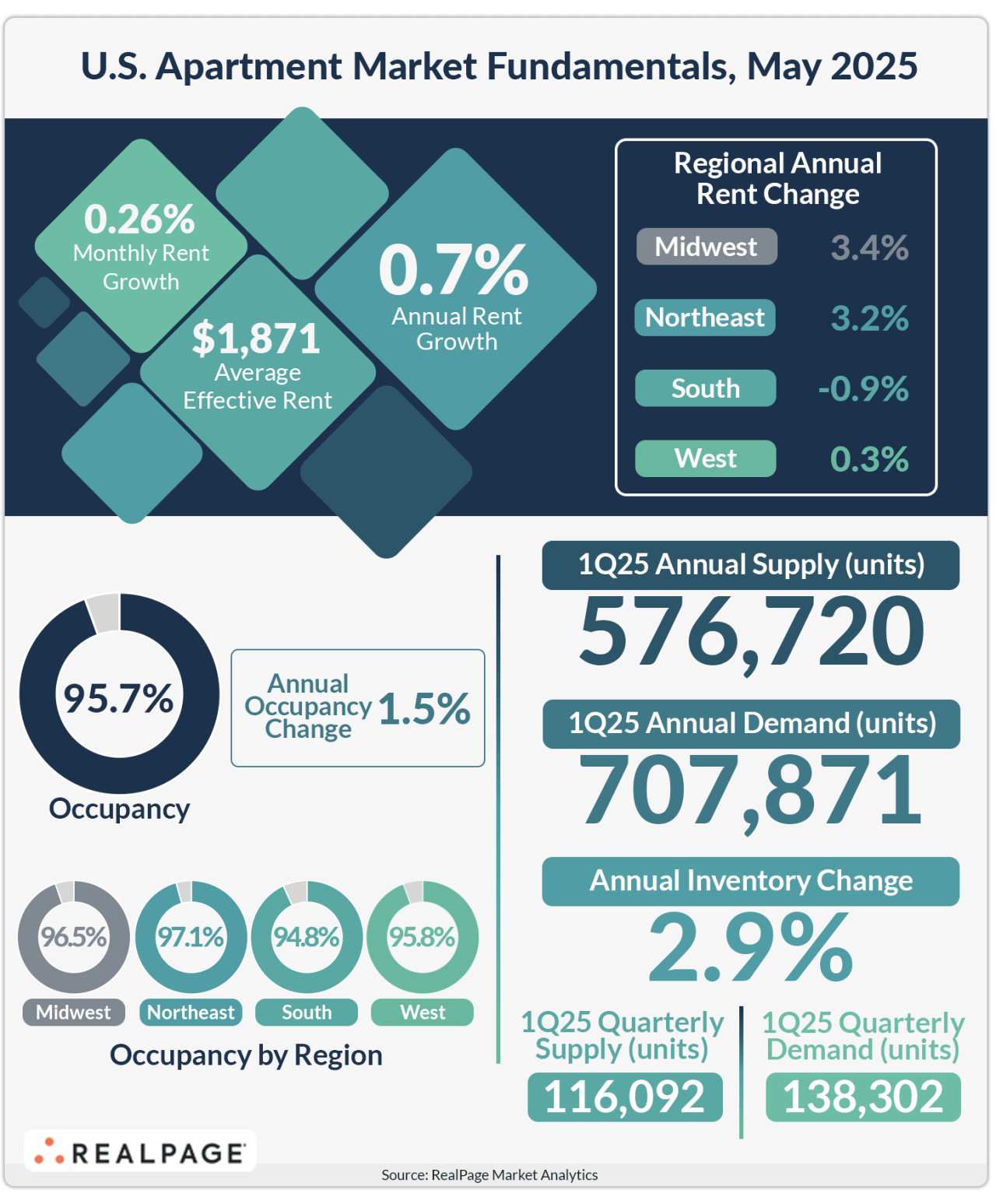

U.S. apartment occupancy held firm in May after a steady climb throughout the early months of 2025. At the same time, rent change in market-rate apartment units, which had been trending up slightly after months of stagnation, backtracked from last month.

Occupancy in the U.S. apartment market registered at 95.7% in May, in line with last month’s reading (95.7%) and up 90 basis points (bps) year-to-date, according to data from RealPage Market Analytics. All the nation’s 50 largest apartment markets posted occupancy growth year-over-year, though about 40% of markets posted declines in the month of May.

Across the nation, the South region posted a mild month-over-month decline in occupancy (-10 bps). Occupancy in the West remained unchanged, while the Midwest (+10 bps) and the Northeast (+20 bps) earned modest improvements over last month.

At the same time, monthly effective rent growth reached 0.26% in May, a mild reading that registered at about half the rate seen in May 2024 (0.51%). As such, annual effective rent growth appeared to backtrack, softening from last month’s 1% reading to stand at 0.7% in May.

The Midwest again posted the strongest annual rent growth nationwide (3.4%), followed by the Northeast (3.2%). The West region still trailed the national norm at 0.3% growth year-over-year, while the South was the only region to post rent cuts in the year-ending May (-0.9%).

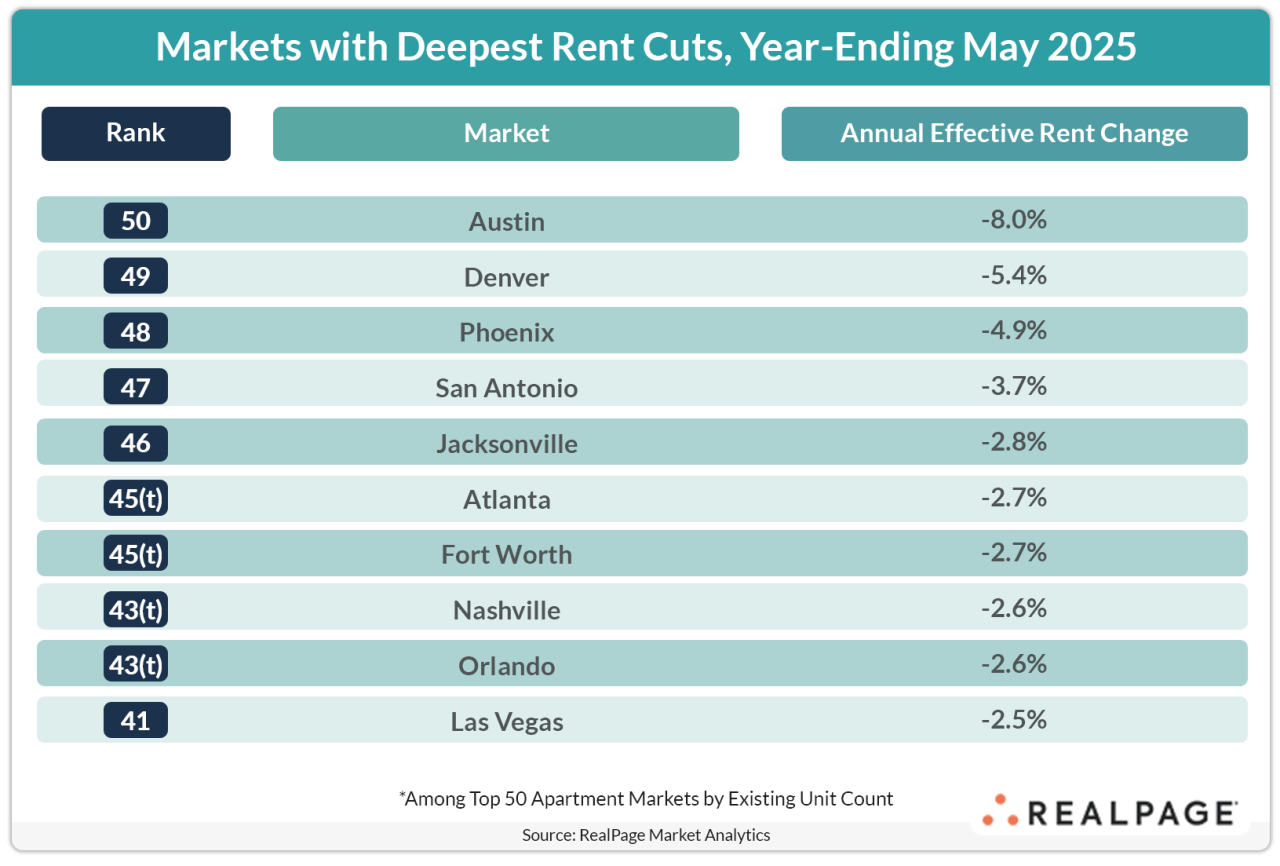

Several South region major markets saw rents fall on a monthly basis, deepening annual rent cuts after previous readings appeared to indicate recovery. Austin – the nation’s rent growth laggard – cut rents 0.9% in May, causing annual cuts to reach 8% after less severe readings in recent months. Phoenix, Tampa, Houston, Memphis and Sacramento all posted monthly rent cuts between 0.4% and 0.6% in May.

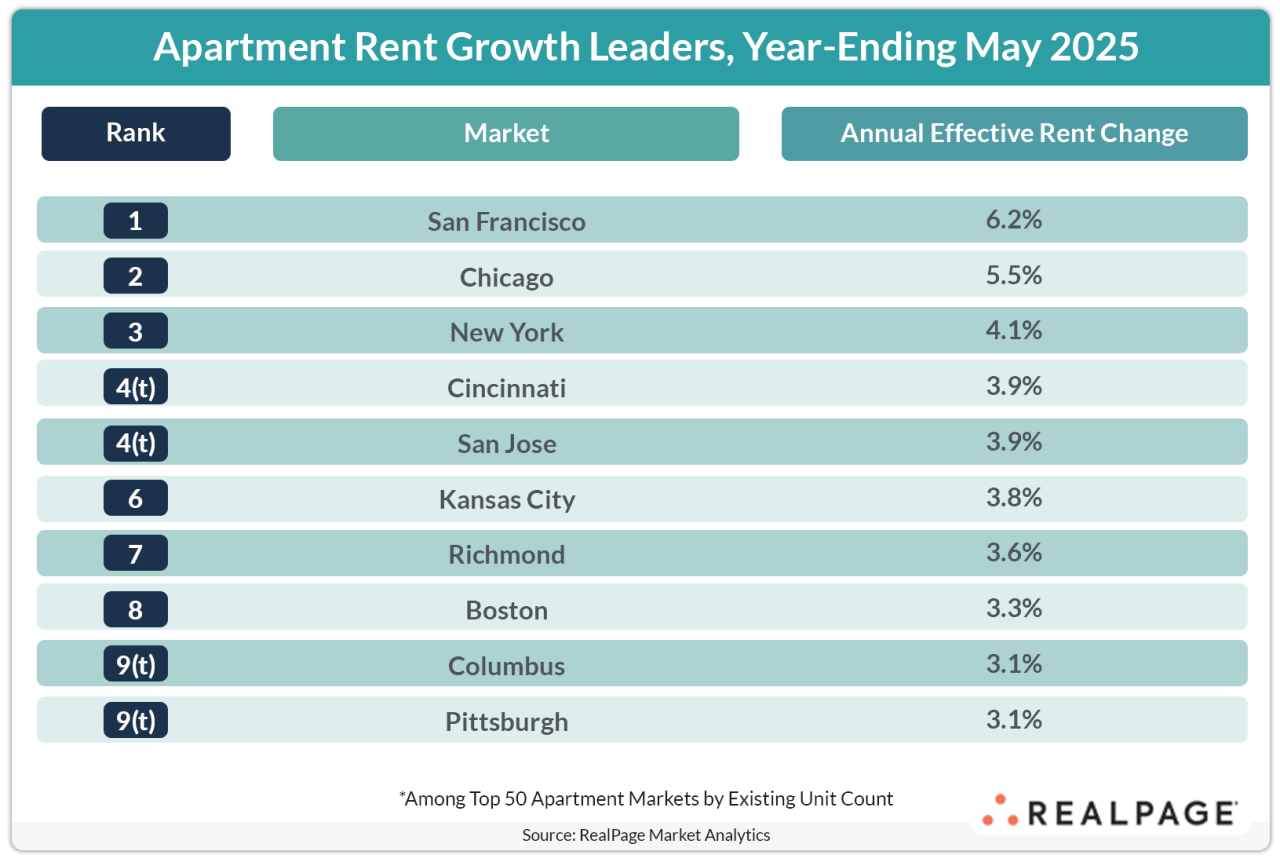

Alternatively, several markets – including many gateway cities – posted strong month-over-month rent growth, boosting annual readings to their highest levels in some time. San Francisco posted the highest monthly rent growth among major markets, which buoyed that market to overtake Chicago as the nation’s rent growth leader in May 2025. This marked the first time in over a year that a Midwest market did not claim the top spot on the national leaderboard. San Jose, New York and Boston all posted monthly rent growth of 1% or more in May.

Still, Midwest markets continued to post some of the highest rent growth in the year-ending May, led by Chicago, Cincinnati and Kansas City.