Rent Cuts Continue Across Most Florida Apartment Markets Amid Sustained Supply

Most Florida apartment markets are logging deep rent cuts, prompted by the continued battering of apartment supply volumes in recent years.

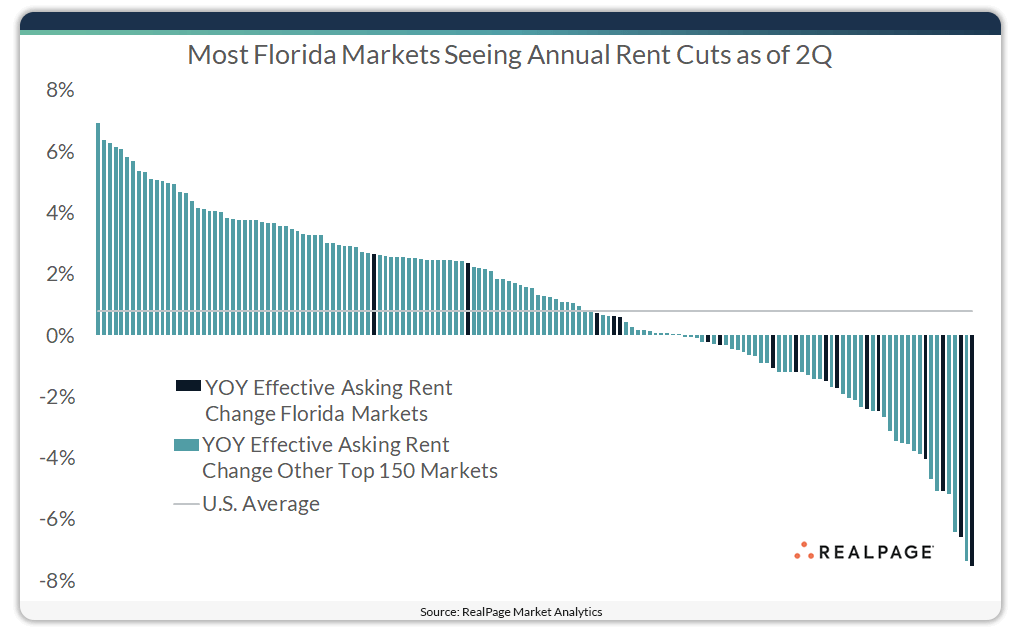

Effective asking rents came down by about 2% to 8% in the year-ending 2nd quarter 2025 across most Florida markets. The deepest declines were in Naples and Cape Coral, where effective asking rents declined by 7.5% and 6.6%, respectively. In those small Florida markets, the impact of supply pressure combined with normalizing migration trends has put downward pressure on rents in recent years.

Annual rent cuts were around 4% to 5% in Crestview and North Port. Two large Florida markets – Jacksonville and Orlando – saw prices come down by around 2.5% in the year-ending 2nd quarter.

Cuts were more modest at less than 2% in Lakeland, Deltona, West Palm Beach, Fort Lauderdale, Palm Bay and Pensacola. While some Florida markets did see a bit of rent growth in the past year, the increases in Tampa, Gainesville and Miami were below the national average (0.8%). The only Florida markets with annual rent growth ahead of the U.S. norm as of 2nd quarter were Tallahassee (2.7%) and Port St. Lucie (4.1%).

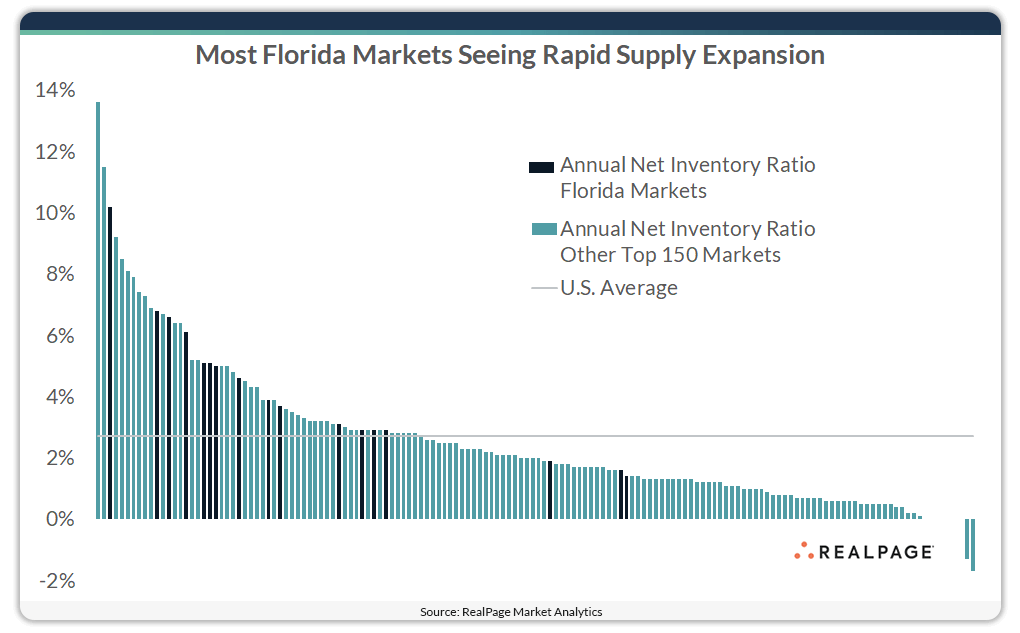

It's no surprise that elevated supply volumes are holding back rent growth in Florida in recent years.

Only three Florida markets – Tallahassee, Gainesville and West Palm Beach – saw inventory growth trail the national average in the year-ending 2nd quarter.

For the most part, the Florida markets with the deepest rent cuts are also the ones seeing the biggest inventory increases. New supply volumes in Cape Coral, North Port, Lakeland and Jacksonville are clearly a big force behind the state’s slowdown in rent positioning.

In the case of Jacksonville, Deltona, Palm Bay, Crestview, North Port, Cape Coral and Lakeland, those markets are all growing inventory at roughly two to four times the pace of the national average (2.7%), which is just coming down from a record peak.

For more information on the state of Florida apartment markets, including forecasts, watch the webcast Market Intelligence: Q3 Florida Update.