Affordable Housing Software

Affordable Housing Solutions That Simplify Compliance, Reduce Expenses and Optimize Efficiency

HOTMA Compliance News Stay up to date with the latest HOTMA compliance news .

PROPERTY OPERATIONS

RealPage Affordable Housing Property Management Solutions

With OneSite® Affordable at its core, our affordable housing property management software is designed to make your workday easier. Process move-ins, certifications and compliance quickly and more accurately. Conquer low-income housing tax credit state (LIHTC) reporting. Seamlessly stay in compliance with HUD, Tax Credits, Rural Housing regulations and the 50058 Public Housing program. And efficiently manage rent and property damage collections.

- Property Management

- Affordable Waitlist

- Document Management

- Accounting Software

- Payments

- Facilities Management

- Spend Management

- Utility Management

- Sustainability Services

LEASING

A Simple, Seamless, Mobile-Responsive Experience

RealPage® makes it easy to provide future residents and staff with the best application and leasing experience. From effectively managing waitlists to simplifying resident communications, say goodbye to manual processes.

- Online Leasing

- Screening

- Insurance

RESIDENT EXPERIENCE

Build a Stronger Affordable Housing Community

From convenient, loyalty-building resident communications to online payments, our RealPage resident experience solutions help you stay connected to your residents and focus on creating experiences that motivate engagement, build loyalty and boost your property’s online reputation.

- LOFT™ (formerly ActiveBuilding®)

- Contact Center Maintenance

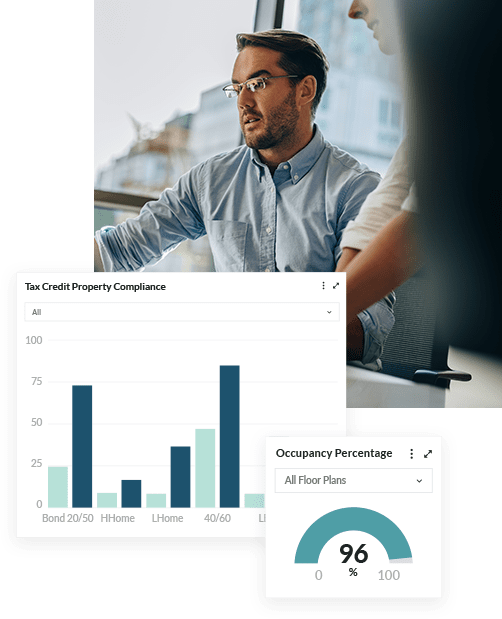

BUSINESS INTELLIGENCE

Get Real-Time Visibility Into Compliance Status

Eliminate time spent compiling data, gain daily insights into performance across your affordable housing portfolio, and get the critical insights your team needs with precise Affordable-specific multifamily performance metrics powered by the industry’s largest lease transaction database spanning 13.5 million units. Monitor special claims, delinquency/prepaid rent by subjournal and rent per unit by subjournal for real-time visibility.

MANAGED SERVICES

Harness the Power of RealPage Managed Services

Leverage a trusted industry name with deep knowledge in property management, specifically the Affordable Housing sector. RealPage Managed Services for Affordable Housing can help you augment your staff and gain accounting, IT and compliance expertise you can count on.

- SmartSource™ IT

- SmartSource™ Accounting

- Compliance Services

MARKETING

Create Exceptional Online Experiences for Better Prospect Engagement

From performance-first websites to SEO, reputation and digital advertising, we ensure that every moment with your tax credit and affordable housing property is designed to meet your prospects’ needs, dynamically measure the impact of your marketing efforts and help you make informed marketing decisions.

- Websites

- Reputation & Social Management

- Digital Advertising

- Knock® CRM

Wingate Companies Relies on RealPage Affordable Solutions

Karoline Lapointe, Regional Vice President of Wingate Companies, talks about how Wingate relies a great deal on RealPage Affordable, which affords real-time visibility so Wingate can stay in compliance.