Student Housing Inventory Growth vs. Enrollment Growth

Inventory growth of purpose-built student housing has been more evident since 2011, when interest in the student-housing sector gained momentum. The strongest inventory growth occurred in 2013 and 2014, when national inventory grew by 10.8% and 9.4%, respectively.

The peak of purpose-built student housing inventory growth took place a few years after 2009, when national enrollment experienced its highest growth since 2002. This additional demand and insufficiency of purpose-built student housing in past decades motivated developers to ramp up construction.

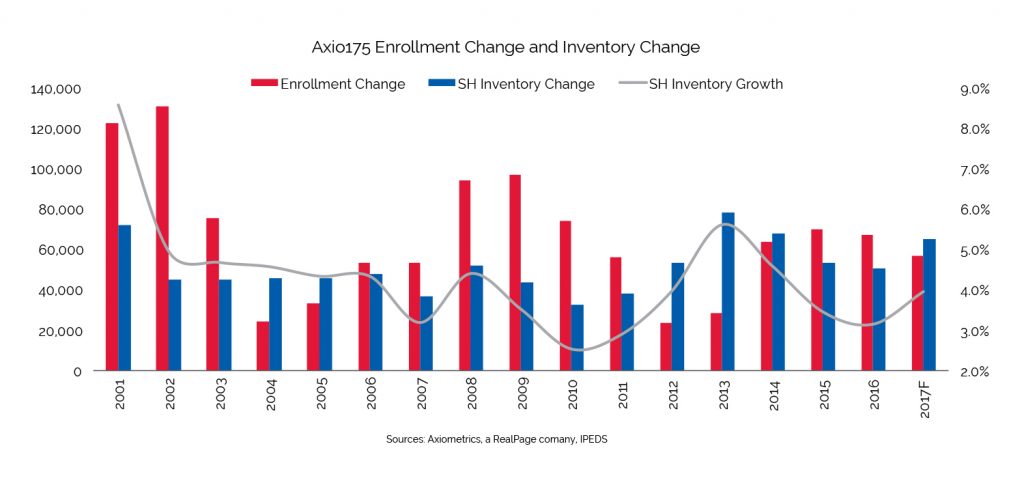

If we look deeper into student housing inventory growth and enrollment growth by focusing on the Axio175, consisting of traditional four-year universities generally targeted for development, we can see a similar trend, as depicted in the chart below: robust growth in student housing supply starting in 2013, four years after the 2009 enrollment boom.

Here’s a look at the inventory growth/enrollment growth relationship at four universities with higher or lower levels of inventory growth relative to enrollment growth:

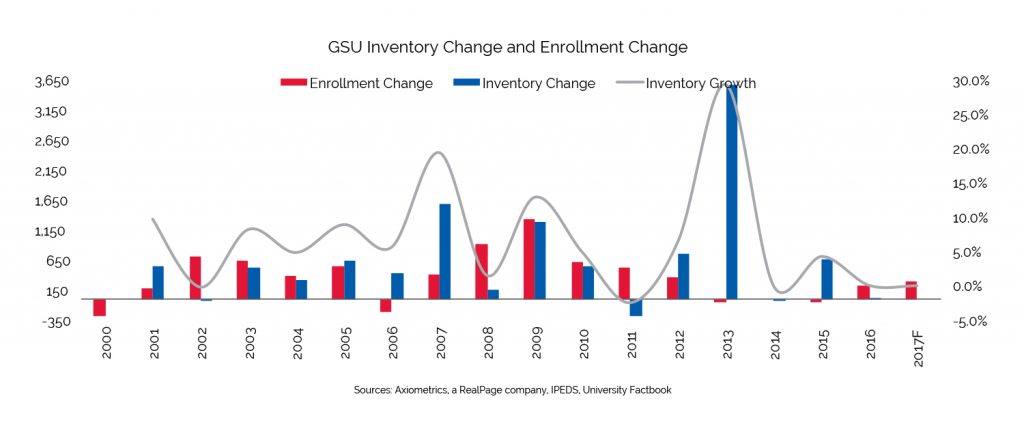

Georgia Southern University

After experiencing moderate to strong enrollment growth from 2007-2012, Georgia Southern’s total on- and off-campus inventory grew by 29.3% in 2013. Inventory growth was mainly focused on off-campus housing, which increased by more than 3,000 beds that year. After another 4.3% inventory growth in 2015, growth has remained flat, and the same trend is expected from 2017-2022, according to the recent forecast by Axiometrics, a RealPage company.

Most of Georgia Southern’s enrollment is being captured by purpose-built student housing, more so after 2013 when most of the new student housing supply was focused off-campus. After 2013, bed-to-enrollment ratio went from 59% to more than 75%. Negative enrollment growth in 2013 further affected the performance of existing supply in this market.

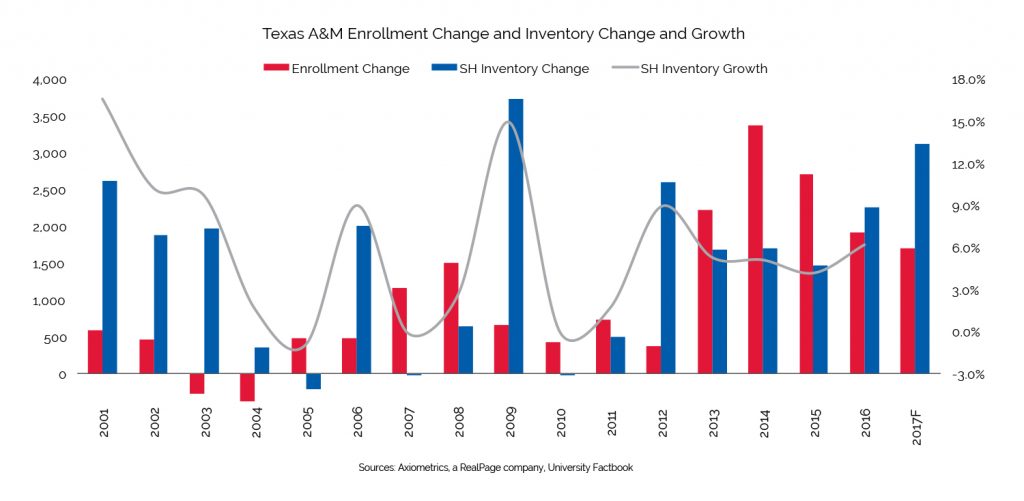

Texas A&M University

As often mentioned, Texas A&M University’s off-campus inventory has grown almost every year since 2007. A&M’s 24.5% inventory increase in 2009 (3,700 new off-campus beds delivered) was a record in this market. Though inventory growth was flat in 2010, it has continued growing since 2011.

Since then, and through fall 2017, off-campus housing inventory at Texas A&M has increased by a 6.9% annual average rate, or about 1,600 total new beds per year. On-campus housing also has experienced inventory growth, specifically from 2012-2017, increasing by a 3.8% annual average, or nearly 400 beds per year. In 2018, the market will receive the same level of inventory growth as in 2017, given that 2,500 off-campus beds already have been identified for delivery next fall.

On the demand side, A&M’s enrollment growth has been elevated since 2013, relative to historical trends. Growth has averaged 4.4% per year (more than 10,000 student). The strong enrollment growth can be attributed in part to the university’s efforts to increase student-body diversity; having one of the best retention records for public institutions in the nation, according to university officials; and the school’s 25 by 25 initiative – the goal of which is to increase its engineering program to 25,000 students by 2025.

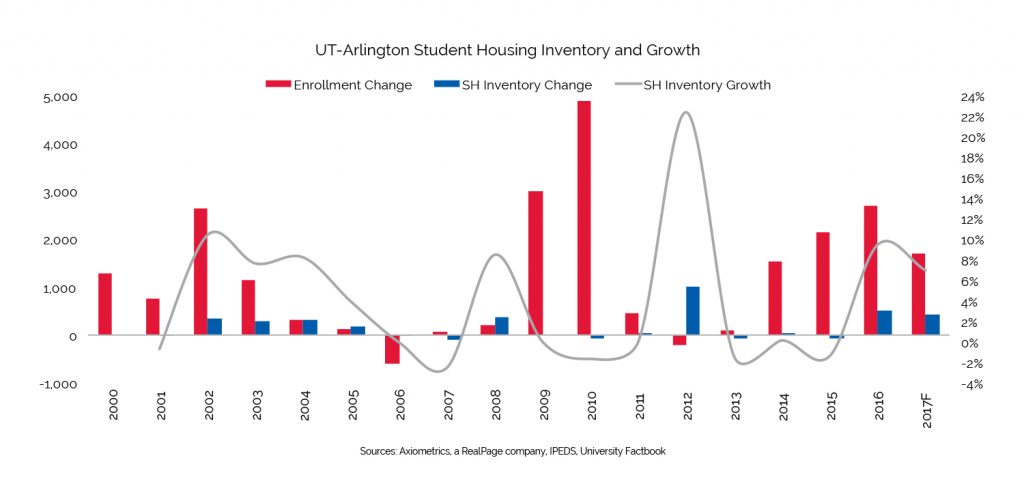

University of Texas at Arlington

The University of Texas at Arlington, with enrollment of more than 41,000 and growing, recorded its highest enrollment growth in 2009 and 2010. Over the past four years (2014-2017), enrollment growth has averaged 5.6%, higher than UTA’s long-term average (4.4%). This is mainly due to heavy recruitment, specifically in North Texas, Houston and Austin, according school administrators. In 2016 alone, UTA had its highest enrollment growth since 2011, increasing by more than 2,500 students.

Total student housing inventory growth (on- and off-campus) also has increased above its 4.1% long-term average. The market saw its largest student housing supply growth in 2012, increasing 22.4%, or more than 1,000 beds. Inventory growth has averaged 2.8% per year since then.

UT Arlington has seen off-campus inventory growth in four years since 2000:

- In 2008, inventory increased by 382 beds.

- In 2012, inventory increased by 1812 beds.

- In 2016, inventory increased by 602 beds.

- In 2017, inventory increased by 493 beds.

For 2018, off-campus inventory growth is expected to increase by 27.1%, or about 800 beds.

On-campus housing inventory has not increased much recently, except for the more than 3,700 beds added in 2012, a 16.5% increase from the previous year.

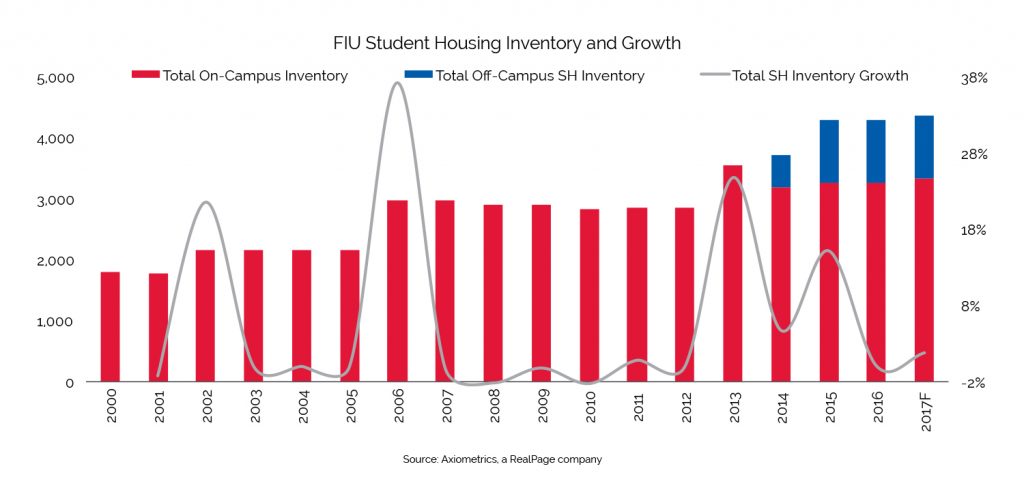

Florida International University

After maintaining total student housing inventory at around 3,200 beds for several years, Florida International University experienced its first off-campus student housing inventory growth in 2014, growing by 37.2% with delivery of more than 500 new beds. Some 500 additional off-campus beds were added the next year, bringing the total student housing inventory to about 4,200 beds.

But, the student housing supply seems low relative to the school’s large enrollment and potential demand for off-campus student housing. The school has a student body of more than 50,000, putting the bed-to-enrollment ratio at around 8.5% (preliminary, based on 2017 forecast enrollment) — a relatively low number of students in either on- or off-campus housing.

The university’s geography and cost of land, among other factors, may be some of the reasons purpose-built student housing development is relatively small. The Miami university is located west of the Atlantic Ocean and north of the Everglades, making it impossible for expansion in these areas. Additionally, a large portion of the student-body commutes to campus, and the lack of available land in the remaining areas, makes it nearly unsuitable to build student housing around the university.

While student housing inventory growth rates have increased nationwide during the current student housing development cycle, some schools have seen high levels of inventory growth relative to total enrollment and growth, while others continue to experience potential unmet opportunity in terms of student housing inventory.