How Do Rents Move in a High-Inflation Market? Look to the 1970s.

Roaring inflation is opening up new questions on the outlook for rental housing. As consumer pocketbooks get stretched due to rapid increases in cost for pretty much everything, what will be the impact to rental rates?

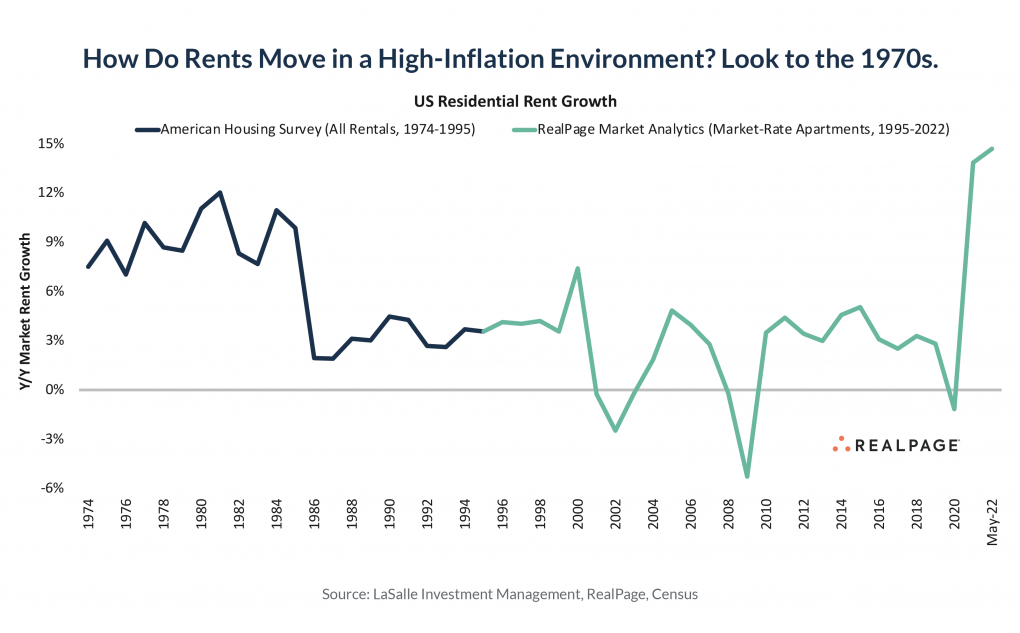

Well, we have to go back 40+ years for clues. That was when we last saw inflation like we see today.

From 1974 to 1985, a stretch that included three separate economic contractions, rents increased 7% to 12% each year. That’s pretty close to where we are today, and perhaps a sign of what’s to come with rents if inflation persists. And it’s a reason we’re skeptical of reversion-to-mean rent forecasts, even if the economy continues to soften.

There are two takeaways here, one for renters and one for rental housing investors and operators.

Implications for Rental Housing Investors & Managers

For investors and operators, this supports the “real estate is a hedge against inflation” concept you’ve likely heard many times.

With rental housing in particular, relatively short leases with reasonable seasonal distribution throughout a calendar year allow managers to re-set pricing frequently. So, you can cut pricing faster to stimulate demand, and push pricing more in a high-inflation environment to offset rapidly rising operational costs (property taxes, insurance, payrolls, utilities).

That sets rental housing apart not only from other real estate types, but from most other industries, too. Of course, it doesn’t solve for the rising cost of capital in getting new deals done. But it positions current owners well through an inflationary period. (In fairness, profit margins are likely to thin due to expense pressures, but the ability to at least keep pace with inflation is a “win” in this environment.)

As Daniel Mahoney of LaSalle Investment Management noted on stage with me at the National Apartment Association’s Apartmentalize conference: “History doesn’t repeat itself but it does often rhyme,” quoting Mark Twain. (Hat tip to Daniel for creating an earlier version of this chart for our NAA panel.)

Implications for Renters

For renters, it’s obviously not ideal that housing costs are climbing just like food, gas and everything else. We’re rooting for continued wage growth to help offset some of those increases. Wage growth has been a huge (and underrated) driver behind rent growth over the last two years.

But for some households, we’ll likely see more renters doubling up with roommates. When COVID hit, the trend went the opposite direction – roommates decoupling. But we’ll probably see that trend revert back somewhat, though not completely given the work-from-home shift (which means the need for more space) that remains very much entrenched.

The historical trends might also be helpful in educating renters about the drivers impacting rising rents. There’s a false narrative that the growing presence of institutional owners is driving up rents. But history exposes the silliness of that idea. The rental market in the 1970s was much less “institutional” than it is today, yet still saw rents surge with inflation.

Rent is like anything else. It’s all about supply (not enough) and demand.